One thing to start: Warner Bros Discovery’s board is weighing rival takeover offers that pit price against regulatory risk and the political dynamics of Donald Trump’s Washington — a decision that could redefine the direction of the legendary Hollywood studio.

And a scoop: Germany’s leading football club Bayern Munich held talks this year with EQT over selling a minority stake to the private equity firm, in a deal that would have reignited a heated national debate over the merits of private capital firms investing in football.

And another: US infrastructure investment group Stonepeak is in advanced talks to acquire BP’s Castrol lubricants business, as the UK oil company attempts to raise $20bn from asset sales by 2027.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

Singapore’s poor sovereign wealth returns

Continuation funds head to court

Patrick Drahi’s creditor battles

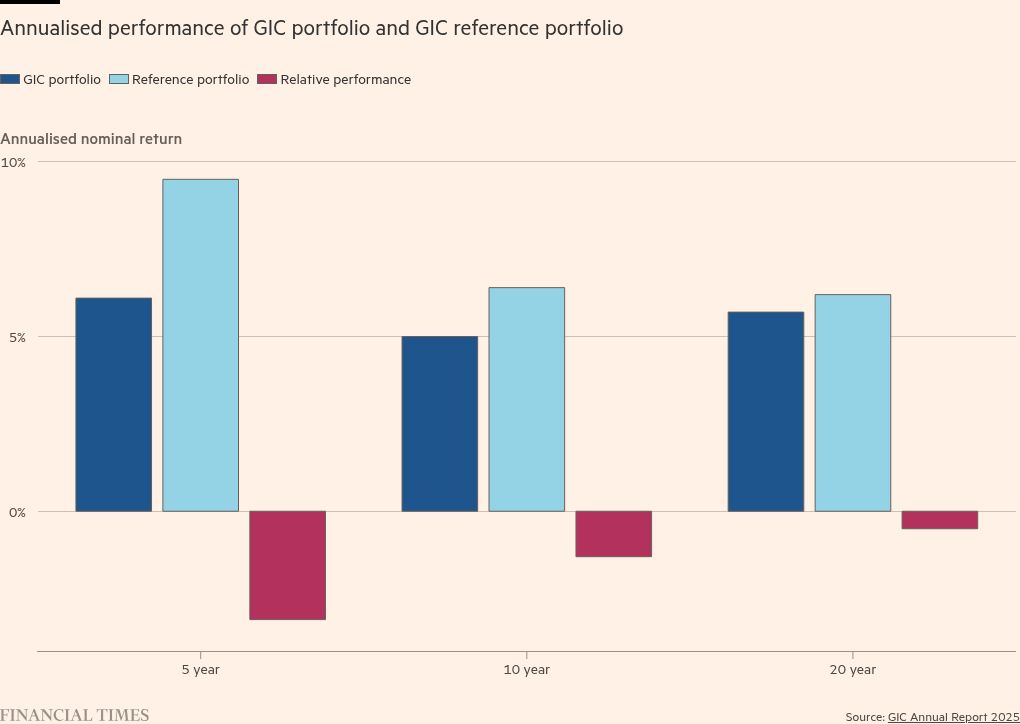

Singapore’s sovereign wealth behemoths confront lagging returns

Singapore is the envy of the world in many regards, from its 10-second airport clearance time to its numerous Michelin-starred street-food vendors.

But when it comes to sovereign wealth fund investment returns? Not so much.

Despite being an island nation of just 6mn people, Singapore boasts two of the world’s biggest and best resourced state-owned investors: Temasek and GIC.

The FT’s Owen Walker took a deep dive into the reasons for their poor performance and how the funds are trying to make their portfolios more resilient in the face of more volatile market conditions to come.

DD readers are likely aware of the two financial behemoths, as they frequently pop up in deals around the world, from Silicon Valley to Shanghai.

Yet each has averaged an annual rate of return of just 5 per cent over the past decade. That places them well within the bottom quartile of a cohort of 50 similar institutions around the world.

At the same time, their importance to Singapore’s economy cannot be overestimated.

Contributions from Temasek and GIC — along with Singapore’s central bank — account for about 20 per cent of the city-state’s budget and have enabled it to maintain a surplus for much of the past two decades.

Their performance will be even more critical as Singapore’s population ages and becomes more reliant on the state.

“Their fund performance is the elephant in the room that nobody wants to talk about,” said Diego López, managing director of Global SWF, who is based in the city-state.

The deal roiling the world of continuation funds

Continuation funds, the complex vehicles private equity firms use to sell assets between their funds, have for years been a special interest for DD.

We have outlined the fraught nature of these deals in which a PE firm is both the seller of an asset and its buyer, an inherent conflict.

Kaye Wiggins, DD’s legal expert, offered epic but prescient deep dives into continuation funds years ago during the exuberant capital markets environment of the early 2020s.

In 2022, DD outlined all of the ways the deals could prove to be problematic, including the incentives for PE firms to use the vehicles to reset lucrative management and performance fees on ageing deals.

At the time, we thought markets were booming. Little did we know the party was just getting started. Continuation funds now account for a staggering 19 per cent of PE exits.

But while we have heard in hushed voices critiques of alleged conflicts and stress in the investment community, few fights have become public.

On Wednesday evening DD’s Antoine Gara scooped what is the most prominent fight in the continuation fund world after Abu Dhabi Investment Council sued to block a large deal from moving forward.

The sovereign fund sought to block Energy & Minerals Group from selling its stake in Ascent Resources, one of America’s largest private gas drillers, to one of the private equity firm’s sister funds.

It alleged the deal undervalued Ascent while generating a windfall for the new fund managed by EMG. It further said the PE firm ran a flawed process.

The sovereign wealth fund’s complaint makes for good reading on all of the alleged ways in which the continuation vehicle deal favoured the PE firm orchestrating the transaction. (Lex offered a take on the drama as well.)

The lawsuit, filed in Delaware, has many rounds to go and will be a good barometer on whether more standard rules for CV deals are needed.

On Thursday, the PE firm agreed to halt the deal subject to arbitration, instead of closing as it had planned to do by year-end.

Drahi goes on the offensive

Patrick Drahi has had his back up against the wall for years as his Altice telecoms empire has struggled under a heavy debt load. Lately he’s come out swinging.

In the aftermath of Thanksgiving celebrations last week, Drahi served up creditors with an unexpected turkey of an asset strip.

Altice International, a subsidiary that owes more than €8bn, moved assets away from creditors in one of the most aggressive transactions to hit Europe’s credit markets in living memory.

Last Friday’s move came just days after Altice USA, which sits on more than $26bn of debt, filed a novel antitrust lawsuit against creditors including Apollo and BlackRock. It accused them of colluding to force it into bankruptcy.

Drahi’s manoeuvres show that the Franco-Israeli billionaire, widely regarded as junk bond royalty, apparently has no intention of easing the pain for the institutions that helped finance Altice’s growth.

Drahi built his telecoms business with heavy borrowing at low interest rates. In 2014 Altice raised $16.7bn in the largest ever high-yield bond deal to finance a takeover of SFR, one of France’s main telecoms providers.

But in a higher rate environment, his sprawling group has begun to fall apart. Drahi’s troubles are setting the stage for a dismantling of his wider empire.

In the meantime, they’ve left him in an escalating stand-off with creditors.

At the end of this, Drahi will still “have his yacht and have a billion in the bank”, one industry executive said. But he may end up as somebody “nobody wants to lend any money to”.

Job moves

Paul Weiss has hired Kelann Stirling and Jamie Franklin as partners in its finance group. Stirling joins from Kirkland & Ellis where she was a partner. Franklin joins from White & Case where he was a partner.

RBC Capital Markets has hired Sean Weissenberger as managing director in its European industrials team. He joins from Citigroup where he was Emea head of chemicals.

HSBC has appointed Thomas Curran as head of global credit and financing. Curran is based in New York but will move to London in 2027.

UK Government Investments has appointed Harry Hampson as its new CEO. He joined as a director in July 2025, and previously was a global chair of investment banking at JPMorgan.

Evercore has hired Ashish Varshneya as a senior managing director in the healthcare group. He joins from TripleTree where he was a managing director.

Smart reads

Customers for life Wall Street groups are vying to manage the millions of “Trump accounts” about to be spawned by a US initiative to give cash to babies, The Wall Street Journal reports.

Sovereign wealth The rapidly growing investment group run by Abu Dhabi’s deputy ruler exemplifies the Emirati economy, the FT writes, where the lines between royal and state assets are blurred. Private sector firms lament they’re being locked out.

Popular appeal The ultra-secretive $3.3tn Capital Group has emerged from the shadows to launch a marketing campaign pitching retail investors on private market funds, Bloomberg reports.

News round-up

US senators seek to block Nvidia sales of advanced chips to China (FT)

Trustpilot shares plummet after short seller alleges ‘mafia-style’ practices (FT)

FCA to grant provisional licences to financial start-ups to help them launch faster (FT)

Meta set to slash spending on metaverse as Zuckerberg shifts focus to AI (FT)

Lead developer of major Scottish carbon capture project to sell stake (FT)

Aberdeen takes on Stagecoach’s pension scheme in ‘landmark’ deal (FT)

EU to review tariffs on Volkswagen’s EVs made in China (FT)

Jane Street’s trading haul juiced by surging bet on Anthropic (BBG)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, Alexandra Heal and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard, Kaye Wiggins, Oliver Barnes, Tabby Kinder and Julia Rock in New York, George Hammond in San Francisco and Arjun Neil Alim in Hong Kong. Please send feedback to due.diligence@ft.com