Stay informed with free updates

Simply sign up to the Chinese economy myFT Digest — delivered directly to your inbox.

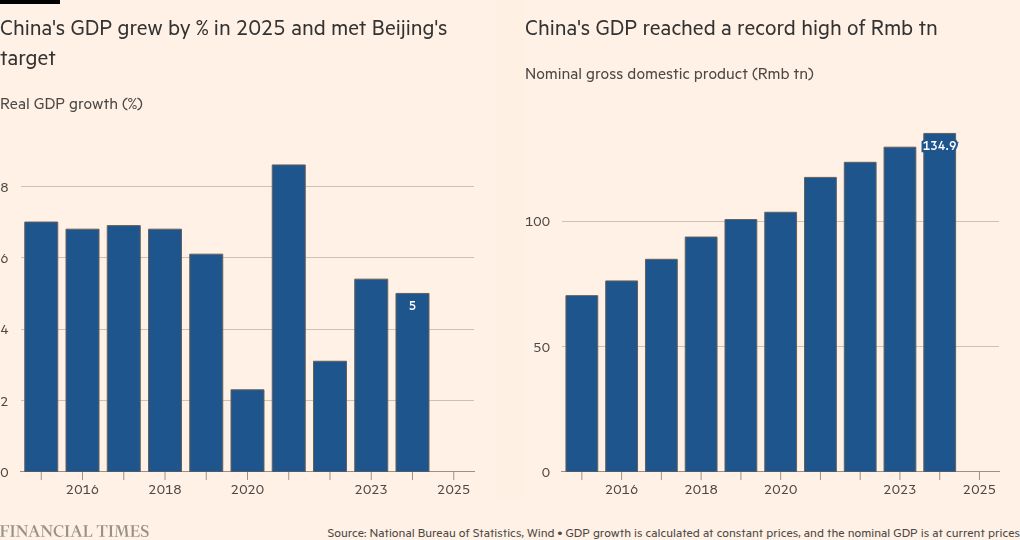

China’s GDP grew 5 per cent last year despite US President Donald Trump’s tariff war, as booming exports offset more anaemic growth in the domestic economy, according to official data.

The results underline challenges facing Beijing’s policymakers as the economy becomes increasingly reliant on exports and manufacturing to maintain growth at a time when Trump’s policies are creating ever greater uncertainty over global trade.

The data released on Monday by the National Bureau of Statistics showed the country’s two-speed economy, with industrial production exceeding expectations while most indicators of domestic demand, from property to retail sales, disappointed.

The birth rate also hit a record low, underlining deep, longer term structural issues in the domestic economy.

“While the headline looks reassuring, the underlying picture does not. Growth has become increasingly lopsided, propped up by exports while households hang back amid fragile domestic demand,” said Sarah Tan, Economist at Moody’s Analytics, in a note.

The full-year GDP figure, which was in line with Beijing’s official target and the average of a survey of analysts by Bloomberg, came as economic growth decelerated in the fourth quarter to 4.5 per cent, the NBS said.

The fourth-quarter figure was in line with analyst forecasts but down from 4.8 per cent in the third quarter.

The slowdown in the second half of the year will put pressure on Beijing to add more stimulus this year to meet an expected target of between 4.5 per cent and 5 per cent for 2026 GDP growth.

A trade truce that China agreed with Trump is due to expire this year, while uncertainty created by his threats to the EU over Greenland could weigh on the global economy, hurting Chinese exports.

President Xi Jinping is due to preside over the annual meeting of China’s rubber-stamp parliament, the National People’s Congress, in early March, at which Beijing will unveil economic targets for the coming year.

This year also marks the start of China’s next five-year plan, with economists expecting Beijing and local governments to make a determined effort to get growth off to a strong start with stimulus programmes.

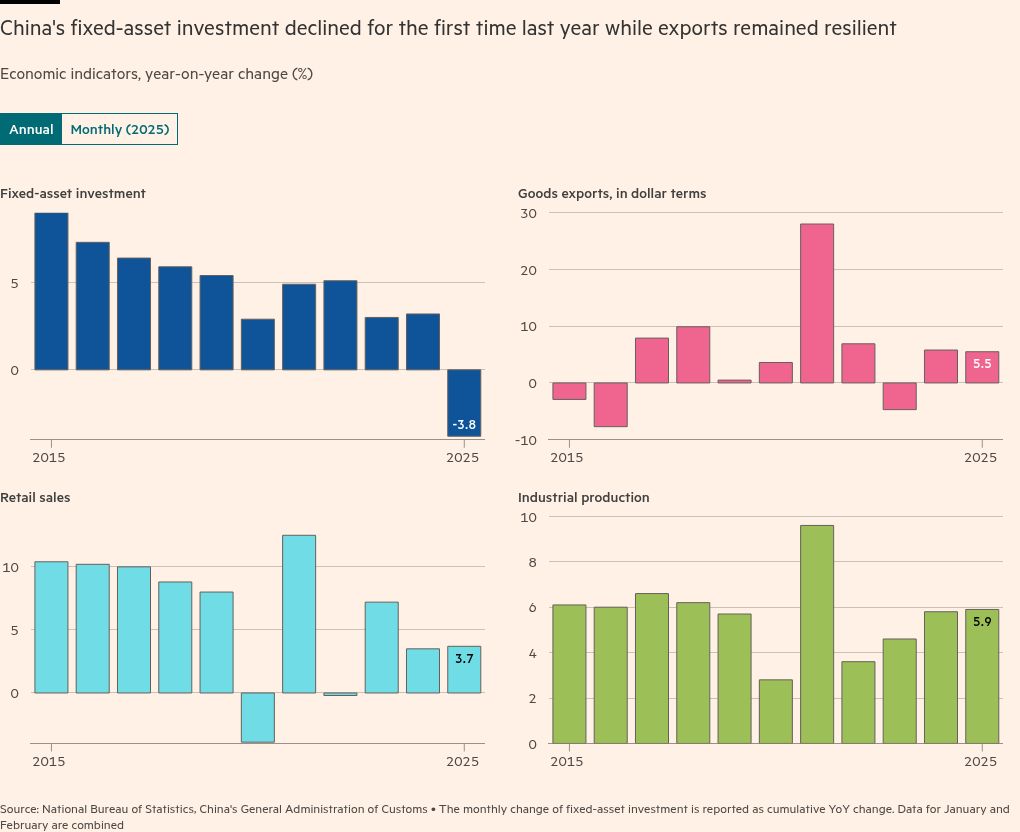

China’s fixed asset investment fell 3.8 per cent year on year in 2025, worse than analysts’ expectations of a 3.1 per cent fall and contrasting with growth of 3.2 per cent a year earlier.

Retail sales rose 0.9 per cent year on year in December, short of analyst expectations of 1 per cent growth, and 3.7 per cent for the full year.

Property investment sank 17.2 per cent last year against analyst forecasts of 16.5 per cent, as the country’s real estate downturn completed its fourth year with no sign of an end. New construction starts fell 20.4 per cent year on year.

Industrial production rose 5.2 per cent in December against a year earlier, compared to analysts’ forecasts of 5 per cent.

China’s population declined for the fourth year running in 2025 by 3mn people to 1.405bn. Its birth rate was the lowest on record at 5.63 births per 1,000 people.

“The consensus is that investment was weak towards the end of last year because the government was focused on debt resolution over launching new investments,” said a senior researcher at a Chinese state-owned bank.

Many believe investment might improve this year because the end of the last five-year plan in 2025 delayed many projects. In 2026, with start of the 15th plan, a large number of new projects would enter the pipeline.

“Since November and December, market sentiment has clearly turned more optimistic because of the outperforming export figures,” said the researcher. “Yet every time exports improves, the mood brightens and then policy action tends to go quiet again.”

With additional contributions from Wenjie Ding in Beijing