This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Toyota’s latest investment into the US

EU imposes fees on Shein and Temu packages

India’s homegrown WhatsApp rival

In search of the perfect pair of black trousers

We start in Japan, where the world’s largest automaker has announced it will invest an additional $10bn into the US over the next five years.

What we know so far: Toyota’s pledge coincided with its opening of a US battery plant, and comes weeks after Donald Trump was presented with an array of spending pledges during his Japan visit. The automaker did not give any further details about how it would spend the $10bn, but analysts have suggested that Toyota will look to increase production in America, noting that executives have discussed importing US-made cars into Japan.

How tariffs are involved: Washington agreed in July to a deal to impose 15 per cent tariffs on goods imported into America from the world’s fourth-largest economy — down from Trump’s initial 25 per cent levy. As a result, Toyota estimated that the tariff impact would be ¥1.45tn this year, or roughly $9.4bn, when announcing its second-quarter results. In return for lower tariffs, Japan has committed to invest $550bn into the US between now and January 2029, when Trump’s presidency is due to end.

Better returns: With local yields rising, Japan’s domestic investments are becoming more attractive than some international alternatives, writes Lex’s June Yoon.

Here’s what else we’re keeping tabs on today and through the weekend:

John Thornhill, the FT’s innovation editor, and Eleanor Olcott, the FT’s China technology correspondent, answered dozens of reader questions on the rise of AI and the battle for supremacy between the US and China. Here’s a look at the latest installation of Ask an Expert.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Exclusive: The EU is imposing customs fees on small packages ordered online from Shein and Temu starting next year. The decision, coming more than two years earlier than expected, marks a hardening of Ursula von der Leyen’s stance towards China and what it perceives as Beijing’s unfair trade practices.

Exclusive: Brussels is planning to investigate Google’s parent company Alphabet over its ranking of news outlets in search results,

‘Foot on our neck’: Mike Fries, the chief executive of telecoms group Liberty Global, has criticised the EU for its heavy-handed regulation.

2. Private equity group Carlyle is interested in the foreign assets of Russian oil major Lukoil, according to people familiar with the US group. The Russian company said late last month that it planned to sell the assets, after the US announced sanctions that have already paralysed the business.

3. “Big Short” investor Michael Burry is closing his hedge fund and warned that market valuations have become unhinged from fundamentals. Other famous short sellers, including Jim Chanos and Hindenburg’s Nate Anderson, have also shuttered their outfits as they struggled to navigate the vigorous rise in many stocks.

4. Tech shares led a slide on Wall Street amid concerns about the US economy and the path of interest rates. As of market close, the tech-heavy Nasdaq Composite dropped 2.3 per cent and the S&P 500 was down 1.7 per cent. The drop also comes a day after Trump brought an end to the longest US federal government shutdown.

AI bubble talk: For the foreseeable future, the market is facing a shortage of capacity, hardly the conditions that spell imminent disaster, argues Richard Waters.

State of AI newsletter: The series in collaboration with the MIT Technology Review recently looked at the challenges facing the US power industry. Sign up here.

5. Trump has pardoned 88-year-old British billionaire Joe Lewis. The former owner of Tottenham Hotspur football club was charged in New York two years ago following an investigation where he was found to have passed on stock tips to friends, private pilots and a girlfriend. A White House official said Lewis requested the pardon to receive medical treatment and visit his grandchildren in the US.

Today’s big read

The old joke about cruise liners being stacked with “the newly wed, the overfed and the nearly dead” is changing. Younger travellers are increasingly choosing ocean-based vacations, pulling down the average passenger age even as populations in core markets get older. Read more on how Gen Z saved the cruise industry.

We’re also reading . . .

Moscow’s new Rubikon team: After two years of striking Russian units with near impunity, Ukraine’s innovative drone pilots have become the hunted.

Malaria fight: Scientists have developed a long-awaited anti-malaria medicine to counter rising drug resistance in Africa and south-east Asia.

Stolen antiquities: Syrian authorities have launched an investigation after ancient artefacts were stolen from the national museum in Damascus this week.

Chart of the day

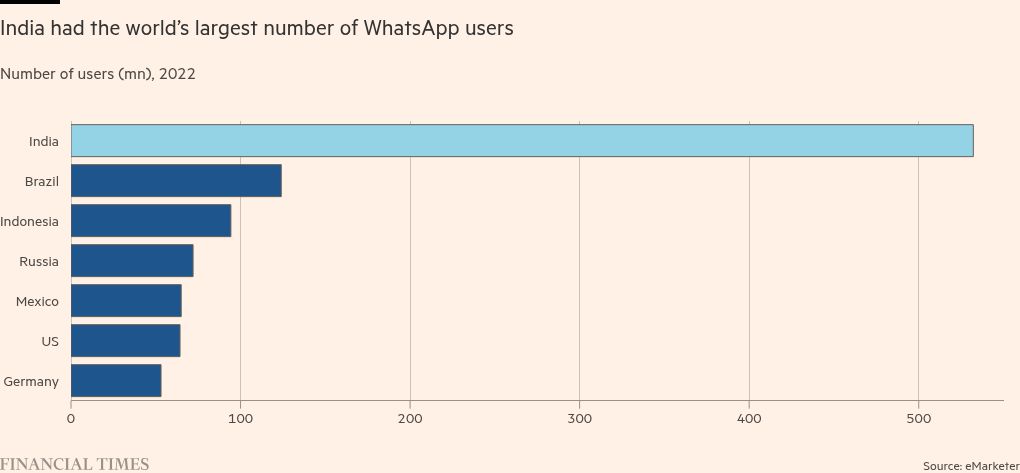

A group of top officials in India are publicly backing a domestic messaging platform, the latest push of self-reliance from Narendra Modi and his administration in the face of US tariffs. While the endorsements have rocketed Arattai to the top of India’s app charts, dethroning WhatsApp in the country — which has the biggest user base in the world — would be a tall order.

Take a break from the news . . .

Claer Barrett, the FT’s consumer editor, has lost four stone in the past year after using the weight-loss drug Mounjaro. This has forced a wardrobe rethink. In this article she writes about her search for the perfect pair of trousers.