Chinese carmakers’ price war is putting the industry’s balance sheet under strain, a Financial Times analysis has revealed, as Beijing demands more action to protect suppliers in the world’s largest car market.

Current liabilities exceeded current assets at more than a third of publicly listed car manufacturers at the end of last year, according to FT calculations based on their most recent financial reports.

The weakening liquidity picture highlights how China’s leading carmakers are being forced to squeeze suppliers to maintain working capital and fund their fight for market share amid heavy discounting.

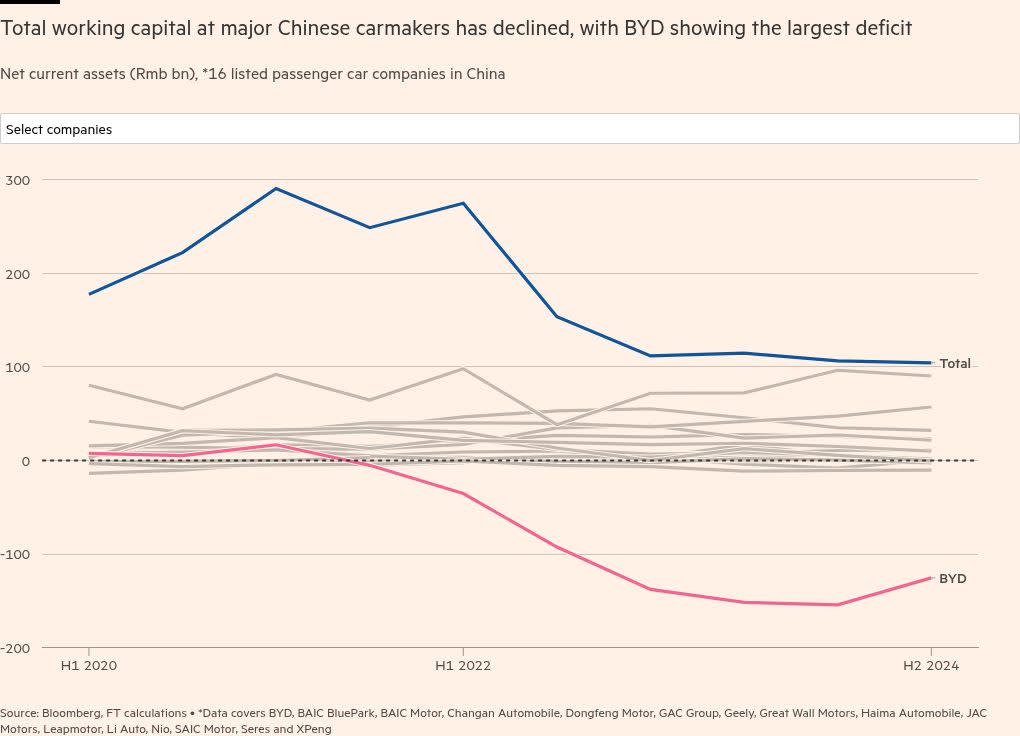

The dominant electric-vehicle maker BYD is deepest in negative territory with its working capital, followed byrivals Geely, Nio, Seres and state-backed BAIC and JAC, while the total net current assets of 16 major listed Chinese carmakers fell to Rmb104.3bn ($14.5bn) by December 31 — a 62 per cent decline from their Rmb290.5bn peak in the first half of 2021.

Yin Xinchi, a car industry analyst at Citic Securities, said a decline in net current assets indicated an increasing rate of cash consumption, with liquidity risks as the numbers turned negative.

“Given the current downward trend, China’s auto industry is expected to enter an industry-wide elimination phase . . . in 2026 at the latest,” he warned. “During the process, some companies will die of liquidity crises.”

Beijing showed its concern about the state of the market last week. In a meeting with 16 major domestic carmakers, government officials issued verbal warnings about aggressive discounting and overdue payments to suppliers, according to two people familiar with the matter. The “zero-mileage” practice of selling brand-new cars as cut-price second-hand vehicles has also been criticised.

This week, companies that attended the meeting, including BYD, Geely, Xiaomi and state-backed GAC and FAW, committed to 60-day bill settlements with the aim of “ensuring supply chain stability”.

Citi analysts noted in a report that only a handful of Chinese EV makers — BYD, Li Auto, Xpeng, Leapmotor and Changan — currently had sufficient net cash to cover the decline in cash reserves that would follow the implementation of a shorter payment cycle.

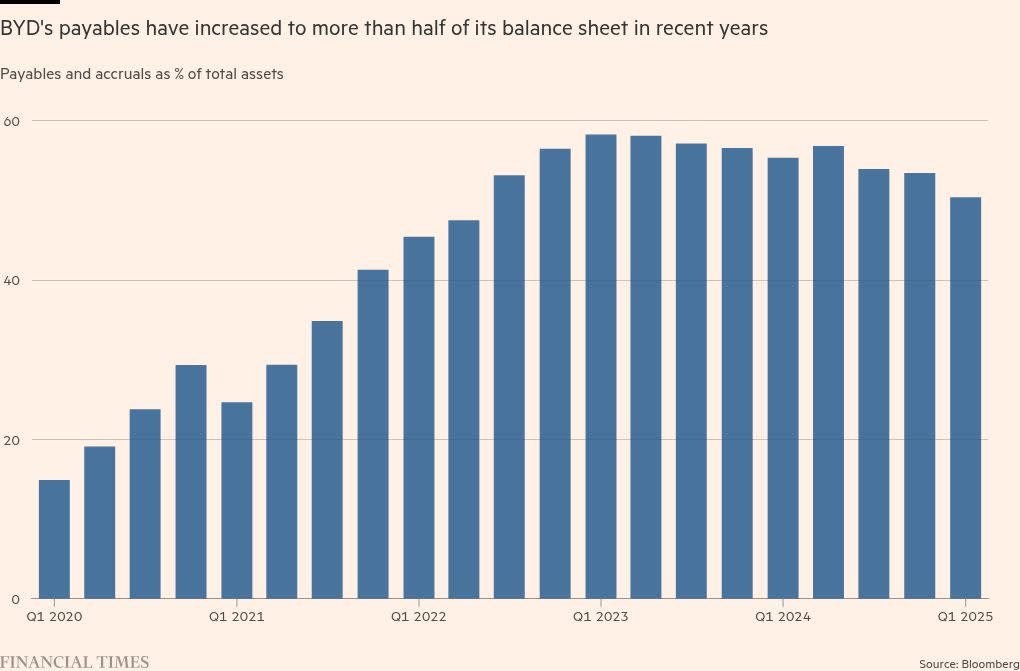

Other analysts have noted BYD’s heavy use of working capital rather than debt financing to fuel its rapid growth.

“None of BYD’s recent growth has been financed with conventional debt. Instead, it has relied on funding from working capital,” said Nigel Stevenson, an analyst at Hong Kong-based GMT Research, who also referred to company practices such as delaying payments to suppliers to maintain cash flow.

“This means that debt as normally measured is understated,” he added.

By the end of 2024, BYD’s current assets of Rmb371bn were exceeded by Rmb496bn in current liabilities. That widened BYD’s working capital deficit to Rmb125.4bn — 36 per cent higher than two years earlier when the price war commenced, according to FT research.

Its smaller rivals — Geely, Nio, Huawei’s EV partner Seres, BAIC and JAC — recorded a total working capital deficit between them of Rmb17.8bn in comparison.

BYD recently came under pressure to defend its financial numbers and business practices after Wei Jianjun, chair of rival Great Wall Motor, called for a comprehensive audit of all major domestic carmakers.

“An Evergrande exists in [China’s] auto sector at the moment — it just hasn’t blown up,” he told local media, raising the spectre of the industry following the property sector into a spiralling debt crisis.

In response, BYD’s public relations head Li Yunfei called Wei’s remarks “astonishing”. In a social media post, he said BYD’s interest-bearing debt stood at Rmb28.6bn in 2024 — significantly lower than that of competitors such as Geely, at Rmb86bn, and Volkswagen, at Rmb1tn.

“The larger a company grows and the higher its revenue, the greater its procurement and collaboration volume,” Li added, in response to criticism of BYD’s extended payment periods.

BYD declined to comment when contacted by the FT.

In another sign of increasing competition, margins are becoming wafer-thin.

In the first quarter of 2025, carmakers’ operating profit margins averaged 3.9 per cent, a drop of 0.7 percentage points from a year earlier, according to data from the National Bureau of Statistics, although BYD’s margins have been improving. The industry’s aggregate profits dropped 6.2 per cent year on year to Rmb95bn in the three-month period.

Concerns about a looming “growth without profits” scenario have prompted industry associations and regulators to issue a series of warnings about China’s EV boom.

“Price wars . . . are pushing the industry into a vicious cycle,” the China Association of Automobile Manufacturers said last month, while asking “leading companies” not to monopolise the market or undermine the survival of other groups.

China’s Ministry of Industry and Information Technology, the country’s top automotive regulator, said in a statement it supported the association and would expand its efforts to prevent a “rat race” and “unfair” competition.

“It’s hard to do anything in the domestic market,” complained an executive at a state-owned carmaker, who asked to remain anonymous. “Everything is fiercely competitive, leaving a brutal and bloody battlefield.”

While analysts have been predicting for years that cut-throat competition will lead to consolidation as the worst-performing companies are wiped out, the process is unfolding more slowly than expected.

State support for the industry has remained strong. In one example, Nio was rescued by a near-$1bn bailout in 2020 by state-owned investors from Anhui in eastern China.

Additional reporting by Edward White in Shanghai