Receive free Indian business & finance updates

We’ll send you a myFT Daily Digest email rounding up the latest Indian business & finance news every morning.

India is “open” to investments from China, a senior government official has said, despite New Delhi’s crackdown on Chinese manufacturers and mobile applications, and recent reports that some investment proposals from mainland companies have stalled.

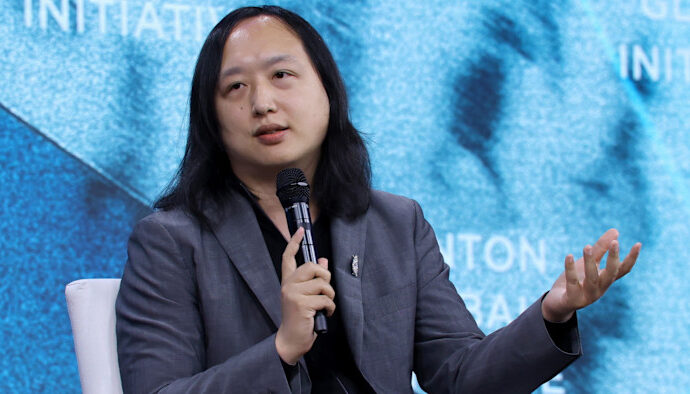

The claim by Rajeev Chandrasekhar, minister of state for electronics and information technology, comes as India seeks to capitalise on global supply chains’ in a pivot away from China, wooing suppliers to multinational companies such as Apple.

“Is India open to doing business with Chinese companies?” Chandrasekhar asked in an interview with the Financial Times. “Of course we are.”

India has banned more than a hundred Chinese social media, lending and other apps, including TikTok, over the past three years, citing data protection and privacy concerns.

New Delhi has also launched regulatory probes against Chinese mobile phone producers Xiaomi, Oppo and Vivo, claiming the companies violated tax, foreign exchange or other laws.

“We are open to doing business with any company anywhere as long as they are investing and conducting their business lawfully and are in compliance with the Indian laws,” Chandrasekhar said.

He added: “We are open to all investment, including Chinese.”

The crackdown began in 2020 after Indian and Chinese troops clashed along their disputed Himalayan border in the Galwan Valley. At least 24 mostly Indian troops were killed in the fighting, and Prime Minister Narendra Modi has said his government would not normalise relations with Beijing until “peace and tranquillity” were restored.

Around the time of the clashes, India also tightened its policy on foreign investments from bordering countries, which are now required to seek central government approval. Chandrasekhar insisted that the process did not target China individually and applied to other countries “in the neighbourhood” including Pakistan, Bangladesh and Nepal.

“The concept of trusted hardware, trusted equipment, a trusted electronics ecosystem all came to the fore around that time,” he said. “I don’t think it’s anything very unique or to do with Galwan as much as it is a general trend of countries of the world waking up to the concern of having their backbone networks, tech ecosystems not necessarily trusted.”

India is seeking to attract foreign investment as companies pursue a “China plus one” strategy, which New Delhi hopes will help it catch up with rivals in high-tech sectors where it has lagged behind, including electric vehicles and semiconductors. But that priority is colliding with its tougher line on Chinese FDI.

Luxshare, a significant Chinese supplier to Apple, has applied for permission to build a factory in India with a domestic partner, according to people close to the company and Indian government officials.

The manufacturer, which assembles iPhones at its Chinese facilities and already has two plants in India, said in May that it would only pursue further investment in India with “sufficient guarantees” of the business environment.

Indian officials said the project had not yet been approved. Luxshare did not respond to a request for comment. Chandrasekhar said he was unaware of the company’s application.

BYD, the Shenzhen-based EV producer, has also applied to build a $1bn car plant in a joint venture with Hyderabad-based Megha Engineering and Infrastructures, according to Indian government officials.

Despite reports this week that India’s government had rejected the proposal, a person with direct knowledge of the situation said the application was “pending [and] still valid”.

BYD and Megha did not respond to requests for comment.

Additional reporting by Gloria Li in Hong Kong