Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Japan has long been known as a retail graveyard, where even global giants like Tesco, Walmart and Carrefour have failed. The rise of Chinese platforms signals a fundamental shift in one of the world’s most closed consumer markets.

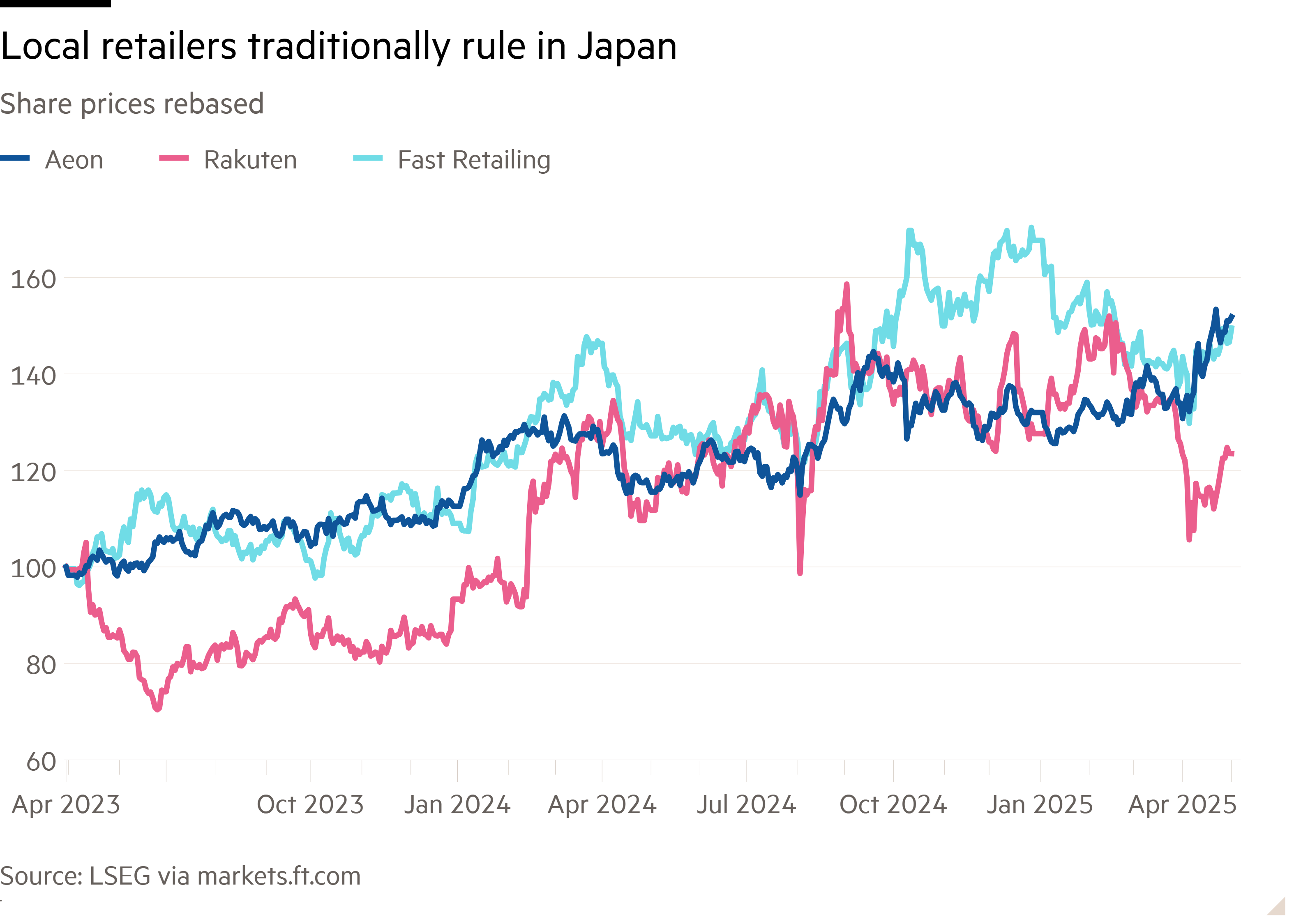

Historically, Japan’s retail and ecommerce sector has been defined by its insularity. Local groups such as Aeon, Uniqlo and Rakuten have long dominated, thanks to intricate supply chains, loyal customer bases and supportive regulatory environments. Cultural factors add another layer of difficulty for foreign entrants, from the long-standing preference for domestically made products to geopolitical tensions, particularly among older generations.

Yet in recent years, a striking reversal has been under way. Chinese companies, including PDD Holdings’ Temu and Shein, have broken through barriers once considered impenetrable, offering products at prices that undercut local retailers by as much as 90 per cent. Chinese-owned TikTok is preparing to enter Japan’s online shopping market in the coming months, signalling a further deepening of China’s retail push into the country.

Their value proposition is clear: as rising living costs weigh down on households, local consumption habits are being reshaped. Ultra-low prices speak louder than legacy brand loyalty. A broader shift in consumer psychology is also playing a role. Younger shoppers, less attached to national brands and more immersed in global digital platforms, are more willing to experiment. Meanwhile, the quality gap that once shaped perceptions of Chinese products has narrowed, with many items now meeting the expectations of increasingly price conscious buyers.

This shift extends to Japan’s ecommerce sector, which has proven just as difficult to enter as its physical retail landscape. Local giant Rakuten controls nearly a third of all online sales, constraining the growth potential of foreign entrants. Even globally recognised platforms like Amazon Japan and Yahoo Shopping have spent decades adapting to the local market. Amazon entered Japan more than two decades ago, investing heavily in logistics, customer service and cultural localisation. Yahoo Shopping, while foreign in name, is now fully operated by Z Holdings under SoftBank.

What US and local groups took decades to build, Chinese platforms are achieving in a matter of months. While they still trail behind incumbents by a wide margin in market share and offer a comparatively narrow product range, the shift signals that even the most guarded markets are now vulnerable to digital disruption, especially when economic stress and generational change collide.