This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

We start in Japan, where a coalition deal reached ahead of a parliamentary vote today has paved the way for Sanae Takaichi to become the country’s first female prime minister.

What to know: A coalition deal agreed yesterday between Japan’s Liberal Democratic party and the reformist Japan Innovation party is expected to give Takaichi enough support to be voted into office. Shares in Tokyo surged over hopes that the policies of the arch-conservative LDP leader, an acolyte of the late prime minister Shinzo Abe, will involve more fiscal spending and be broadly supportive of the equity market.

What it means for political stability: Analysts said the formation of the coalition was a significant shift in Japanese politics, as parliament becomes more fractured and populist parties battle to attract younger voters. The LDP’s deal with the JIP follows the collapse of the ruling party’s 26-year coalition with Komeito. Experts who spoke to the FT had mixed views on the stability of the LDP-JIP coalition.

Here’s what else we’re keeping tabs on today:

Bank of Japan: Deputy governor Ryozo Himino gives a speech at the 2025 GZERO Summit Japan.

Results: Netflix, Coca-Cola Company and General Motors report earnings. Australian mining company BHP releases its quarterly operational review.

Financial markets in India are closed for Diwali.

Five more top stories

1. Trump has offered strong support for Aukus, saying the deal to help Australia obtain a fleet of nuclear-powered submarines would boost deterrence against China in the Indo-Pacific. The US president’s first public backing of the programme came during a meeting with Australian Prime Minister Anthony Albanese at the White House yesterday.

2. China’s Communist party leaders are expected to prioritise increased investment in advanced manufacturing, as they meet this week to hammer out the next five-year plan in the shadow of tensions with the US over technology and trade. Read more about the party’s elite Central Committee gathering.

China’s GDP release: The Chinese economy grew at its slowest pace in a year in the third quarter amid a trade war with the US and a prolonged property downturn.

China tech news: Nexperia’s China unit has told local employees they can disregard instructions from the chipmaker’s Dutch headquarters as tensions escalate between Beijing and The Hague over control of the Chinese-owned group.

3. Global hedge funds are participating in Hong Kong listings at the highest rate since 2021 as the so-called “smart money” returns to the Chinese market after an extended slowdown. The city is poised to claim the top spot for global listings in 2025, according to KPMG, with about 300 IPO applications in the pipeline.

4. Amazon’s cloud business suffered significant “errors and connectivity issues” yesterday as it tried to recover from a widespread outage that forced customers’ apps and websites offline. The outage disrupted a range of companies from ride-hailing app Lyft and coffee chain Starbucks to OpenAI’s ChatGPT.

5. A company with a $180 skincare gadget promoted by Kylie Jenner has become South Korea’s most valuable cosmetics group, marking the rise of the next generation of K-beauty. APR’s stock price has surged more than fourfold since January, while sales of its facial skincare device have risen after the product was promoted on TikTok by Jenner, a member of the Kardashian family.

News in-depth

In Hungary’s second-largest city, Debrecen, workers are putting the finishing touches to a vast battery factory built by China’s CATL to supply BMW, Mercedes and other European car brands. But nearly three years after CATL announced the €7.3bn mile-long plant, weaker than expected EV demand in Europe is forcing a review of its size. The move reflects wider forecasts of slowing Chinese investment in new projects in Europe amid geopolitical and trade tensions.

We’re also reading . . .

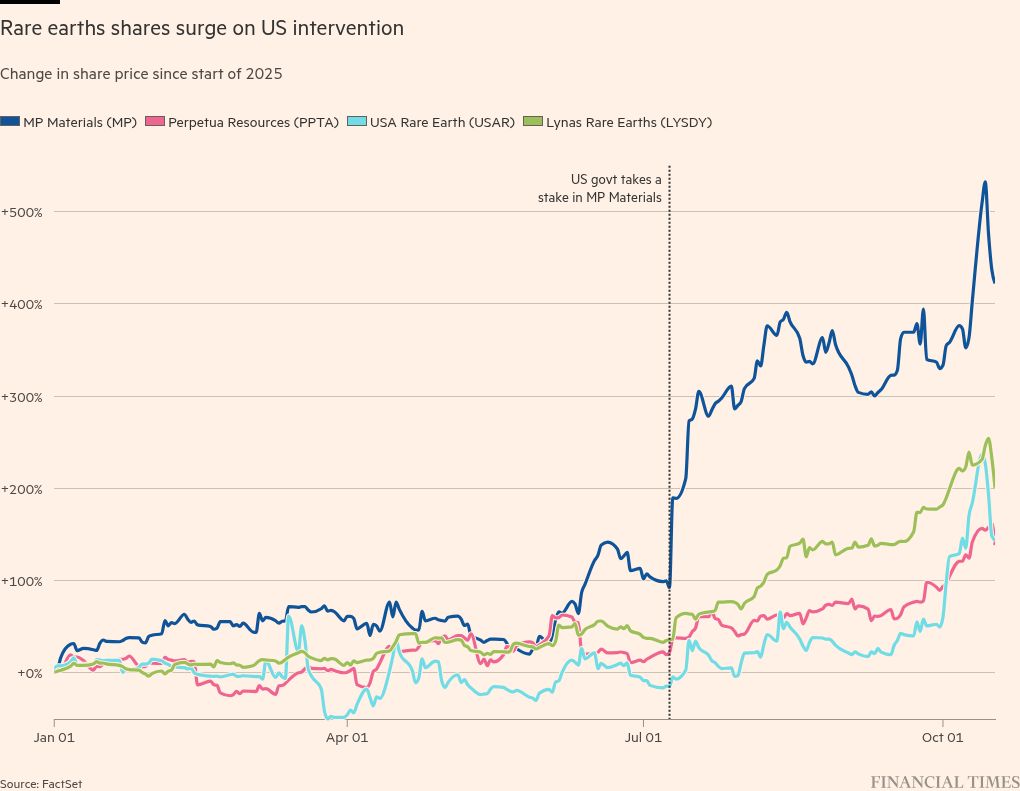

US-China trade war: Rare earths look like Beijing’s most potent weapon, writes Gideon Rachman, but there are others that could be deployed.

The gold-stock duet boom: Historically, the correlation between stocks and gold was zero, writes Ruchir Sharma. Now they’re rising together on a tide of liquidity.

The manosphere: Online influencers are targeting young men with tips on how to walk, talk and breathe, writes Josh Gabert-Doyon.

Chart of the day

Investors are racing to back rare earth companies, sending their shares to record highs, as Trump’s attempt to break China’s stranglehold on the supply of critical minerals electrifies the once sleepy sector.

Take a break from the news . . .

HTSI’s Ajesh Patalay toured south-east London to feast on Nepalese food. The area is home to the highest number of Nepalese-born residents in the city — and there are numerous Himalayan restaurants, cafés and food trucks to discover.