Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

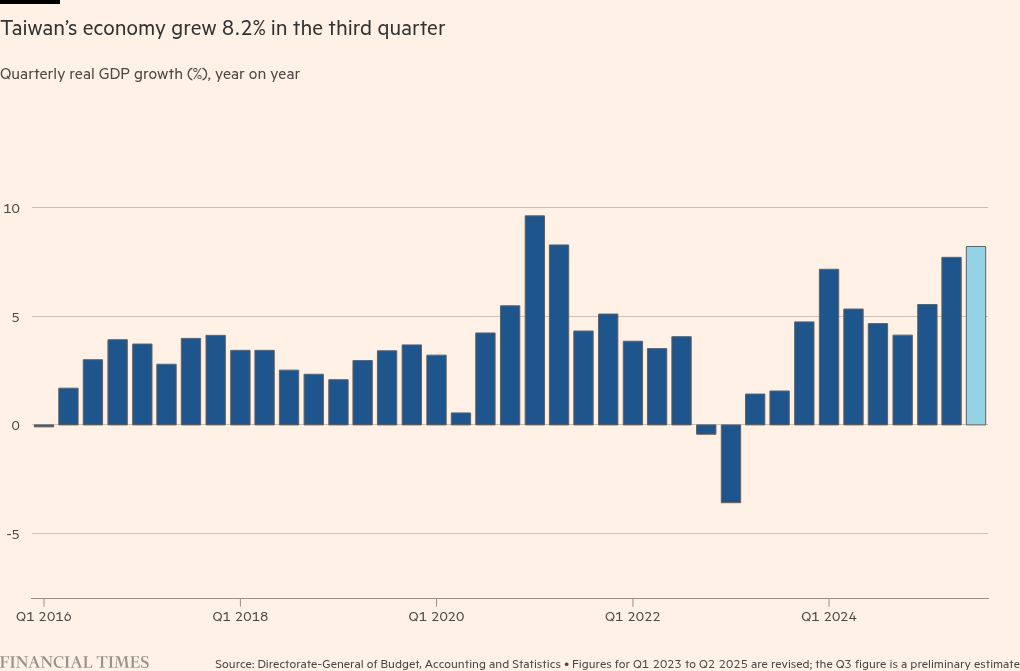

Taiwan is enjoying an artificial intelligence-fuelled boom that pushed GDP growth above 8 per cent in the third quarter, but Kevin Chung, an engineer at a machinery manufacturer in the New Taipei Industrial Park, has not been feeling much benefit.

“The economy’s pretty bad,” Chung said recently in the park, a cluster of small factories, warehouses and offices west of the capital Taipei. “All of our costs are going up. A lot of our customers have gone out of business.”

Such downbeat sentiments reflect a stark divergence in Taiwan’s industrial sector between the fortunes of cutting-edge technology companies and more traditional manufacturers.

Demand for AI and consumer electronics sent Taiwan’s exports soaring 32 per cent year-on-year in the three months from July to September, pushing GDP growth for the quarter to 8.21 per cent, according to official data released last week.

But Taiwanese manufacturers of more traditional products, such as car parts and machine tools, have been hit hard by hefty import tariffs imposed by US President Donald Trump and by a rise in the Taiwan dollar that has eaten into their profit margins.

At the same time, traditional manufacturers are suffering increasing competition from lower-cost rivals in China and shortages of skilled workers for key roles such as machine operators.

A quarter of Taiwan’s labour force is in traditional industries, according to figures cited by Chung-Hua Institution for Economic Research vice-president Jiann-Chyuan Wang.

Production of integrated circuits increased nearly 30 per cent year-on-year between January and October 2025 and that of computers, electronic and optical products was up more than 40 per cent, according to indices compiled by the economics ministry. But output of motor vehicles and parts was down 8 per cent and that of furniture slumped 12 per cent.

“Our customers are in traditional industries that are really struggling,” said Fei, a worker at a chemicals company who declined to give his full name. “Everything is about AI at the moment.”

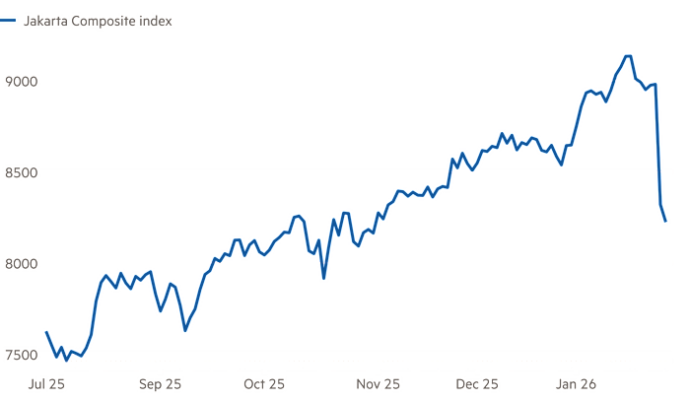

Such woes have hurt investors in traditional manufacturing. While Taiwan’s main stock market index remains close to record highs hit in recent months, its non-finance, non-electronics sub-index has fallen more than 3.5 per cent this year.

The extent of the AI and electronics boom has surprised many forecasters, who previously feared that traditional manufacturers’ difficulties and Trump’s trade policies might weigh heavily on Taiwan’s economy this year. In May, the cabinet’s statistics agency forecast GDP growth for 2025 of 3.10 per cent. Last week, it predicted growth of 7.37 per cent, a growth rate that would be Taiwan’s fastest in 15 years and — rarely for a developed economy — even outpace China.

“People were expecting some kind of economic slowdown,” said CIER vice-president Chen Shin-Horng. “So far, so good.”

Taiwan’s tech industry has proven one of the biggest beneficiaries of a surge in global demand for semiconductors and servers. In September, chipmaker Taiwan Semiconductor Manufacturing Co, which produces about 90 per cent of the world’s most advanced semiconductors, reported its highest quarterly profits and raised its outlook for the rest of the year on “very strong” AI demand.

“No other countries can catch this trend so quickly,” said Kamhon Kan, an economics researcher at Taiwan’s Academia Sinica.

But Kan said global macroeconomic uncertainty caused by US trade policy had deterred investment elsewhere. “Companies do not invest, except for the AI sectors,” Kan said.

At the same time, the sharp appreciation of Taiwan’s currency against the US dollar in the first half of the year hurt many exporters.

“The profit margins for Taiwanese companies are usually quite low,” Kan said. “TSMC has these enormous profit margins, so they’re OK.”

And while Taiwanese exports of semiconductors and associated hardware are so far exempt from Trump’s tariffs, other products are subject to 20 per cent levies, putting them at a disadvantage to competitors in Japan and South Korea, with a 15 per cent rate.

Diplomatic isolation imposed by China, which claims sovereignty over Taiwan and has threatened the use of military force if Taipei resists its control indefinitely, has also prevented the country from sealing deals that might give it more secure access to overseas markets.

“We don’t have free trade agreements with major trading partners,” said Chen at CIER.

Taiwan’s reliance on the semiconductor industry has also raised concerns, particularly given market jitters about a potential international AI bubble.

“If AI infrastructure investment becomes saturated and capital expenditure slows in the medium term, we could see slowing growth in the chip sector,” said Cynthia Yang, an industry analyst at Market Intelligence & Consulting Institute.

In an interview with the Financial Times last month, Wu Cheng-wen, the minister who oversees Taiwan’s National Science and Technology Council, said the government was seeking to diversify its economic model, focusing on areas such as drones, robotics and medical technology.

The country should “not rely entirely on semiconductors like now”, Wu said.