Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Vietnam’s ruling Communist Party has kicked off its five-yearly conclave to select a new leadership slate for one of the world’s fastest growing economies, as it navigates a global trade war and sweeping domestic reforms.

The seven-day congress began on Monday in Hanoi, where 1,600 party delegates from across the country will choose a central committee and politburo as well as set key economic targets for the country.

The event comes at a crucial time for export-reliant Vietnam, an Asian manufacturing powerhouse grappling with recently imposed US tariffs of 20 per cent and a rapidly ageing population, while pursuing wide-ranging bureaucratic and economic reforms.

The congress is “a one in five years leadership transition in Vietnam . . . and there will also be some signals about policy changes,” said Nguyen Khac Giang, a visiting fellow at Singapore’s Iseas-Yusof Ishak Institute.

“This year is very crucial, because we have seen so many changes in terms of tariff, in terms of global systems,” he added. “They want to shift the direction of the economy away from the export-led economy into domestic resilience.”

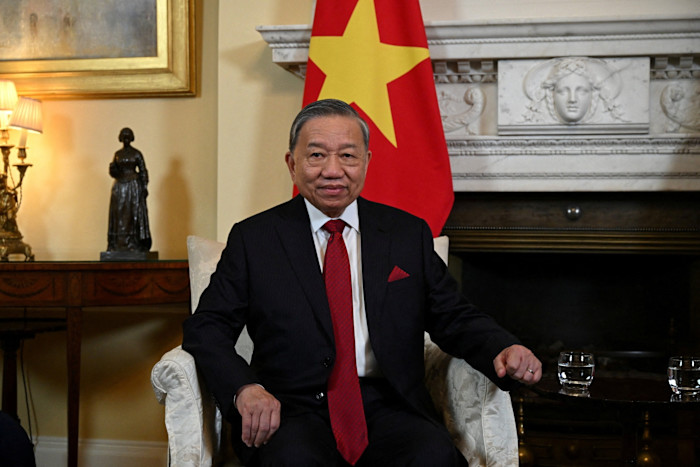

Leading that shift is To Lam, who became the Communist Party chief — Vietnam’s most powerful position — in August 2024 following the death of his predecessor Nguyen Phu Trong. He is now seeking a full five-year term at the congress.

He launched an overhaul of the bureaucracy last year by merging provinces and trimming the number of ministries and the size of the government. Thousands have lost their jobs in the restructuring.

On the economic front, Lam launched a plan to make the private sector the country’s “most important force”, with an aim to boost the domestic economy and reduce Vietnam’s reliance on foreign direct investment and, eventually, trade.

Lam and the ruling party hope these expansive reforms will help Vietnam reach its ambitious goal of becoming a developed country by 2045. Hanoi has also targeted economic growth of 10 per cent this year, following 8 per cent growth in 2025.

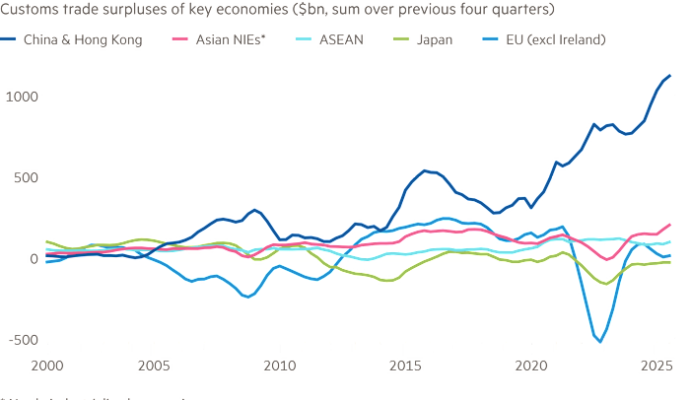

Vietnam has become a critical player in global supply chains in recent years as manufacturers move production there to diversify away from China amid a trade war with the US.

America accounts for nearly a third of Hanoi’s exports. Trump’s tariffs last year, however, has given fresh momentum to the trade-dependent country to look for an alternative economic model.

“Vietnam needs to add something to its exports, rather than its labour and the utilisation of foreign investment. So it’s looking for a massive and major change across the economy and society,” said Carl Thayer, emeritus professor at the University of New South Wales Canberra and the author of several books on Vietnam.

Thayer said Lam’s policies have broad consensus support in the party, which will discuss and approve socio-economic targets at the congress this week.

Vietnam has a four-person collective leadership system, which comprises the party chief, president, prime minister and National Assembly chair. Media reports suggest Lam will seek the presidency, along with the party chief post.

Analysts say Lam has already consolidated power in recent years. As public security minister until his ascension to the top job in 2024, he headed the country’s anti-corruption crackdown which some saw as an attempt to consolidate power and neutralise rivals.

The crackdown triggered rare political instability in Vietnam as hundreds of officials, including some from the party’s top leadership, were arrested.

If Lam does succeed in becoming president, he would have to compromise with the more conservative faction of the Communist Party, said Iseas’ Giang.

“Either way, I don’t think the collective leadership system in Vietnam will succumb to To Lam’s attempt to consolidate power without any kind of pushback,” he added.

Some investors would welcome a consolidation of the top four roles.

“Vietnam right now is run as a sort of partnership, and a concentration of roles would give rise more to the notion of a CEO. And that’s perhaps not something that people would find too negative,” said Dominic Scriven, founder and chairman of Dragon Capital, a Vietnam focused asset management firm.

“Uncertainty runs very much against the interests of [Vietnam’s economic] ambitions. So I think there’ll be a big premium on avoiding uncertainty,” Scriven added.