Hello everyone, this is Cissy from Hong Kong. This week, the Hong Kong police are on high alert again as Wednesday marked the 36th anniversary of Beijing’s bloody crackdown on pro-democracy demonstrators in and around Tiananmen Square in the Chinese capital.

Although public mourning over the tragedy has diminished since the implementation of the National Security Law in 2020, some pro-democracy individuals still have been trying in their own ways to commemorate those who were killed. For example, one shop was selling white candles — like those traditionally used for candlelight vigils to mark the anniversary — for HK$6.40 each. Some individuals stopped by Victoria Park, where people had gathered to commemorate the victims of the crackdown for 30 years, with white flowers, but they were soon escorted away by the police. In Causeway Bay, the usual starting point for most protests over the past 30 years, a performance artist chewing gum with her hands in pockets was searched by police and then escorted to a subway station.

Even more upsetting is the case of the owner of a white Porsche with the licence plate “US 8964”. The driver was pulled over and detained by police on June 4 in both 2023 and 2024, and he told local media this week that he has shipped the car outside Hong Kong after his family was harassed and intimidated by unknown individuals over the past year.

From its population structure to daily consumption patterns, Hong Kong has changed a lot in the past five years. As I was casually watching the street on Wednesday, I briefly counted the car brands passing me at an intersection in the central business district. In the space of about 5 minutes, the majority of cars that passed by were Tesla, Toyota or Mercedes-Benz. I also saw five Maxus, a brand under the state-owned SAIC, one BYD, one Xpeng and one Zeekr, as EV brands from mainland China are increasingly seen in Hong Kong’s streets, while they are caught up in an increasingly ugly war at home as their pricing and inventory tactics draw scrutiny from regulators.

Expecting a record

Despite geopolitical tensions, tariffs and volatile exchange rates looming over the semiconductor market, the world’s largest chip foundry is confident that it will log a record profit this year as AI demand remains strong, writes Nikkei Asia’s Cheng Ting-Fang.

TSMC Chairman and CEO CC Wei said during the company’s annual general meeting on Tuesday that tariffs would drive up prices and potentially suppress demand, and that the only thing he fears is a global economic slowdown. Still, he noted that AI chip demand continues to exceed supply, and his recent discussions with Nvidia CEO Jensen Huang have centred on quickly boosting production capacity to address this shortfall.

Wei also talked about his company’s fresh $100bn investment in the US, saying he announced the total all at once because a smaller figure “wouldn’t even make Trump open his eyes”. And while he did try to explain to the president how challenging it would be to achieve that five-year plan, Trump — whom Wei described as “warm” — simply replied, “Do your best!”

In the crosshairs

Electronics giant Xiaomi is among the Chinese tech groups hit hardest by Donald Trump’s latest crackdown on the semiconductor supply chain, write the Financial Times’ Zijing Wu and Eleanor Olcott.

The US president announced a directive last month instructing electronic design automation (EDA) groups to stop supplying their technology to China.

That move will hit a number of Chinese groups that use the American-made software to design their own advanced chips before manufacturing the processors in Taiwan.

And Xiaomi is first in line to be affected, according to people with knowledge of the matter.

The company unveiled a breakthrough self-designed mobile processor in May. Its chip is on a leading-edge 3nm node of miniaturisation and is made in Taiwan with a mix of licenses and tools from now-restricted US EDA companies.

Other Chinese groups also using American EDA tools and TSMC’s contract manufacturing for their self-designed chips include the world’s biggest computer maker Lenovo and bitcoin mining specialist Bitmain, according to industry insiders.

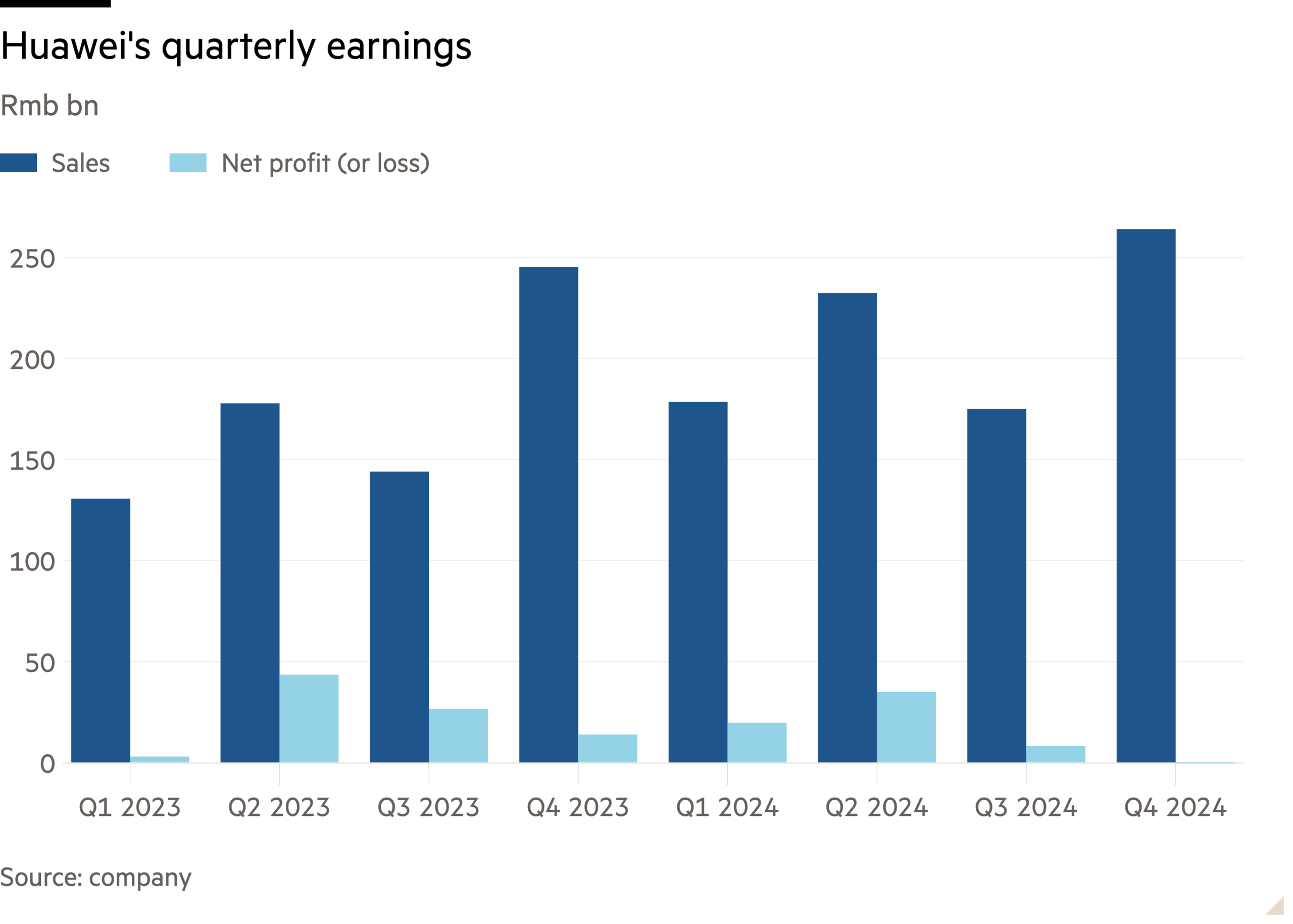

Huawei’s investment strategy

Since Huawei was sanctioned by the US in 2019, the Chinese tech giant has invested in more than 60 chip companies in China to foster its own supply chain, Nikkei’s Itsuro Fujino reports.

Huawei has been ramping up its investments through Hubble, a wholly owned investment arm established in 2019. Since its inception, Hubble has backed companies spanning chip design, materials, manufacturing and testing. In the majority of these deals, Hubble holds a stake of less than 10 per cent.

In addition to its investments through Hubble, Huawei maintains close ties with chip equipment maker SiCarrier. The Shenzhen-headquartered company develops and produces equipment primarily for the front-end process of creating fine circuits on wafers. The company reportedly spun off from Huawei following US sanctions and now operates under the umbrella of the Shenzhen city government.

Half the power, just as strong

SoftBank and Intel are partnering to develop an advanced AI-specific memory chip that promises a substantial reduction in power usage. The plan involves creating a novel stacked DRam chip that is distinct from current high-bandwidth memory (HBM) and is expected to halve power consumption, according to Nikkei’s staff writers.

The project is spearheaded by Saimemory, a newly formed company, leveraging Intel’s technology alongside patented innovations from Japanese institutions, including the University of Tokyo.

The goal is to complete a prototype within two years, after which a decision will be made on mass production. Targeting commercialisation within the 2020s, the project is estimated to cost about $70mn.

Suggested reads

Nintendo plays it safe with Switch 2 in bid to break its post-hit jinx (Nikkei Asia)

Indian tech fund sees domestic opportunity akin to 1990s Silicon Valley (FT)

Myanmar start-up looks to bring ‘affordable housing’ to Bhutan, India (Nikkei Asia)

Cooking robots from Japan to serve US restaurants short on labour (Nikkei Asia)

Chinese tech groups prepare for AI future without Nvidia (FT)

‘AI godfather’ Yoshua Bengio to develop rogue behaviour guardrail (Nikkei Asia)

The west fears AI’s threat to jobs. In Japan, it might save them (Nikkei Asia)

Donald Trump orders US chip software suppliers to stop selling to China (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp