Stay informed with free updates

Simply sign up to the Indian business & finance myFT Digest — delivered directly to your inbox.

Indian stocks have underperformed other emerging markets by the widest margin in more than three decades as global investors pivot towards China and equities linked to the artificial intelligence boom.

The MSCI India index has returned 2.5 per cent in dollar terms this year compared with 27.7 per cent for the MSCI Emerging Markets index, India’s weakest relative performance since 1993.

Foreign investors have pulled more than $16bn out of India this year, the second-largest drawdown on record, as they book profits from years of strong gains to fund investments in other Asian markets.

Chinese and South Korean equities, especially semiconductor and software stocks, have rallied sharply this year because of optimism over AI and a broader re-rating of their markets from a low base.

“Investors saw India as a funding trade this year to fund their [long positions] in the rest of the Asian region,” said Sunil Koul, global emerging market equity strategist at Goldman Sachs.

Before this year, India had maintained a streak of outperformance against other emerging markets since 2021, benefiting from investors reallocating funds from China, said Wong Kok Hoi, founder and chief strategist of APS Asset Management, a Singapore-based fund.

But uncertainties around a trade deal with the US and the lack of a clear AI theme in Indian equities have led investors to take money out of the market.

“The interplay of persistent underweight positioning, rotation towards tech-heavy north Asia, tariff-driven sentiment weakness and moderating earnings visibility” is driving India’s relative underperformance, said Harendra Kumar, managing director of institutional equities at Elara Capital in Mumbai.

Matthew Quaife, global head of multi-asset at Fidelity International, noted that Chinese and Indian equities rarely rallied together. “When one’s really hot in the market, the other one tends to have a little bit of a harder time,” he said.

India’s relative underperformance comes despite a hot market for initial public offerings. Listings have mostly been in non-tech sectors and corporate earnings have fallen short of expectations, denting foreign investor interest in the country’s stocks.

The underperformance in dollar terms has also been driven by the Indian rupee being the worst-performing major Asian currency this year. The rupee weakened past Rs90 a dollar on Wednesday, bringing it down 5 per cent against the US currency since the start of the year.

“Earnings growth has just been cut all year long,” said Ray Farris, chief economist at Eastspring Investments. “There’s been a bit of derating.”

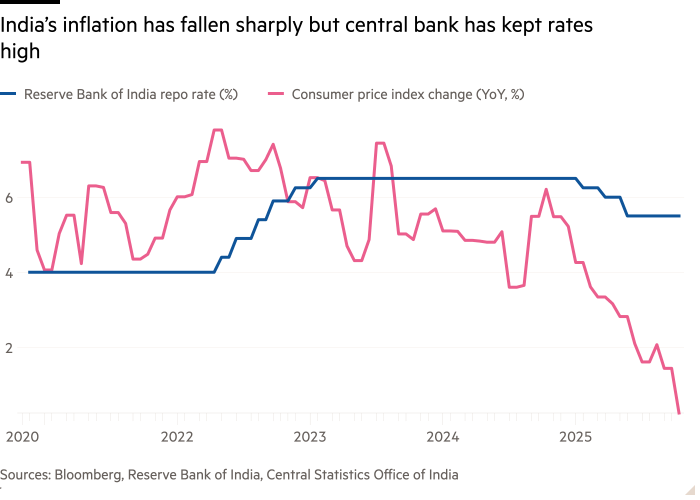

Analysts also pointed to the Reserve Bank of India keeping interest rates high even as a pandemic-induced rise in inflation had eased.

“Both fiscal and monetary tightening led to a growth slowdown last year, which led to an earnings downgrade cycle,” said Goldman’s Koul.

India’s consumer price index rose 0.25 per cent year on year in October, its lowest level in more than a decade. The RBI, meanwhile, has held the repo rate at 5.5 per cent since June.

“Inflation surprised to the downside,” said Eastspring’s Farris. “Real interest rates remain very high.”

Amid foreign outflows, domestic investors have buoyed the Indian market with a continual influx of money from retail systematic investment plans. The Nifty 50 index of the market’s largest companies is trading at record highs, even as the broader MSCI India index is down 3 per cent from its peak in late September last year.

“The market probably would have fallen more if it wasn’t for the SIPs,” said Joshua Crabb, head of Asia-Pacific equities at Robeco.

India Business Briefing

The Indian professional’s must-read on business and policy in the world’s fastest-growing big economy. Sign up for the newsletter here

Many investors and banks are optimistic that India will perform better next year. Goldman Sachs and HSBC recently upgraded the country’s equities to overweight, citing recent government reforms such as overhauling the goods and services tax and opening up the banking sector to more foreign investment.

Goldman analysts wrote in a note that earnings at MSCI India companies had bottomed and were likely to recover next year. “We think foreign money will come back,” Koul said.

Robeco’s Crabb added: “The vast majority of the relative underperformance has probably played out now.”