Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Japan’s finance minister has said US Treasury secretary Scott Bessent shares Tokyo’s concerns about the yen’s recent weakness, fuelling speculation that Japanese authorities might intervene to support the currency.

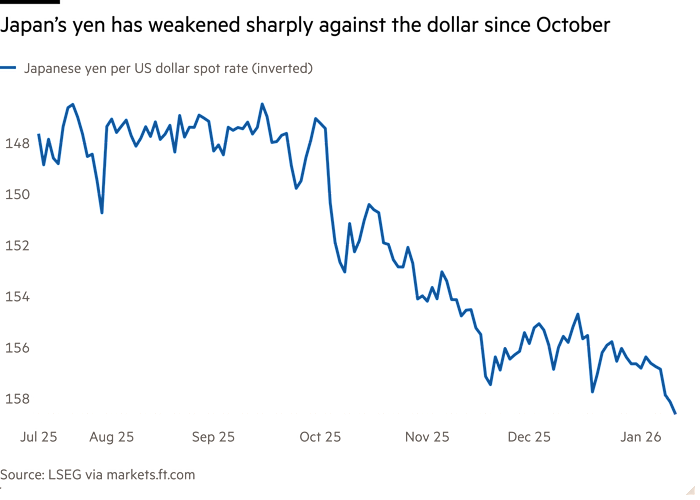

The comments by Satsuki Katayama, who met Bessent in Washington on Monday, came as the yen weakened to ¥158.7, its lowest since July 2024 and close to the level at which the finance ministry has previously stepped in to support the yen.

“I expressed my concerns about the one-way weakening of the yen,” Katayama told reporters after the meeting. “Secretary Bessent shares those concerns.”

The yen’s persistent weakness has become an intensely political issue in Japan, where it has contributed to rising food and energy prices — a sharp contrast to years of deflation and little change in the cost of living.

The currency’s fall has been attributed in part to a “Takaichi trade” as investors respond to the prime minister’s plans to raise spending and her preference for looser monetary policy.

Prime Minister Sanae Takaichi’s $135bn stimulus proposal has spooked bond markets and weighed on the yen while boosting equities.

The Nikkei 225 stock index on Tuesday rose more than 3 per cent to an all-time high, driven by speculation that Takaichi is considering a snap election in February.

Yields on 20-year Japanese government bonds rose to a record high of 3.135 per cent, while the 10-year yield climbed to 2.135 per cent — its highest since February 1999. Yields move inversely to prices.

The yen has weakened despite the Bank of Japan raising interest rates in December to a 30-year high of 0.75 per cent and expectations among economists that the central bank will increase borrowing costs again this year.

When the yen fell after the BoJ decision, Katayama said she had a “free hand” to intervene if needed. Japan intervened on four occasions in 2024, when the yen weakened to about ¥160 a dollar.

Shoki Omori, chief global desk strategist at Mizuho, said the Bessent-Katayama meeting was notable for its focus not on the exchange rate itself but on whether the moves had become excessively one-sided and rapid.

“I do see a chance of intervention,” said Omori, adding that traders would be looking at how consistently authorities conduct currency policy and the extent to which their messaging can gain credibility in the market.

Some investors said the rise in the country’s long-term borrowing costs, compounded by Takaichi’s fiscal plans, was starting to fuel concerns over its debt burden, which at more than 200 per cent of GDP is the largest among rich nations.

“The market is worried about debt sustainability,” said Kit Juckes, chief FX strategist at Société Générale.

“Fiscal concerns and the gradual pace of BoJ rate hikes leave the yen vulnerable to further weakness at the start of this year,” said Lee Hardman, senior currency analyst at MUFG.

Swaps markets are fully pricing in only a quarter-percentage-point interest rate increase from the BoJ over the course of this year.

Other analysts argued the debt picture was more positive.

“Inflation is higher than interest rates so net debt is coming down,” said Nicholas Smith, Japan strategist at CLSA.

There are “a lot of reasons” to think the yen should strengthen, including falling US interest rates and oil prices, but it has “just been bloody stubborn recently”, he added.