Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The US Treasury secretary has criticised weakness in the Korean won, saying its depreciation is “not in line” with the country’s “strong economic fundamentals” and adding to concerns about the currency’s volatility in one of Asia’s biggest exporters.

The Korean won strengthened as much as 0.84 per cent following Scott Bessent’s comments to Won1,463 overnight in Asia, before weakening during Thursday trading back to Won1,472.

Bessent “emphasized that excess volatility in the foreign exchange market is undesirable” in a meeting with Korean finance minister Koo Yun-cheol this week, according to a statement from the Treasury department.

Bessent added that the “recent depreciation of the Korean won . . . was not in line with Korea’s strong economic fundamentals”.

His intervention was “likely intended to support the South Korean government’s commitment to defending the won” and would help stabilise the currency in the short term, Park Sang-hyun, a researcher at IM Securities, wrote in a client note.

“The excessive depreciation of the won is uncomfortable for the US,” he said, in a nod to Korea’s trade surplus with the US.

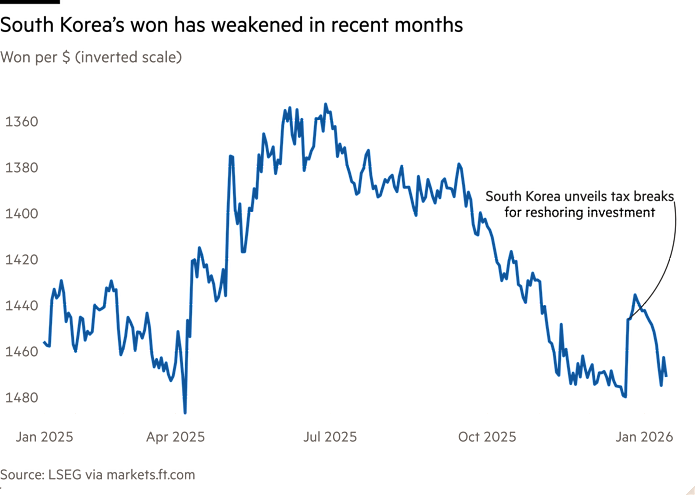

The Korean currency, which traded at Won1,350 against the dollar as recently as June last year, weakened to levels around Won1,484 last month, near 17-year lows, which officials have blamed on surging demand among retail investors for US equities.

Former IMF chief economist Kenneth Rogoff this month said the won was “very undervalued”.

This is the second time in recent months that the Treasury secretary has commented on the currency of a major US trading partner. Last year, he warned that the Bank of Japan was falling “behind the curve” on fighting inflation and called for “policy space” to raise rates.

Bessent and Koo also discussed critical minerals and the implementation of a US-Korea trade deal agreed in October. The deal provided relief for Korea’s vital car industry, lowering tariffs to 15 per cent, in line with rivals in neighbouring Japan, in exchange for a pledge from Seoul to invest $350bn in US industry.

The Bank of Korea is facing competing pressures from higher house prices and sluggish consumer and business sentiment. It held its benchmark interest rate steady at 2.5 per cent on Thursday.

BoK governor Rhee Chang-yong said on Thursday that “anyone would agree” with Bessent’s comments. “It’s difficult to agree with the pessimism about the Korean economy and the value of the won,” he said.

The Korean finance ministry’s December “Green Book” of monthly economic trends highlighted a boom in semiconductor exports on demand for artificial intelligence, which it said masked declines in other sectors.

Rhee also suggested that Korean investments in the US, which are capped at $20bn annually under the trade deal, could be lower in order to prevent disruptions in foreign-exchange markets.

Korean authorities have blamed the currency’s weakness on the country’s retail investors’ appetite for US equities, as traders chase gains by American tech companies.

US equity holdings by individual traders, known as gaemi (ants), increased by more than $1.8bn in December alone, according to the Korea Securities Depository, even as Korean markets were among the best-performing in the world last year.

In an effort to lure traders home, Korea’s finance ministry last month announced tax breaks for reshoring overseas stock investments, alongside temporary changes in levies and currency trading regulations. In a rare combined statement, the finance ministry and the BoK warned that the won’s weakness was “undesirable”.

The won jumped more than 2 per cent last month in the wake of the package.

Additional reporting by Kang Buseong