One scoop to start: UBS has begun the process of killing off Credit Suisse’s international brand, replacing signs at the collapsed bank’s US headquarters and planning changes in other critical offices, according to people familiar with internal discussions.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

US investors cool on China deals

Tapestry tries to challenge LVMH and Kering

Dentons retreats from China

Biden’s China tech ban casts a shadow over US investors

If western private equity and venture capital firms weren’t already aware, investing in China isn’t what it used to be.

The Biden administration’s executive order banning US investment in some of China’s tech industries is the latest example of how an increasingly fractious geopolitical landscape is interfering with making money.

The long-awaited announcement, which was more limited in scope than many expected, is aimed at stopping US investors funding Chinese quantum computing, advanced chips and artificial intelligence companies.

For some of the US investment industry’s biggest names, including Sequoia Capital, Warburg Pincus and General Atlantic, betting on China’s emergence as an economic and technological superpower offered the chance to score outsized returns.

Buyout and venture firms made lucrative investments in fast-growing Chinese technology start-ups like Alibaba and TikTok parent ByteDance. Their thesis was broadly correct but what they hadn’t reckoned on was the speed at which relations between China and the US would turn sour.

Beginning with former president Donald Trump’s trade war, tensions have continued to escalate. This, coupled with Chinese president Xi Jinping’s crackdown on investment in sectors such as private education, has made investors increasingly nervous, the FT reports.

“We haven’t been making new commitments into China for a few years,” one large limited partnership said. “Government intervention is obviously a risk.”

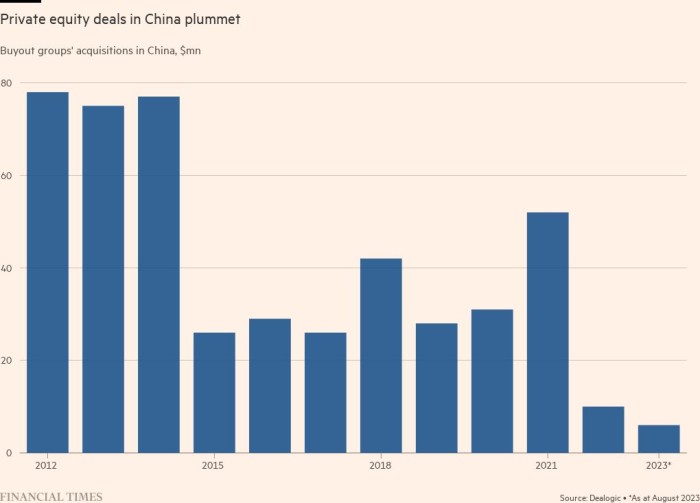

Funds focused on greater China only raised $25bn in 2022, a 77 per cent fall on the year before, a Bain & Co report found. Dealmakers have also scaled back their efforts. Buyout groups struck deals in China worth $47bn in 2021, but that fell to just $2.4bn in 2022 and $2.8bn so far this year, figures from Dealogic show.

The latest US government salvo isn’t likely to help matters, although much of the damage has already been done as several investors have cut their exposure to China. However, the impact of the ban remains unclear and is certainly less strict than expected.

“The administration is trying to strike a very delicate balance. It is not a blanket prohibition on investments in China, even in the enumerated sectors, artificial intelligence, quantum computing and advanced semiconductors,” said Jonathan Wakely, a partner at law firm Covington, who specialises in national security.

“Rather, the approach the administration has taken is to restrict certain categories of investments in what the administration perceives as the most sensitive and problematic technologies,” he added.

The issues firms are facing may get worse as other countries consider whether to follow suit. UK Prime Minister Rishi Sunak is weighing whether to follow President Joe Biden into restricting outbound investment into Chinese tech companies.

The European Union said in June it was going to consider proposals on how to limit potential security risks to outbound investments by the end of the year.

Tapestry wants to weave its way into European luxury

America finally has its closest thing to Bernard Arnault’s LVMH and François-Henri Pinault’s Kering. Sort of.

On Thursday, Tapestry — the owner of Coach, Stuart Weitzman and Kate Spade — agreed to buy Capri Holdings for $8.5bn in the boldest attempt yet to create a US luxury goods powerhouse to take on the well-established (and better-heeled) European conglomerates.

The deal will add the Versace, Michael Kors and Jimmy Choo brands to Tapestry’s portfolio, giving the company a stronger, albeit relatively small, toehold in the higher echelons of the luxury world.

While Tapestry’s chief executive Joanne Crevoiserat said the acquisition would “importantly increase” its business with luxury consumers, the company has a long road ahead before it is in the ring with either of its bigger French rivals.

The debt load Tapestry will be saddled with — some $8bn of bridge financing provided by Bank of America and Morgan Stanley — will limit how the company can compete for other prestige brands surely to come into play over the next two years.

As Lex notes, Tapestry’s dealmaking record isn’t great and analysts at S&P cut the company’s outlook to negative on the deal.

Then there is the operational turnaround ahead for Crevoiserat, given the stumbles Capri’s brands suffered this year. Sales across the luxury market have softened, as consumer spending normalised following the pandemic. That’s meant sales have slowed for many brands, including Michael Kors.

LVMH, Kering and Richemont centred their luxury businesses on a single big brand: Vuitton, Gucci and Cartier, respectively. And then they did everything they could to make them stars that generated high margins and helped pay for the next brand acquisition.

While Versace may have more clout, the big brand Tapestry is buying in terms of sales is Michael Kors, far from a prestige player. Revitalising that business will prove to be the real test for Crevoiserat and her team.

But great turnarounds have happened before. Kors himself helped execute one at a little brand in the 1990s and early aughts: Celine. Today, it’s a jewel in LVMH’s crown.

Dentons demerges from China

Perhaps no global law firm was more invested in China than Dentons.

Since 2015, when it announced it was “uniting East and West” through a merger with leading Chinese firm Dacheng, it even incorporated Chinese characters into its logo.

No longer. This week Dentons quietly retreated from China, telling clients in an email seen by the FT that due to “new mandates and requirements relating to data privacy, cybersecurity, capital control and governance”, it would sever its official relationship with Dacheng, and simply refer work to its former partner, or use its Hong Kong practice.

At issue for Dentons was the recent broadening of Beijing’s new anti-spying laws, which now cover any “documents, data, materials or items related to national security and interests”.

As a result, people familiar with Dentons’ decision told the FT, the firm was unable to share information freely between Chinese and non-China based partners, rendering it incapable of performing basic conflict of interest checks or of carrying out due diligence on Asian deals. Even compiling a list of Dacheng employees was deemed illegal.

Worse, there had been a number of “visits” to Chinese sites in the weeks leading up to Dentons’ decision, and non-Chinese staff were advised not to travel to the country after some professionals were prevented by authorities from flying back home.

The question now is whether Dentons’ move will prompt a mass exodus. New York-headquartered firm Proskauer Rose already said in June that it would close its mainland China office, while Ropes & Gray is “shifting some of its China-based resources to Hong Kong”.

Meanwhile, Xi Jinping’s administration in Beijing was “showing no signs of letting up”, a person close to Dentons warned. “If you are foolish enough to think the scrutiny will not be extended to your operation,” the person said of rival firms, “[you do so] at your peril.”

Job moves

Smart reads

Book buyout KKR, the buyout firm immortalised in the book Barbarians at the Gate, recently agreed to buy US publisher Simon & Schuster for $1.6bn. Puck’s William Cohan does a deep dive into the deal.

Legal ethics During his three decades on the Supreme Court, Clarence Thomas has enjoyed a luxurious lifestyle far beyond what his income could provide. ProPublica reveals who has been footing the bill.

Betting Boom Americans have bet $245bn on sporting events since restrictions were loosened in 2018. Many fear a surge in gambling addiction is coming, the FT reports.

News round-up

Arm’s IPO problems show just how much is at stake for SoftBank (FT)

Disney weighs options for TV networks as cord-cutting accelerates (FT)

UK discount retailer Wilko collapses into administration (FT)

Deliveroo to return extra £250mn to shareholders (FT)

X chief Linda Yaccarino revives ‘client council’ in effort to woo advertisers (FT)

Ladbrokes owner Entain puts aside £585mn to settle bribery probe (FT)

India approves Sony-Zee merger to form nation’s biggest media company (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, William Louch and Robert Smith in London, James Fontanella-Khan, Francesca Friday, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde and Antoine Gara in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to due.diligence@ft.com