Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It is good to launch a share sale on a strong day for the markets. CATL, the world’s biggest battery maker, charged its deal with news of a temporary US-China trade truce that lifted stocks around the world. Trouble is, the Chinese group’s $4bn listing in Hong Kong also underscores the risks for its new international backers.

CATL’s share sale is the world’s largest so far this year and gives international investors a chance to bet on the Shenzhen-listed group’s potential at the cutting edge in a key, fast-developing technology. The company said last month that it had overtaken BYD in the race for faster recharging, providing 520km of driving distance for five minutes of charge time. That came just weeks after its rival had stunned the industry with 470km in about the same time.

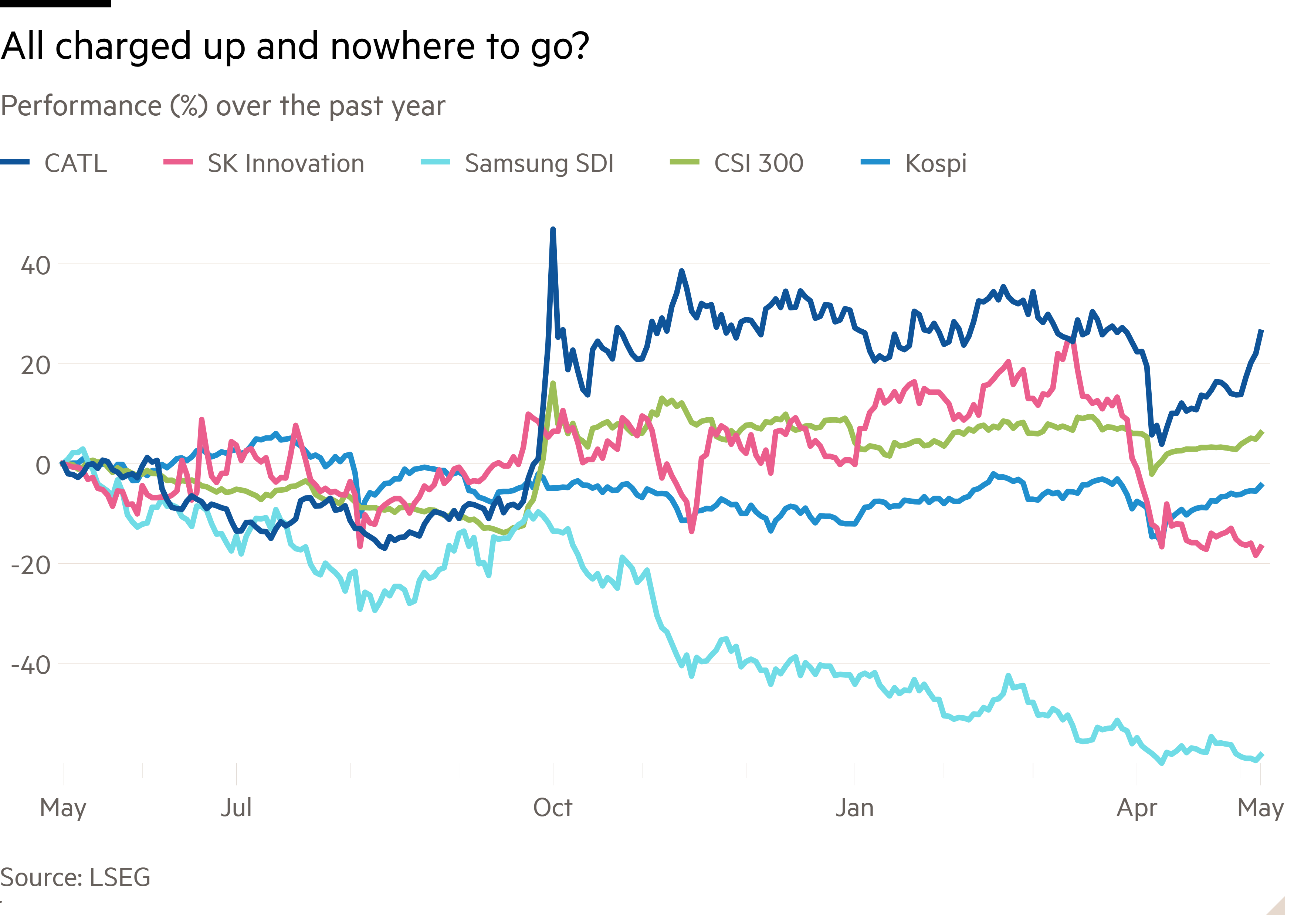

There are several ways to look at what is on offer. CATL’s status as a pure-play battery business — unlike many rivals including carmaker BYD — could be attractive, but falling unit prices hurt its sales last year. In valuation terms, it trades on 16 times forecast earnings, just below the battery units of South Korean conglomerates Samsung and SK Group. Size and liquidity matter too in this deal: less than 3 per cent of the shares will trade in Hong Kong and up to two-thirds will go to cornerstone investors who cannot sell for six months, limiting liquidity still further.

Nor is CATL leaving much value on the table for new investors: its top price of HK$263 a share represents a mere 1.5 per cent discount to its pre-deal close in Shenzhen and a premium to its average over the past month.

By far, though, the biggest issue is the US. CATL is pushing a global story — 31 per cent of last year’s sales were overseas — but that is largely Europe and Asia. In January CATL was placed on a US list of companies with alleged ties to China’s military, something the company says was a mistake, while last month American lawmakers urged JPMorgan and Bank of America to stop working on the share sale.

The list is not a ban and the banks are still deal sponsors. But small wonder CATL’s shares are not being offered to onshore US investors and the big investors already signed up are heavily Chinese, leaving the few more international names to stand out, such as the Kuwait Investment Authority and Italy’s Agnelli family.

CATL picked its moment well. Europe’s battery ambitions are in tatters following the March collapse of Sweden’s Northvolt, while Elon Musk’s politics have influenced the share price gyrations of Tesla. Nonetheless, with US intentions unclear still — already President Donald Trump has warned tariffs could soar again — getting big international investors to go the distance on CATL is going to take more energy than any quick charge-up can provide.