Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Good morning. The S&P 500 eked out another record high yesterday, closing barely above flat. It was dragged up by US homebuilders PulteGroup and DR Horton, which rose 12 per cent and 17 per cent, respectively. Neither did particularly well last quarter: both saw lower revenue and lower net income than this time last year. But they did not do as terribly as Wall Street feared. For the broken US housing market, that’s a huge win.

As a reminder, make sure to look out for our inaugural Chart of the Week this Saturday, a weekly instalment where we will tell a splashy market story with one visual. Email us: unhedged@ft.com

China

Treasury secretary Scott Bessent announced yesterday that he will meet his Chinese counterparts in Sweden next week, and that the scheduled August 12 end to the trade truce would probably be delayed. Depending on where you fall on US-China relations — all-out hawks are probably not happy with the negotiations to begin with — this is likely good news for the US economy and markets. It gives American companies more time to import Chinese goods at potentially lower prices; extends the freeze on simmering tension; and could suggest that the two parties will eventually reach a deal.

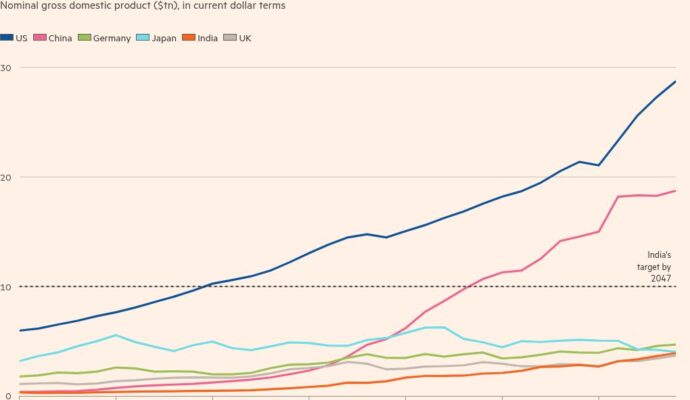

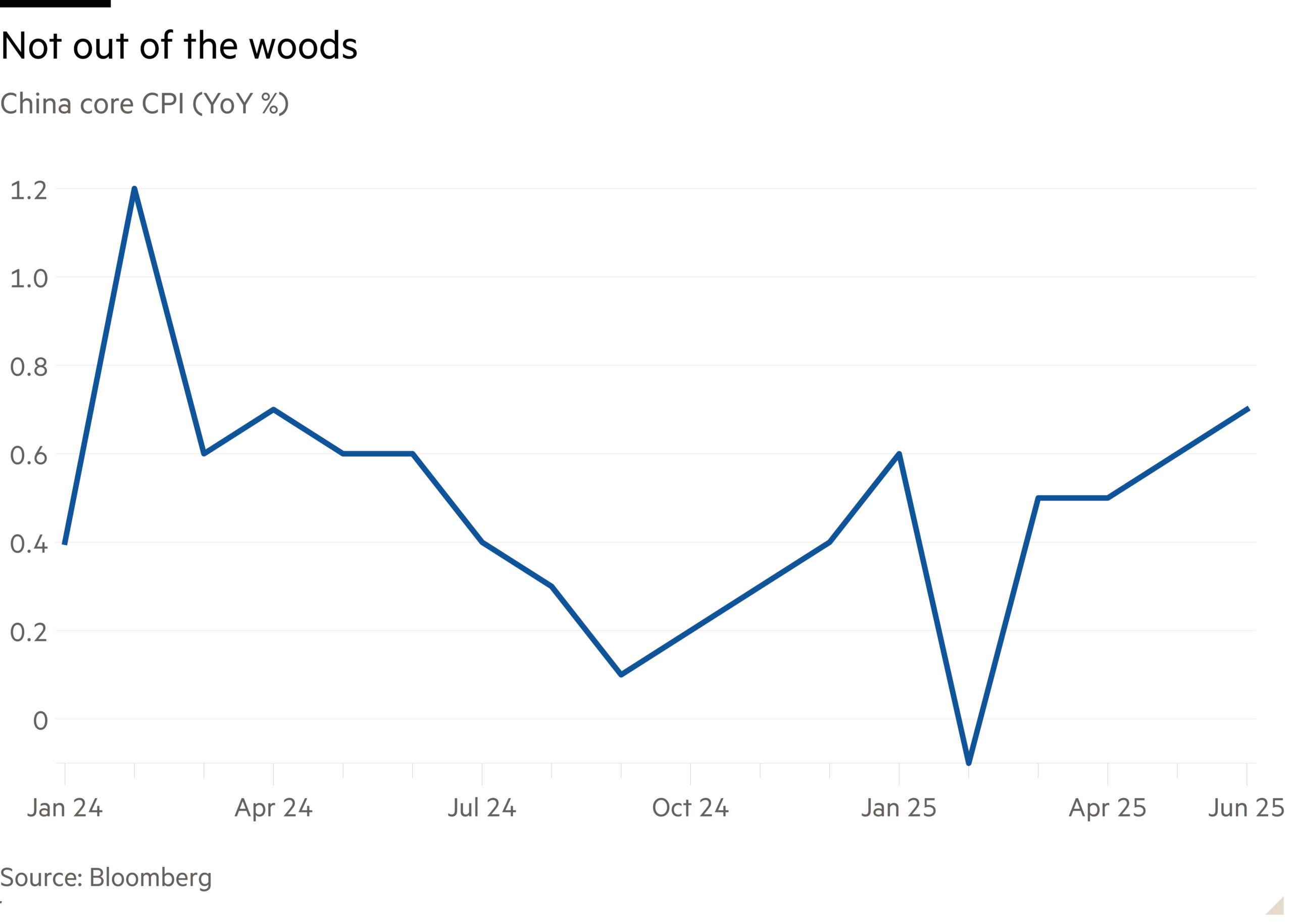

For the Chinese economy, this is especially good news. The US-China trade truce uplifted Chinese exports in the second quarter. That was a boon to an otherwise flailing Chinese economy. Its headline GDP number — always to be treated with a grain of salt — fell from 5.4 per cent growth year over year to 5.2 per cent in the second quarter; reliable China activity proxies suggest the fall was even bigger. Gloom can be found everywhere: domestic demand is weaker than hoped, fixed investment keeps missing expectations, and the property market continues to slide. Inflation has picked up, but it is still eerily close to zero:

The domestic policy tools to reverse the decline appear limited. The Chinese Communist party has a long-standing aversion to zero-interest monetary policy; it’s unclear if the People’s Bank of China will push China’s policy rates lower. And, according to Zichun Huang and Julian Evans-Pritchard at Capital Economics, the country’s fiscal firepower is depleted. Substantive stimulus may not come.

That leaves only tariff relief. A longer truce should help, but Chinese industry will need more concessions for the economy to turn things around. To us, that suggests that China will give in to some of Bessent and Trump’s demands next week in Sweden. There has already been some messaging from central leadership around addressing overcapacity.

The Chinese market is hoping for a deal, too, or at least more tariff slack. Despite the economic backdrop, Chinese equities have had a strong two months:

They got a lift at the start of the truce and had an especially big rise last week when Trump removed a trade embargo on Nvidia’s high-powered H20 chips. The CSI 300 tech sub-index leapt 6 per cent in dollar terms on the day, and the AI hype helped lift the broader index by 3 per cent in dollar terms over the following week.

Future equity performance will depend on what other sweeteners Chinese negotiators can get, and what other relief the US will offer. But China is not coming to the negotiating table in a strong economic position.

(Reiter)

Tariff effects in earnings

It’s hard to believe, but we are still in the early days of the trade war. We don’t know where tariffs will wind up and, crucially, we don’t know who will pay for them. So far this year, the US has collected more than $100bn in tariff revenues; according to George Saravelos at Deutsche Bank, from the data we have so far, it appears that it is American companies that are paying the price. On net, most countries are passing on the tariffs to US importers, he said, and not preemptively slashing prices to mitigate the pain, as some companies had hoped.

This sounds like what happened in 2019: according to various studies, it was US companies, not Chinese exporters, who paid for the majority of the tariffs, and they eventually passed those prices on to consumers. Given that many consumers are already showing price sensitivity, this does not bode well for US companies’ bottom lines.

Some of the companies that have reported so far this season have already started to sound the alarm. Yesterday, General Motors beat the consensus EPS forecasts, but its stock fell 8 per cent. Its profits suffered a $1.1bn hit; its net income also dropped to 4 per cent, from more than 6 per cent a year ago. Chief financial officer Paul Jacobson directly attributed that hit to Trump’s tariffs:

“EBIT adjusted was $3 billion for the quarter, inclusive of a net tariff impact of approximately $1.1 billion with minimal mitigation offsets. As we previously mentioned, [tariff] mitigation efforts will take time to yield results, limiting their effect on the second quarter.”

Meanwhile, RTX, the defence behemoth, lowered its full-year earnings forecast: its highest EPS estimate is now below the bottom end of its prior range. Its CFO Neil G Mitchill cited a “30 per cent tariff headwind” and an “income statement headwind” from tax code changes this year. Even though the company beat Wall Street’s expectations for both revenue and adjusted EPS this quarter, investors latched on to the guidance. RTX’s share price slumped 1.6 per cent.

It’s still early innings for tariffs; these companies could overshoot falling expectations. RTX did emphasise that it has optimised its supply chains to deal with trade duties, while GM is hoping to build more plants across America. But this all adds to what we have heard from various investors. Both companies soundly beat earnings forecasts. Yet, with all the uncertainty over tariffs, guidance is what really matters this quarter.

(Kim)

Correction

In yesterday’s letter, we said Amazon reports its earnings this Thursday. That is a mistake. They will report earnings next week on July 31. We apologise for any confusion.

One good read

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.