Good morning. The IPO frenzy is continuing right till the end of the year. Meesho’s shares have almost doubled since the online retailer listed on the exchanges last week. Tomorrow is another big one: ICICI Prudential’s $1.2bn share sale, which received $33bn in bids, will debut in the markets.

In today’s newsletter, as we wind down towards the end of the year, enjoy the best of our Buzzer Round questions. But first, full foreign ownership in the insurance sector has been cleared by parliament.

Red carpet

India will allow fully foreign-owned insurance companies, with the lower house of parliament clearing the amendment bill on Tuesday. The legislation, approved by cabinet last week, also introduced several reforms aimed at expanding the insurance industry in India and improving governance.

India has been increasing foreign holdings in insurers in a phased manner over the past 25 years, starting at a cap of 26 per cent in 2001. Foreign investors are currently conditionally allowed to only hold up to 74 per cent. Finding a suitable Indian partner for the remaining 26 per cent is a “mammoth effort”, Nirmala Sitharaman told parliament. The finance minister also attempted to allay opposition concerns that decisions about Indian insurance would be made on foreign shores, saying that global investors in the sector would be subject to all local laws.

The other main thrust of the bill is in expanding the powers of the Insurance Regulatory and Development Authority. The amendments allow the regulator to inspect, search for and seize documents, similar to the stock market watchdog Sebi. Such actions may be taken in relation to cases of suspected violations of the law, illegal payments of commissions and rebates, and accounting irregularities, among other things, and cover intermediaries including banks, fintech companies and online aggregators. (My favourite bit from the new legislation — the officer may also break open doors, lockers, safes or other receptacles if keys are not available, seize relevant documents found during the search, and mark, copy or extract records required for investigation. I’m ready for an IRDA officer superhero movie franchise).

Mis-selling of insurance products — where agents push investment-linked policies that are more lucrative for themselves — is a serious issue for Indian consumers. If the IRDA’s expanded powers can curb this problem, that would go a long way towards restoring faith in the system. But regulatory over-reach is a concern for industry participants, and the regulator’s early actions once the amendment becomes the law will be closely watched.

According to most estimates, so far only $10bn of foreign money has been invested in the insurance sector. Insurance penetration in the country was 4.2 per cent in 2022, with life insurance at 3.2 per cent. The government is hoping foreign money will both broaden and deepen the market, as well as bring with it some industry best practices from around the world.

Earlier this year, Germany’s Allianz terminated its 24-year alliance with Bajaj and then re-entered the country with Ambani’s Jio Financials. Others such as Axa, AIA, and Ergo also operate in India, with big local partners. Once the amendments clear the legislative process, some of these existing partnerships and equations will probably change. It will also bring in new players from around the world. This is good news for both the sector and its customers.

Recommended stories

Interest rates will stay low for a “long period”, Reserve Bank of India governor Sanjay Malhotra told the FT.

Donald Trump has an “alcoholic’s personality”, his chief of staff revealed in a tell-all interview in Vanity Fair.

Vladimir Putin’s threat to retaliate over frozen assets has rattled EU capitals.

Inside Meta’s turbulent bet on AI: A year of internal disorder, fluctuating priorities and colossal spending.

Oracle’s $10bn Michigan data centre is in limbo after funding talks stalled. Tech stocks slid.

Japan’s $580bn hidden asset? Potentially re-sellable household objects in the back of the cupboard.

Buzzer Round

This is the last Friday issue of India Brief this year; we are taking a break next Friday, December 26. Thank you for a year of enthusiastic participation in our newsletter’s humble trivia section. As you disperse to your various festive gatherings, we hope this list of our 10 top Buzzer Round questions of the year will prove a useful party icebreaker with family, friends and colleagues.

Which beverage was invented as a livener for travellers arriving at Foynes airport in County Limerick? (Answer)

According to Donald Trump, who operates the Panama Canal? (Answer)

Why is the Tokyo government planning to allow staff to work four-day weeks? (Answer)

What is Saudi Arabia investing $40bn to create? It’s an industry it projects will employ 39,000 people by 2030. (Answer)

For which job will a search committee identify candidates by interpreting visions and signs, including the direction in which the predecessor in that role was looking when he died? (Answer)

Which Hong Kong-based company, founded as an opium trader in the 1800s, inspired a novel that was made into a movie starring Pierce Brosnan? (Answer)

What is the United Arab Emirates aiming to deploy to speed up lawmaking by 70 per cent? (Answer)

What popular fitness wisdom was dreamt up by the Japanese company Yamasa around the time of the 1964 Olympics? (Answer)

Which art form, recently all the rage on social media, is said to have descended from pictographic scrolls in the 12th century? (Answer)

What connects the Swiss watch Tag Heuer, French cognac Hennessy and Rihanna’s Fenty Beauty? (Answer)

If you’d like 10 more of these on December 29, let me know at indiabrief@ft.com. And today’s Buzzer Round question: What connects the terms “rage bait”, “brain rot”, “rizz”, and “goblin mode”?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Go figure

The auction for the Indian cricket league IPL’s 2026 tournament concluded on Tuesday. Here are some key numbers. (All prices in INR).

630mn

Biggest spender — Kolkata Knight Riders

252mn

Cameron Green — Most expensive overseas player

142mn

Prashant Veer & Kartik Sharma — priciest Indians

Read, hear, watch

I was absolutely riveted by All Her Fault, (JioHotstar) a thrilling drama about a kidnapped child starring Sarah Snook of Succession fame. It sagged a bit towards the end, but it really captured the pressure (and the risks) that having a career and raising a child entail.

Last year, I wrote in this newsletter that my resolution was to watch a lot more Indian content. I have not been very successful with that. Send me your recommendations.

Have you made your new year resolutions? Write to me at indiabrief@ft.com, if you don’t mind sharing them. My main goal in the coming year is to clear my inbox every day and not let it reach a state where it overwhelms me. (I’m currently at 2,175 unread mails on my work email. I hope my boss is not reading this.)

Tell us your plans and resolutions for 2026. Hit reply or email me at indiabrief@ft.com

Quick answer

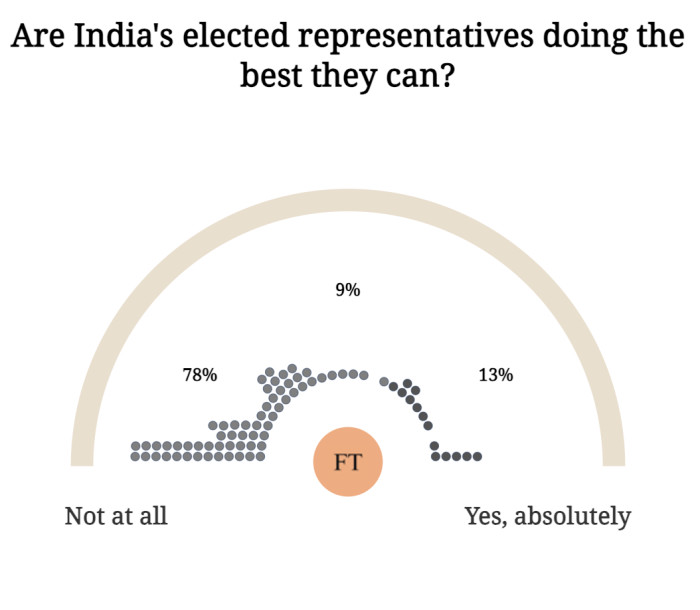

On Tuesday we asked if India’s elected representatives are doing their best to be productive and effective in parliament? Nearly 80 per cent of you do not think they are. (They are not.)

Thank you for reading. This India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.