Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Companies buying into sports brands often themselves sound like coaches. Anta Sports, about to become Puma’s largest shareholder with 29 per cent, is no different: it wants to help the ailing German brand get stronger and perform better. Unlike the typical coach, though, it’s Anta that wants to be the real star.

Anta boss Ding Shizhong has been clear that he doesn’t want his Hong Kong-listed group to be just the Chinese version of Nike. Judging by his current model, that means taking his own-label sportswear global while managing or being involved with brands such as Puma and outdoor wear specialist Jack Wolfskin. A successful turnaround of Puma’s fortunes in China would help his pitch.

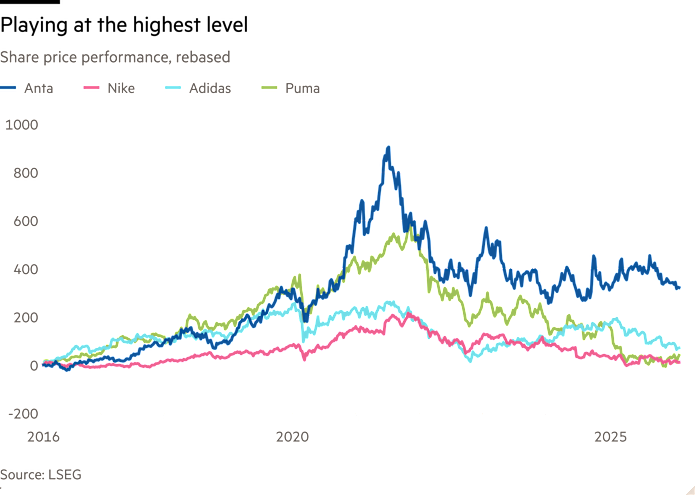

For now, Anta’s sales are almost entirely in China, and its $10bn of revenue compares with $46bn at sportswear leader Nike. But in growth terms, it has already surpassed some of its peers. Its sales have grown on average 17 per cent a year for the past five years, with Nike managing 4 per cent. Anta’s shares have delivered a total return of 450 per cent over the past decade, according to LSEG, where the US maker of the famous swoosh returned just 19 per cent.

Anta has its work cut out with Puma. The German sports brand’s sales in China dropped by more than a fifth between 2023 and 2025, according to Nomura analysts, who blamed slow updates to its stores, weak online channels and a reliance on a few big retail partners for the bulk of its sales.

In theory, Chinese consumers want what western ones do: to be fit and well. Both regions have a population that is ageing but would presumably rather not feel or dress like it. But it has proved difficult for western brands to fully accept the degree of localisation needed to succeed there. More than half the clothes Adidas sells in China are now designed and developed there specifically for that market, the German brand said recently.

Nike, too, wrestles with the same trends. It admitted in December that its China turnaround was behind schedule and that it needed to operate more locally, as well as follow boss Elliott Hill’s global push back into high-end performance and away from casual gear. “The reality is we have become a lifestyle brand competing on price in China,” Hill told investors in December.

That sounds dangerously like the place Puma finds itself in, notwithstanding its strength in football and basketball. It is an opportunity for Anta though, if it can use its local expertise to boost Puma in its home market. Asia Pacific in total provides about a fifth of Puma’s sales, so its overall recovery still rests largely on its actions in Europe and the US. But a strong game in China would boost Anta’s standing in global leagues too.