Good morning. Was there a weekend? Didn’t quite feel like it. On Friday, as expected, the Reserve Bank of India announced its decision to keep interest rates unchanged for now. And early on Saturday morning, we got the first taste of what the trade deal with the US will look like. Let’s jump right in.

Deal’s on

At last, India has a trade deal with the US. Or, to be more specific, we have an interim trade agreement, which lays down the broad contours of what the deal will probably contain. While this ends the months-long anxiety about whether or not New Delhi and Washington can work together, the agreement contains several complexities.

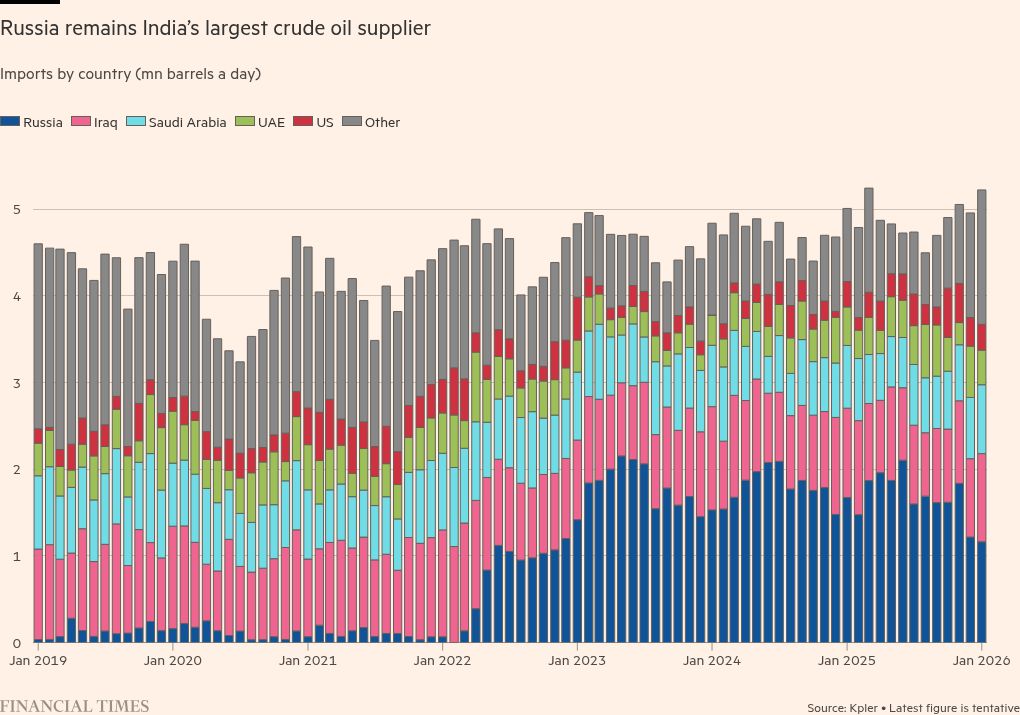

The first concerns India’s strategic autonomy over its energy imports. Shortly after releasing the interim agreement, the White House also published a presidential executive order saying that Washington would monitor whether India resumes “directly or indirectly” importing Russian oil. If India is found to be doing so, the US president can take additional action, including reimposing the 25 per cent punitive tariff.

Crude is India’s biggest import, accounting for nearly 30 per cent of all goods brought into the country, and this clause would limit the country’s ability to be cost-efficient in its oil procurement. Over the weekend, the government remained tight-lipped about its plans. Since this was done through an executive order and not as part of the interim agreement, it gave commerce minister Piyush Goyal the opportunity to deflect the question. The issue instead comes under the remit of the external affairs ministry, whose officials convened a press conference last evening. But it turned out to be a masterclass in speaking many words without saying very much.

Also, what does this mean for India’s relationship with Russia. Just a few weeks ago, after Vladimir Putin visited New Delhi, the two countries “reaffirmed their shared ambition to expand bilateral trade”. The US trade deal will effectively contract this. In the past few months, India has substantially reduced the amount of crude it is procuring from Russia. Will this now become zero? The agreement with the US also casts doubt on the future of India’s second largest single-site refinery, Nayara, in which Russia’s Rosneft has a 49.13 per cent stake.

A second complexity is the $500bn in aircraft, technology, energy and other goods India has committed to purchasing from the US over the next five years (without a reciprocal commitment from the US). India’s total imports from the US were roughly about $45bn in the last fiscal year, an amount that will have to double starting this year if it intends to meet this new target. But even if India increases its orders of aircraft and semiconductor chips, US-based vendors are not in a position to deliver them on schedule. Both Boeing and Nvidia have significant backlogs on their order books. The final deal document will potentially make clear if there are any penalties if India does not manage to reach this goal.

The third complication is agriculture. The entry of US farm goods is at the core of how the Indian public receives the deal. Under the agreement, India is expected to address “long-standing non-tariff barriers” for such products. This has not gone down well in the domestic market. Farmers’ unions in the country have already sounded the alarm and called for nationwide protests starting this Thursday. In all his interviews over the weekend, Goyal has made it clear that sensitive items have been excluded from the deal and others will be controlled through quotas. He also said that cuts in duties for US farm goods would be done in a phased manner, but did not elaborate on the details and the timeline.

The final point is on the sanctity of the deal. The Trump administration has, so far, not demonstrated much inclination to adhere to its promises. In the past few weeks, the US has threatened both South Korea and the European Union with more tariffs after having signed deals with them. In Trump’s world, where everything is theatre, signing a deal is not a guarantee of anything. This puts India in a difficult spot of having to realign other strategic partnerships without the comfort of being able to anchor it around this deal with Washington.

Ministry sources indicate that reduced tariffs will kick in this week after the Trump administration issues an executive order. The legal document of the deal will be signed next month. Meanwhile, parliament will reconvene for the second phase of the budget session on March 9. The government should, ideally, open the deal up for discussion, as befits a democracy. A lot can happen between now and then. Stay tuned.

Do you think this is a good deal for India? Hit reply or email us at indiabrief@ft.com

Recommended stories

Japanese stocks soar to record high after Sanae Takaichi’s landslide election win.

Bank bosses are pushing for strict return-to-office mandates.

Keir Starmer faces a crunch week in his battle to hold on to power.

Washington Post looks to life after Will Lewis.

The Harvard professor who foresaw our age of anger.

Power couple

Two of the power sector’s largest government-owned funders are merging, a move telegraphed by the union budget earlier this month. Finance minister Nirmala Sitharaman had announced the government’s intention to create a big corporation to achieve scale and improve efficiency in the sector.

On Friday, the board of the Power Finance Corporation approved the merger of its subsidiary, REC (formerly the Regional Electrification Corporation) with the parent corporation. This follows the PFC’s 2018 acquisition of a 53 per cent stake in REC from the government. Currently, the former has a loan book of Rs11.5tn ($127bn), and the latter nearly half of that at almost Rs6tn.

While the PFC is primarily focused on projects in generation, transmission and distribution, over the years REC has expanded its business from rural electricity projects to cover the entire gamut of financing in the sector. This also includes projects in renewable energy.

India needs to significantly ramp up investments in the sector if it is to power its 8 per cent GDP growth. To this end, the government has set some ambitious targets in its national electricity plan of 2023-2032. Peak power demand, which is currently around 250GW, is expected to double by 2040. According to the estimates in the budget, public sector enterprises are expected to increase their capital expenditure by 18.6 per cent this year. Last month, the power minister said the country’s electricity sector alone needs investment of nearly Rs5tn by 2032.

All of this means the Power Finance Corporation will not have to try very hard to find borrowers. With the merger, it will also have the ability to fund an expanded directory of projects in the sector. India’s power sector needs all the help it can get, especially since all demand projections have multiplied significantly in the past few quarters as large global companies have set about building massive data centres across the country.

Go figure

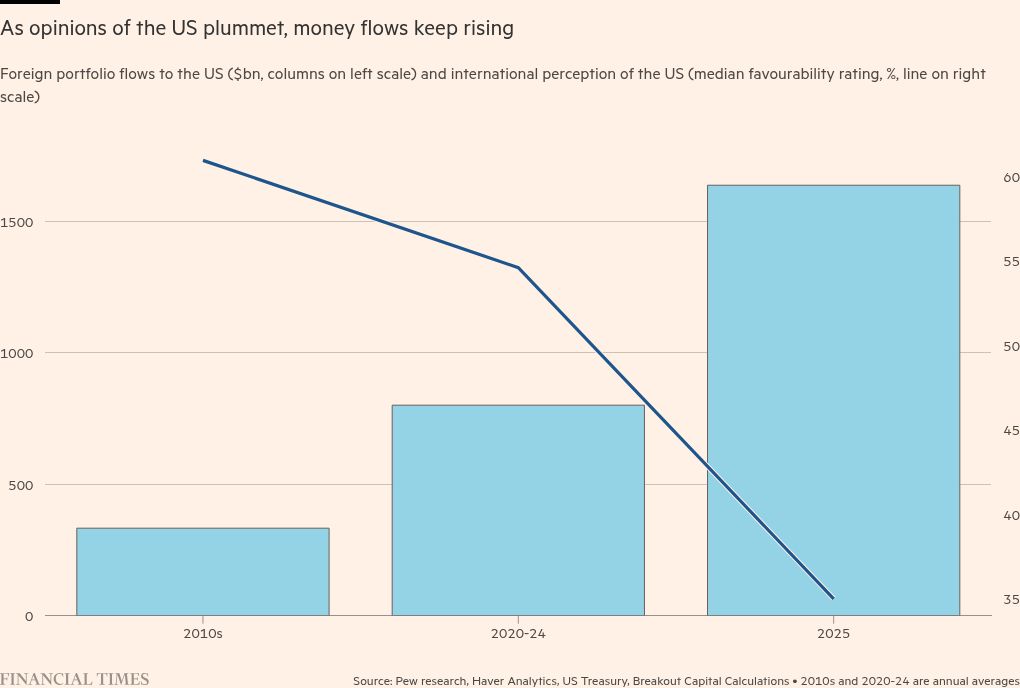

People love to bash the US, but they continue to pour money into it, writes Ruchir Sharma. But for a brief “Sell America” wave last April, foreigners were big buyers in every month of 2025.

Quick question

Do you think India has a good chance of winning the ongoing T20 cricket world cup? Tell us here.

Buzzer round

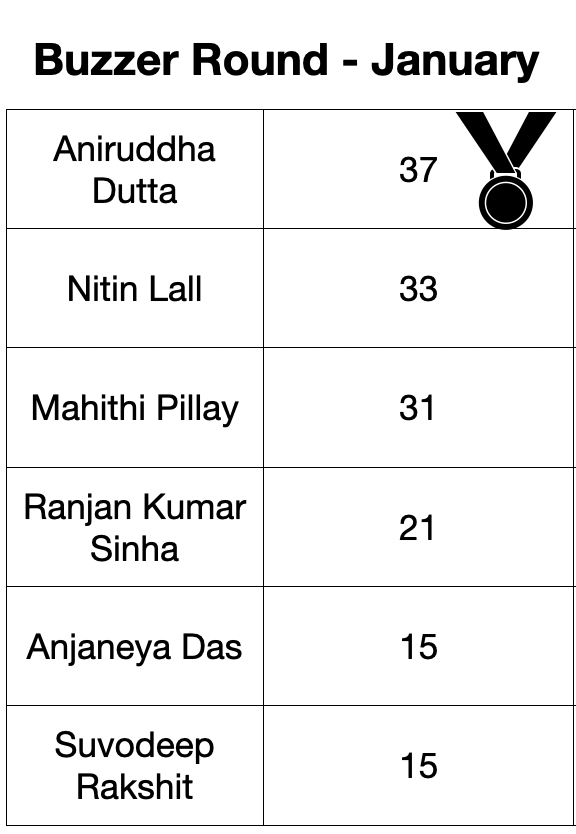

On Friday, we asked: Which flagship annual event frequented by political leaders and billionaires is considering moving its venue from its current iconic Alpine location?

The answer is of course, the World Economic Forum, which is looking for other locations as it has outgrown Davos.

Ram Teja was first with the right answer, followed by Aniruddha Dutta, Himanshu Sharma and Ranjan Kumar Sinha. Congratulations!

Aniruddha Dutta is the winner of Buzzer Round in January. Congratulations!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.