Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Some of Wall Street’s biggest banks are betting on a substantial rebound for China’s stock market in 2024 after last year’s brutal rout, even as many fund managers remain wary of diving back in without stronger policy signals from Beijing.

Strategists at JPMorgan have forecast that the MSCI China index will finish this year up roughly 18 cent from where it closed out December. Goldman Sachs has set its 12-month target for the index at the same level.

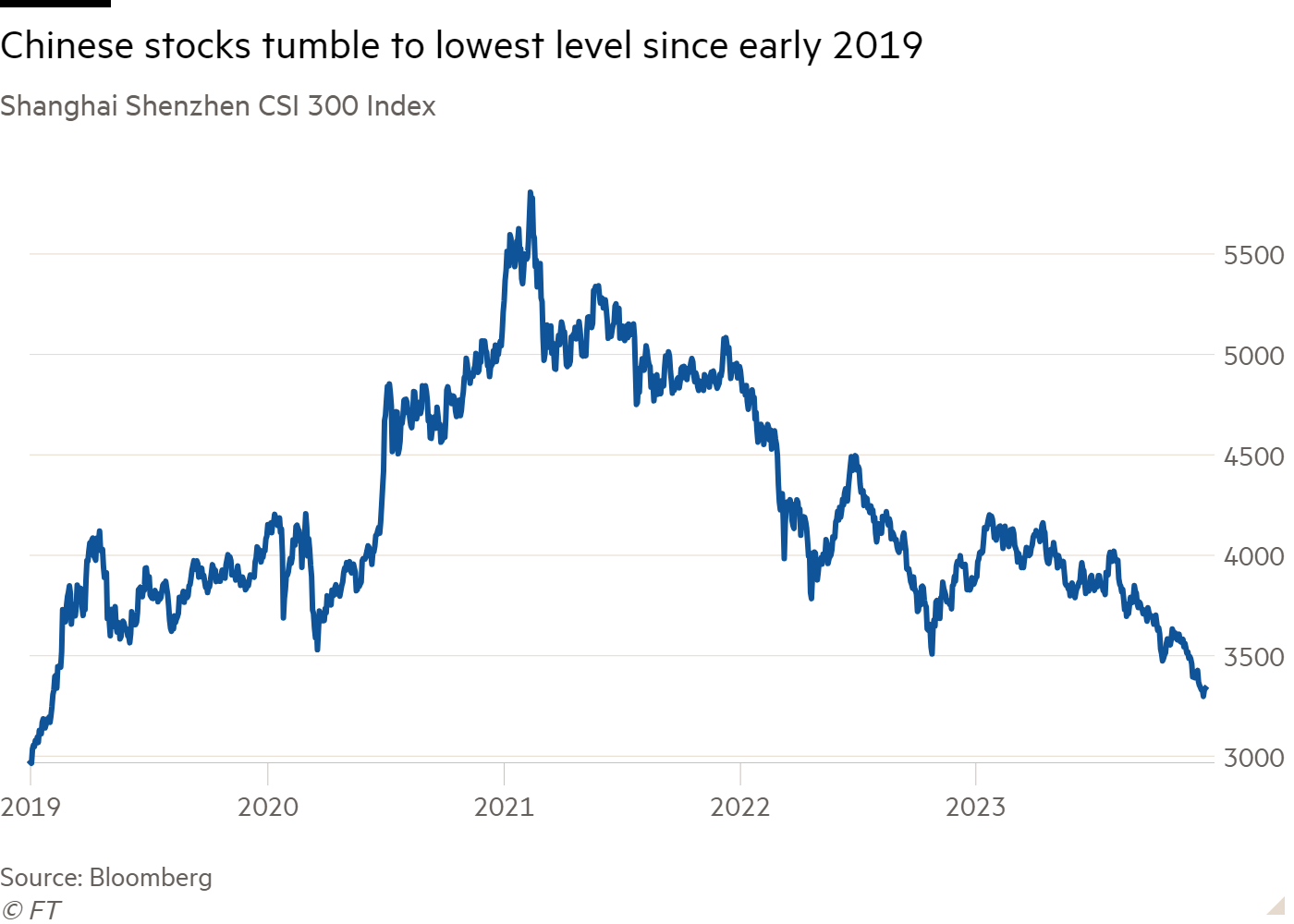

Injections of fiscal and monetary support administered by the Chinese Communist party to rejuvenate the economy have so far failed to arrest a sell-off in locally-listed stocks, with the MSCI benchmark falling more than 13 per cent last year.

“It’s like ‘Waiting for Godot’,” said Alain Bokobza, head of global asset allocation at Société Générale, leaning on Samuel Beckett’s absurdist play of the same name to describe the many false dawns for the Chinese stock market last year. “We’ve had a tactical ‘overweight’ on Chinese equities for a while. It’s been very painful.”

That stock market underperformance prompted nearly 90 per cent of foreign money funnelled into Chinese equities in 2023 to flow back out before the year’s end. Financial Times calculations based on exchange data show net foreign investment into China’s stock market stood at just Rmb30.7bn ($4.3bn) at the end of December.

FT calculations based on data from Hong Kong’s Stock Connect trading programme show net foreign investment into China’s stock market in 2023 came to less than Rmb44bn — the smallest total since 2015.

But many Wall Street forecasters are keeping the faith that more forceful measures will eventually arrive, and are urging investors who fled China’s markets in the second half of 2023 to jump back in while stocks are cheap.

“We do not share the view many hold in the market that ‘China is largely uninvestable’, and we see a favourable risk-reward situation in China,” said Kunjal Gala, head of global emerging markets at Federated Hermes, whose global emerging markets fund is overweight Chinese equities.

Gala emphasised “critical areas” such as electric-vehicle batteries and chipmaking where China is a significant global player as evidence that the country could shift its economy towards “more sustainable growth drivers”.

Other fund managers emphasised that Chinese companies were trading at historically cheap valuations, with the MSCI China index down 57 per cent from its 2021 high as of January 1 this year.

“The quality of companies isn’t reflected in their valuations,” said Alessia Berardi, head of emerging macro and strategy at the Amundi Institute.

Berardi said Amundi was “tactically overweight” in sectors in which China had made significant progress, such as automation, robotics and clean technology, “while neutral overall”.

Even so, Beijing’s approach to domestic issues is likely to set the tone for the year. In another sign of growing pessimism on the country’s economic health, rating agency Moody’s cut its outlook on China’s sovereign credit rating to negative at the start of December, citing the risk from a rolling liquidity crisis in the country’s property sector and lower middle-term growth.

Wendy Liu, chief China equity strategist at JPMorgan, acknowledged that many investors “would like to see a road map” on how Chinese policymakers plan to deal with issues such as the property market crisis and a towering pile of local government debt.

Analysts warned most global investors were likely to remain wary of Chinese equities before the so-called Two Sessions in early March — an annual gathering in Beijing where Communist party leaders announce an economic growth target and chart out policy priorities for the year ahead.

“There’s a vacuum period for policy releases before the Two Sessions and we expect that it would be difficult for large-scale, game-changing policies to reverse the market’s expectations during this time,” said Kevin Liu, an equity strategist at Chinese investment bank CICC.

Investors’ hopes have been stirred by party leaders’ promises last month of a “proactive” fiscal and “effective” monetary policy to support economic growth. “It’s less about the if and more about the quantity and nature of the various stimulus measures we’re expecting,” said Bokobza.

Alejandro Arevalo, head of emerging market debt at Jupiter Asset Management in London, said he was encouraged by comments from the government that it was “increasingly willing” to intervene to support the economy.

“We believe we have seen a bottoming out in Chinese markets and sentiment, and therefore expect to see some improvement there as the year progresses,” he said.

Even so, optimists realise they are fighting against the outflow of money and sentiment on Wall Street. Morgan Stanley strategists have forecast that the MSCI China index will rise just 7 per cent this year, less than half of what JPMorgan and Goldman Sachs expect.

“[China’s stock market] has been pretty beaten up,” said Alex Brazier, UK managing director of BlackRock in an outlook call. “But the growth prospects have deteriorated, so we have ended up neutral.”

Like others, JPMorgan’s Liu is undeterred. While clients might prefer “something concrete” from Chinese policymakers to justify snapping up undervalued shares, she said that from her experience “the best buying opportunity is when there are no catalysts”.

Additional reporting by Cheng Leng in Hong Kong