Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Global bond markets dropped on Monday after the Bank of Japan signalled that it could soon raise interest rates, in a decline that heaped fresh pressure on bitcoin and other speculative assets.

Japan’s two-year government bond yield jumped above 1 per cent for the first time since 2008 after Bank of Japan governor Kazuo Ueda indicated that the central bank might raise rates this month. Longer-term debt also fell, with the 10-year yield up 0.07 percentage points to 1.87 per cent.

The rise in Japanese yields rippled through global fixed-income markets, sparking declines from the US to Germany.

The US 10-year Treasury yield, a benchmark for trillions of dollars in assets globally, rose 0.08 percentage points to 4.09 per cent — its largest increase in a month. The 10-year German Bund yield climbed 0.06 percentage points to 2.75 per cent.

“Global bonds are feeling the butterfly effect following the Bank of Japan’s hawkish signal to prepare for a December rate hike,” said Matt Miskin, co-chief investment strategist at Manulife John Hancock Investments.

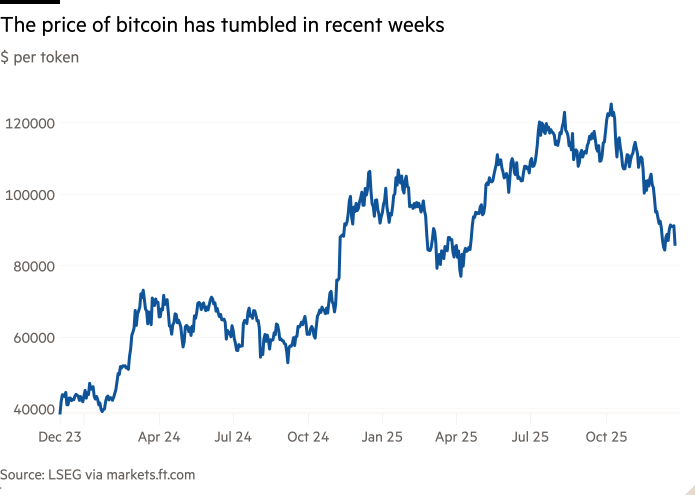

The selling in bonds hit risky assets, which generally decline when investors can obtain higher yields from holding haven assets such as Japanese and US government debt. Bitcoin slumped 5.5 per cent, taking the cryptocurrency’s drop over the past month to more than 20 per cent.

Analysts said the unwinding of so-called carry trades, when investors borrow in a low-yielding currency such as the Japanese yen and lend in those that generate higher returns, could also have contributed to the selling in riskier asset classes.

“Low rates [in Japan] facilitated a carry trade that’s now unwinding and all risky assets sold off,” said Jasper De Maere at crypto trading group Wintermute.

Japan’s yen also rallied about 0.6 per cent against the US dollar to ¥155.3 as traders sharpened bets on higher rates.

The global move in bonds also reflected the possibility that with access to higher-yielding bonds at home, Japanese investors may bring cash back home, decreasing demand for foreign government bonds.

“The more it becomes clear that Japanese rates . . . are normalising, the higher the probability that Japanese investors begin to repatriate funds from foreign bond markets or at the very least buy fewer foreign bonds, removing a key source of international finance at a time when sovereign issuance is surging,” said Michael Metcalfe, head of macro strategy at State Street Markets.

Japan’s government bond market has endured a brutal sell-off this year that has pushed the 10-year yield up almost 0.8 percentage points, as the rate normalisation mixes with anticipation of rising government spending and a drop in demand for long-term debt from buyers such as life insurers.

US stocks also fell on Monday. Wall Street’s tech-heavy Nasdaq Composite index closed down 0.4 per cent, while the S&P 500 fell 0.5 per cent.

Crypto-linked stocks endured some of the heaviest selling. Digital asset exchange Coinbase fell 4.8 per cent, while bitcoin holder Strategy dropped more than 3 per cent.

Additional reporting by Ian Smith in London