Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Good morning. Donald Trump has sued JPMorgan and Jamie Dimon for $5bn, alleging the bank closed his accounts for political reasons. It seems that setting up and contributing up to $10bn to a “national economic security and resiliency” fund — an ESG fund with Maga characteristics — is not enough to keep the president off the bank’s back. Happily, the market thinks the lawsuit is just noise, and it’s probably right. JPMorgan’s shares rose in line with the wider market yesterday. Email us: unhedged@ft.com

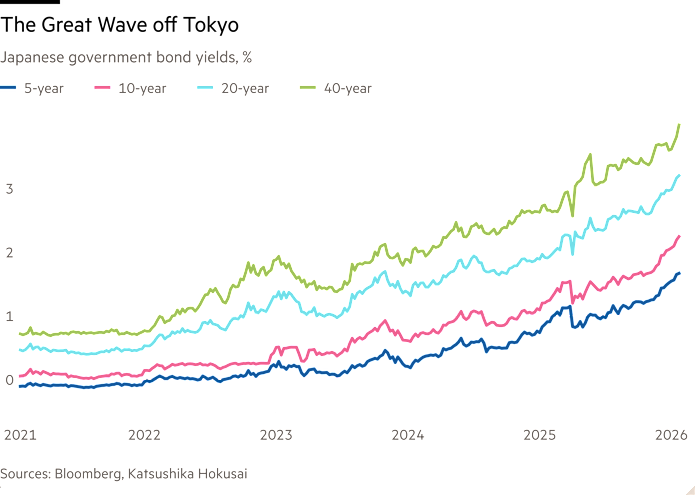

Japanese yields

The Japanese bond market is having what Ken Griffin called its “Liz Truss-lite moment”. Yields are spiking as the yen weakens:

Proximally, the issue is fear of fiscal profligacy, should Sanae Takaichi win the snap general election on February 8. She has promised tax cuts and higher spending.

The more global worry is that the rise in Japanese yields threatens to upset the rate environment and perhaps the economic status quo worldwide. Nearly 13 per cent of the US Treasury market is held by the Asian nation’s investors. If domestic yields become attractive enough, the story goes, Japanese capital will return home, US yields will rise in response, and global yields will follow, pushing an indebted financial system towards instability. Permabear king Albert Edwards of Société Générale sounds the alarm:

The world’s financial markets had long gorged themselves on Japan’s multi-decade era of ultra-low interest rates and supersized QE. Western politicians in particular should quiver with fear as Japan turns off the liquidity tap that has in effect suppressed western bond yields below levels that their bloated fiscal deficits justify.

Unhedged is sceptical. For one, Japan simply does not produce enough bonds for, or have enough bond liquidity to accommodate, a fraction of the the investors who might (in theory) depart US Treasuries. About $30.5tn in US Treasuries are outstanding, and trading volume is more than $1tn a day, according to Sifma. The stock of JGBs is less than a quarter of that size, and trading is thin, as a Bloomberg story pointed out yesterday:

It took just $280mn of trading to push Japan’s $7.2tn government bond market into meltdown. That was the combined turnover for the country’s benchmark ultra-long-maturity bonds as they plummeted on Tuesday, unleashing a $41bn wipeout across the Japanese curve that sent shockwaves through global markets.

A massive move out of Treasuries and into JGBs would be like an elephant trying to pass through a mouse hole. It isn’t going to happen.

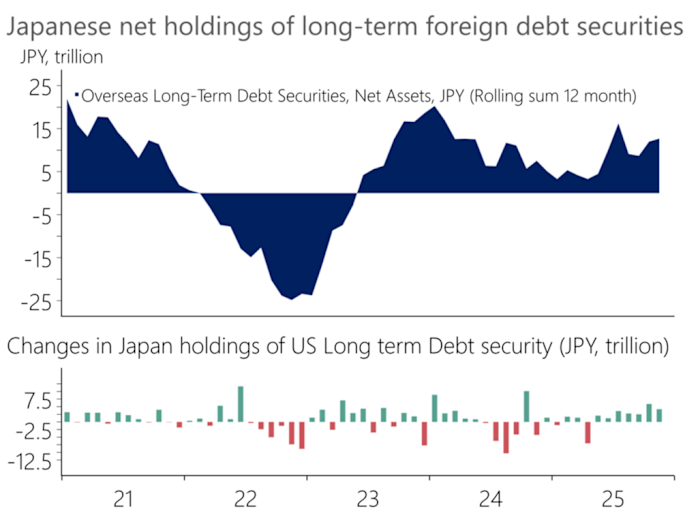

Volume and liquidity dynamics aside, Japanese investors may not want to make the trade. “We think high level of volatility in JGBs — relative to their typical levels in recent history — will dissuade Japanese investors from returning to their local government bond market, even at high-yield levels,” said Javier Corominas at Oxford Economics. “If anything, it looks like Japanese investors are continuing to increase their holdings of foreign securities.” His chart:

We think higher global interest rates are an important risk for investors to bear in mind. But we don’t think the increase will be triggered by the repatriation of Japanese capital.

(Kim and Armstrong)

A signal from staples?

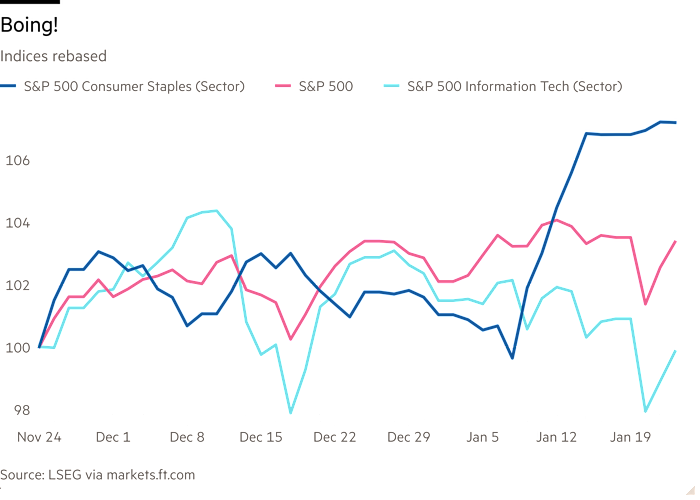

Back in November I wrote a hopeful newsletter about consumer staples stocks. It argued that (a) staples have been the most hated industry group for a long time; (b) this is partly because the big consumer goods and food/beverage companies are hardly growing; (c) the stocks aren’t particularly cheap either, but all the same (d) if the AI trade starts going sideways, staples may start looking good.

Well, the AI trade has gone a bit sideways, and the S&P 500 staples stocks have had a sharp little rally:

This might not mean much. The rally is smallish, and we have seen bigger ones in the past few years that faded quickly. It could be a dead cat bounce. But it is notable how many staples stocks that performed terribly in recent years, with barely any revenue growth, have had sharp increases this month: Constellation Brands, Brown Forman, Colgate, Church & Dwight, Hormel and many more.

The strong bid for staples was in evidence yesterday, when Procter & Gamble reported falling sales volumes and nudged down its earnings targets for the year. The chief financial officer talked about “softer consumer markets” and “aggressive competition”. Yet the stock rose 3 per cent.

Adam Josephson, of the “As the Consumer Turns” blog, writes that the problem for the staples companies is a stretched US consumer; I think the consumer is fine, but the companies’ product portfolios are outdated. Whatever the problem is, it’s not getting better any time soon. My guess is that the staples rally reflects the desire to hedge the Big Tech stocks that have dominated the market for so long. Could detergent be the new gold? It pays a dividend, at least.

(Armstrong)

One good read

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.