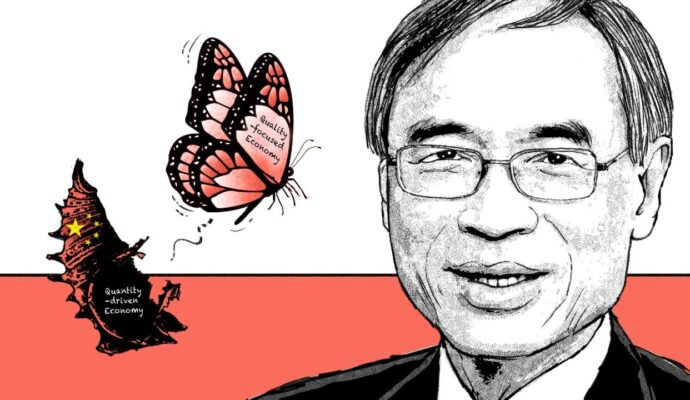

What is changing is not just trade policy, but the basis of power itself: from who prices assets best to who can still build, supply and sustain them when systems come under strain.

Advertisement

Behind these concerns lies an older question: can nations sustain influence when finance outpaces production?

History suggests they struggle. Power has long rested on the ability to produce things – roads, ports, machine tools and more recently, software, data and artificial intelligence systems, at least so long as these translate into real output rather than inflated expectations.

Advertisement

Problems arise when societies become better at trading titles to future income than at expanding productive capacity in the present.