This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome to FirstFT Asia. In today’s newsletter:

We start in the US, where the Pentagon has launched a review of the 2021 Aukus nuclear submarine deal with the UK and Australia. The US will determine whether it should scrap the project, throwing the security pact into doubt at a time of heightened tension with China.

What to know about Aukus: Australia and Britain are due to co-produce an attack submarine class known as the SSN-Aukus that will come into service in the early 2040s. While Aukus has received strong support from US lawmakers and experts, some critics say it could undermine the country’s security because the navy is struggling to produce more American submarines.

What happens now? The reassessment will be led by Elbridge Colby, a top US defence department official who previously expressed scepticism about Aukus. Last year, Colby wrote on X that it “would be crazy” for the US to have fewer nuclear-powered attack submarines in the case of a conflict over Taiwan. Ending the pact would be a blow to a security alliance the US has with UK and Australia.

Here’s what else we’re keeping tabs on today:

Israel: The UN General Assembly will hold an emergency special session on Israel.

Economic data: India reports its May inflation figures. The UK publishes GDP figures for April.

China-Africa relations: The fourth annual China-Africa Economic and Trade Expo begins. Chinese FM Wang Yi is expected to attend.

Five more top stories

1. Donald Trump said the US and China’s deal to restore their trade war truce is “done” after two days of negotiations in London. The deal revived a truce agreed in Geneva last month that faltered because of differences over Chinese rare earth exports and US export controls. Here’s the full readout from the talks.

2. The EU is preparing sanctions against two Chinese banks that allegedly enabled banned trade with Russia as part of the European Commission’s latest package of measures, people with knowledge of the plans told the Financial Times. The move would be the first time Brussels has targeted a third-country lender for supporting Moscow.

3. Elon Musk posted on X that he “regrets some” of his recent comments about Donald Trump after the two traded insults last week. White House press secretary Karoline Leavitt told reporters on Wednesday that the US president “acknowledged” and is “appreciative” of the billionaire’s remorse. Since last week, allies have continued to urge Musk and Trump to repair their relationship.

4. One of the world’s largest auto parts suppliers has filed for bankruptcy as it seeks breathing space from its debts. KKR-owned Marelli’s decision to seek court protection brings to a close the latest chapter in one of the most contentious, costly and publicly sensitive private equity deals in Japanese corporate history.

5. The World Bank will lift a decades-long ban and “re-enter” the nuclear space, the lender’s president said in an email to staff on Wednesday. The shift follows advocacy from the pro-nuclear Trump administration and a change of government in Germany that previously opposed financing atomic energy.

Visual investigation

In March, Mexican authorities seized a 46,000-tonne vessel suspected of illegally importing fuel from the US. A subsequent raid on nearby storage facilities uncovered weapons, tanker trucks and 10mn litres of diesel. But this was no isolated case. The FT has uncovered dozens of suspicious shipments, with millions of barrels of fuel falsely declared as industrial lubricant. Our latest visual investigation explores how the sophisticated smuggling operations fund Mexico’s cartels.

We’re also reading . . .

Declining population: As birth rates continue to plunge, Japan must stop being overly optimistic about how quickly its population is going to shrink, economists have warned.

Junior banker stand-off: Apollo Global Management is the latest group to delay hiring junior bankers after recent pressure from Jamie Dimon.

CEO pay and perks: Executives may find the idea of disclosing less about their packages attractive, but this carries its own risks, writes Brooke Masters.

Chart of the day

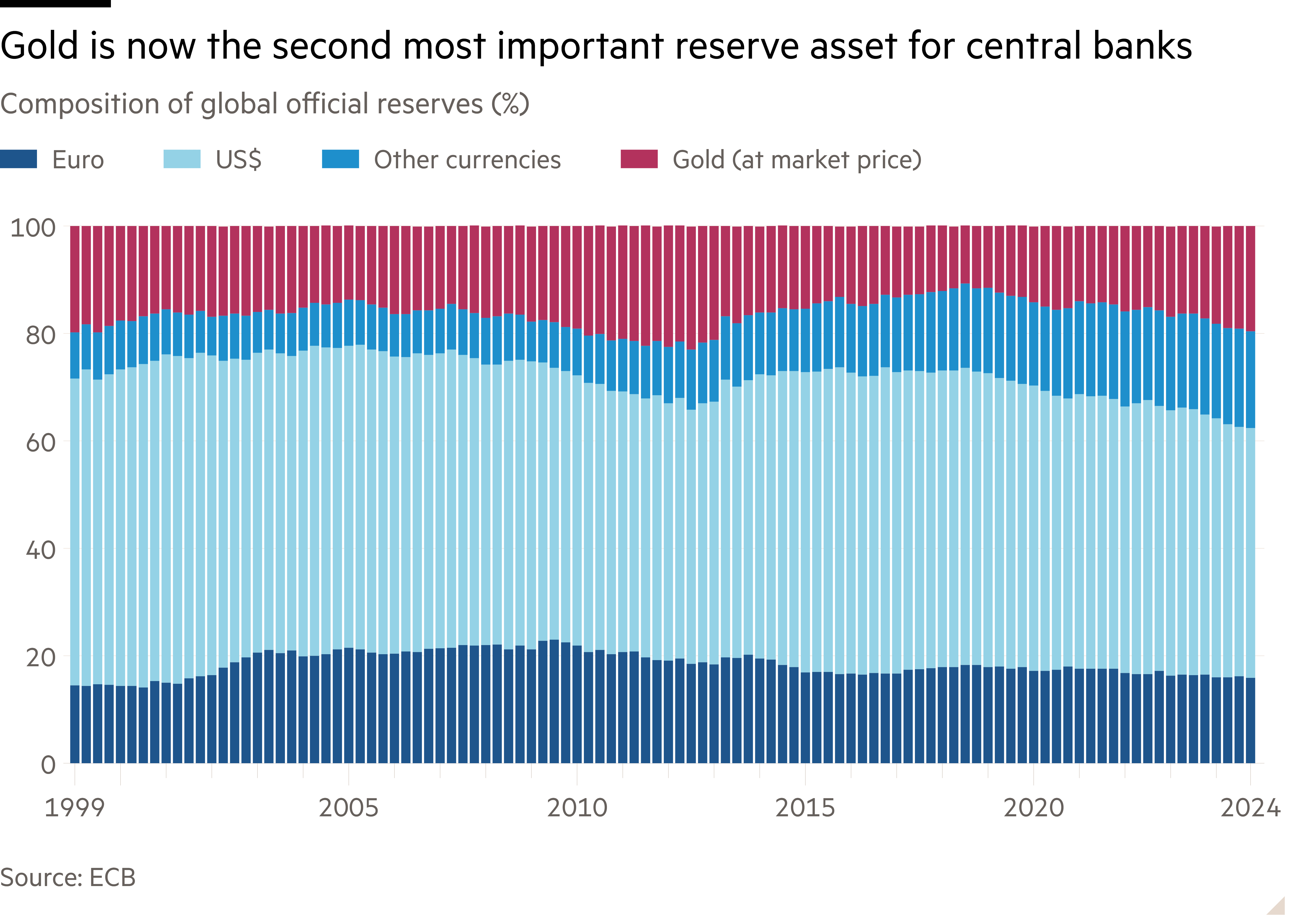

Central banks are accumulating gold at a “record pace” and have now overtaken the euro as the world’s second most important reserve asset, according to the European Central Bank. Bullion accounted for 20 per cent of global official reserves last year, with its largest buyers being India, China, Turkey and Poland, per the World Gold Council.

Take a break from the news

The Tour de France in Scotland, rugby in Las Vegas and the Saudi Arabian Grand Prix? Tourist boards are discovering the benefits of luring big-name sporting events from their traditional homes. Sports tourism is now one of the fastest-growing segments in travel. Will it last?