China unveils slew of reforms to prop up flagging capital markets

China’s securities regulator has announced a slew of reforms to “boost capital market investor confidence”, as underwhelming economic growth drags on the country’s stocks and bond markets.

The China Securities Regulatory Commission said it would consider extending trading hours for both stock and bond markets, maintain a “reasonable pace” for new IPOs and refinancing of debt, call on state-run and large listed firms to step up mergers and acquisitions, and cut handling fees imposed on brokerage transactions to encourage more trading activity.

China’s stock market has badly lagged global peers in 2023, with the benchmark CSI 300 index down more than 2 per cent this year against a rise of almost 14 per cent for the S&P 500.

Risers and fallers in Europe

Big share price moves in Europe today include Dutch payments group Adyen, Sweden-based games developer Embracer, and Polish supermarket group Dino:

Adyen: Shares in the Netherlands-based payment group fell more than 6 per cent in early trading after an earnings miss on Thursday that wiped nearly 40 per cent off its share price.

Embracer: The games developer rose 4 per cent after weaker than expected results on Thursday, but the company maintained its full-year outlook.

Dino: Shares in the Polish supermarket chain fell more than 6 per cent after warning that rising prices would hit sales this year, despite reporting continued growth in sales and profits on Friday.

Hungary leader vows to ‘show force’ to tame Europe’s highest inflation rate

Hungary’s leader has vowed to push on with the battle to tame what is Europe’s highest inflation rate until it reaches 5 per cent next year and economic growth rebounds.

Inflation fell below an annual 20 per cent for the first time in nearly a year in July, at 17.6 per cent, while growth remained negative in what is Hungary’s longest recession in decades.

Prime minister Viktor Orbán has long blamed foreign companies for soaring prices and has used price caps and mandatory price reductions in what he called “using force against price speculator multinationals”.

“They have hiked prices more than justifiable,” Orbán told public radio on Friday. “We need to show force, this can’t continue.”

Adyen investors skittish after earnings miss batters share price

Shares in Adyen were volatile on Friday, a day after an earnings miss disappointed investors in the Dutch-listed payments company and wiped almost €20bn off its market cap.

Hiring costs dented first-half earnings, with remuneration soaring 80 per cent, as did competition in the US, where aggressive pricing from local providers such as San Francisco-based Stripe and PayPal’s Braintree is winning over online merchants.

Adyen ended the day down 39 per cent, valued at less than €30bn, below the valuation of private rivals such as Stripe and London-headquartered Checkout.com.

Despite the hit, chief financial officer Ethan Tandowsky said the company would continue with its hiring plans for the year, bucking an industry-wide trend of lay-offs and cost-cutting.

Japanese stocks decline at fastest weekly clip since March

Japan’s Topix posted its sharpest weekly fall in five months on Friday, as global fears over increased bond yields and China’s stagnant economy sapped interest in the country’s equities.

The Topix fell 0.7 per cent on Friday, taking its weekly losses to 2.9 per cent, its worst performance since mid-March.

Japan’s economy this week posted annualised growth of 6 per cent for the second quarter, its highest level in two years and above consensus forecasts. The country’s equities have performed strongly as new stock exchange guidance and a slower pivot away from decades of ultra-loose monetary policy have boosted valuations.

But rising global bond yields and China’s persistently gloomy economic data dented that momentum this week.

British retail sales fall more than expected as shoppers deterred by wet weather

British retail sales fell much more than expected in July as an unusually wet month kept shoppers from the high street, according to official statistics.

The quantity of goods bought in Great Britain fell 1.2 per cent between June and July, following an expansion in the previous three months, according to data published on Friday by the Office for National Statistics.

This was a much larger contraction than the 0.5 per cent fall that was forecast by economists polled by Reuters.

Food stores sales volumes fell by 2.6 per cent in July, with supermarkets reporting that the wet weather reduced clothing sales, although food sales also fell back. Retailers indicated that the rising cost of living and food prices continued to affect sales volumes.

China tech stocks down on weak earnings and economic gloom

Chinese tech stocks declined on Friday, following weak earnings and pessimism over the country’s economic prospects.

The Hang Seng tech index, which tracks the biggest Chinese tech companies listed in Hong Kong, fell 2.6 per cent, with drops of 9.4 per cent and 7.4 per cent for health tech groups JD Health International and Alibaba Health Information, respectively.

Lenovo, the world’s biggest manufacturer of personal computers, lost 3.9 per cent, while electric vehicle maker Xpeng shed 6 per cent.

The moves followed the release of a disappointing series of earnings across the sector. Enthusiasm for Chinese equities has also been sapped by weak economic data from the country.

Taipei mayor to visit Shanghai amid tense cross-Strait relations

Taipei mayor Chiang Wan-an is to visit Shanghai for a bilateral city conference, as Taiwan and China gradually resume some exchanges after an almost complete three-year break in cross-Strait travel because of the pandemic.

Chiang, a member of the Kuomintang, Taiwan’s largest opposition party that advocates closer ties with China, will participate in the Taipei-Shanghai City Forum this year, his office said on Friday.

First held in 2010, the forum was suspended by the pandemic. Its resumption comes at a sensitive time, with China continuing its military intimidation campaign around the island and debate over cross-Strait relations heating up in Taiwan before next January’s presidential elections.

What to watch in Europe

Country ratings: Moody’s is set to release its updated ratings for Switzerland and Moldova on Friday, while Fitch and S&P are due to update their ratings for the Netherlands and Estonia, respectively.

Kingspan: The Ireland-based construction materials company is to release first-half results.

Women’s World Cup final: Spain and England will meet in the 2023 Fifa Women’s World Cup final on Sunday at Stadium Australia in Sydney. Kick-off is at 11am British summer time.

Asian stocks down on possibility of further US rate rises

Asian equities edged lower on Friday morning, as investors assessed the possibility of further interest rate increases by the Federal Reserve.

Hong Kong’s Hang Seng index shed 0.1 per cent, Japan’s Topix fell 0.4 per cent and South Korea’s Kospi slid 0.3 per cent. The mainland Chinese benchmark CSI 300 was flat.

Minutes from the Fed’s last meeting showed that officials were divided over the need for future rate increases, with some seeing “significant upside risks to inflation”. The US Labor Department on Thursday reported a decline in the number of applications for unemployment benefits for the week ending August 12, adding to the case for tight monetary policy.

Bitcoin falls nearly 8% as cryptocurrency slide continues

Bitcoin fell by nearly 8 per cent during an hour of frenzied trading on Thursday afternoon in the US, extending a day of losses that reversed most of the cryptocurrency’s gains since June.

The price of a token briefly fell to as low as $25,409, according to data from CoinMarketCap, before staging a partial recovery.

The whipsaw price action left the digital asset changing hands for 15 per cent less than the $31,814 high registered in July, echoing recent declines in stocks, bonds and other financial assets.

Read more about Bitcoin’s tumble here.

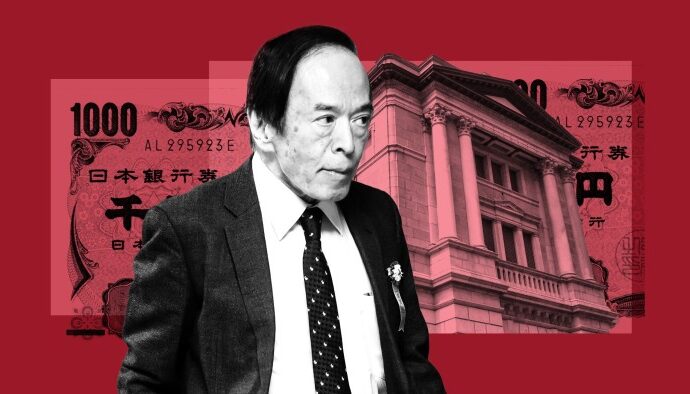

Falling energy prices push Japan’s core inflation lower

Falling energy prices nudged Japan’s consumer price inflation rate lower in July, confirming the predictions of central bankers that inflation would slow heading into the second half of the year.

The rate of core inflation, which excludes volatile fresh food prices, was 3.1 per cent, down from 3.3 per cent in June and exceeding the Bank of Japan’s 2 per cent target for a 16th straight month.

Underlying “core-core” inflation accelerated to 4.3 per cent from June’s 4.2 per cent as hotel charges and other service prices rose.

At the BoJ’s latest meeting, one committee member said that the year-on-year rate of CPI inflation was likely to decelerate as the effect of high import prices last year began to subside.

What to watch in Asia

Summits: US president Joe Biden hosts Fumio Kishida and Yoon Suk Yeol, his Japanese and South Korean counterparts, at Camp David on Friday. Biden is set to announce a landmark trilateral agreement that will help Washington and its Asian allies boost deterrence against North Korea and China.

Economic data: Malaysia publishes second-quarter GDP figures on Friday. Economists expect the data to show growth slowing in the quarter that ended in June. Japan, meanwhile, releases consumer price index figures for July.

Markets: Stocks futures declined in Japan and Hong Kong on Friday. A rise in US sovereign bond yields, which neared their highest levels since 2007 on Thursday, weighed on the country’s equities, with the Nasdaq Composite dropping 1.2 per cent and the S&P 500 ending 0.8 per cent lower.

Singapore: Prime Minister Lee Hsien Loong is to give a National Day Rally speech on Sunday, some 10 days after the country’s National Day holiday on August 8. The speech is considered among the most significant political addresses of the year in the island-state.

China Evergrande files for bankruptcy in New York

Troubled property group China Evergrande has filed for bankruptcy protection in a New York federal court using the so-called Chapter 15 process for foreign companies seeking recognition of their restructuring in the US.

According to the petition, Evergrande is also pursuing a parallel “scheme of arrangement” in the Cayman Islands, as well as a restructuring proceeding pending before the High Court of Hong Kong.

The petition was signed by Jimmy Fong, who listed himself as a “foreign representative” of China Evergrande Group. A meeting of “scheme creditors” is set for August 23 at the Hong Kong office of Sidley Austin, the US-based law firm representing Evergrande.

CVS shares take biggest hit in 10 months after ending its pharmacy service

Shares in CVS Health fell more than 8.1 per cent at the close on Thursday after a decision was made by the insurer to drop its Caremark unit as its main pharmacy benefit manager (PBM).

The fall was the largest in a single day for shares in the company — one of California’s largest health insurers — since October last year.

Health plan provider Blue Shield of California said it would work with other companies, including Amazon and the Mark Cuban Cost Plus Drug Company, to supply medicines to its 4.8mn customers.

The insurer said the US drug purchasing system, which is dominated by PBMs — essentially drug middlemen — is “broken” and that it expected to save $500mn in annual drug costs with its new model.

US escalates trade dispute with Mexico over corn

The US government has escalated a trade dispute with Mexico over its ban on genetically modified corn, reflecting the political power of US corn belt states ahead of the 2024 presidential election.

Washington requested a dispute resolution panel on Thursday, which would make a binding decision under the US-Mexico-Canada trade pact. The trade dispute is also reputational, with the US contending that genetically modified corn is not harmful to humans.

Mexican president Andrés Manuel López Obrador’s administration has said the measures to limit genetically modified corn are to protect the population’s health. The US claims the rules violate the trilateral trade agreement and are not based on scientific evidence.

Citadel fund to finance most of $142.5mn bankruptcy loan for trucker Yellow

A Citadel credit fund has agreed to provide most of the pricey financing to bankrupt trucking company Yellow, having recently acquired an existing $500mn loan to the group previously held by Apollo Global Management.

Yellow, which filed for bankruptcy protection earlier this month, has secured a $142.5mn bankruptcy loan and struck a deal to sell its real estate for $1.3bn, its lawyers told federal bankruptcy court on Thursday.

That deal will have the Citadel fund provide $100mn of so-called debtor-in-possession financing, while Yellow’s largest stockholder, MFN partners, will provide the remaining $42.5mn.

Estes Express Lines has bid $1.3bn for Yellow’s terminals, which would cover all the group’s existing secured debt.