Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Politicians seldom turn out to be exactly what they promised, but that does not stop investors hoping for the best. Japanese stocks have jumped since Sanae Takaichi’s surprise weekend party victory put her on course for the country’s premiership later this month. The reality of a “Takaichi trade” though, neatly alliterative though the term is, is likely to be more nuanced.

The premise behind this week’s near 5 per cent rally in the benchmark Nikkei 225 has been that Takaichi means to stimulate the economy through government spending and easier monetary policy. The yen, bank stocks and long-dated bonds, which would be hit hardest in this scenario, duly fell.

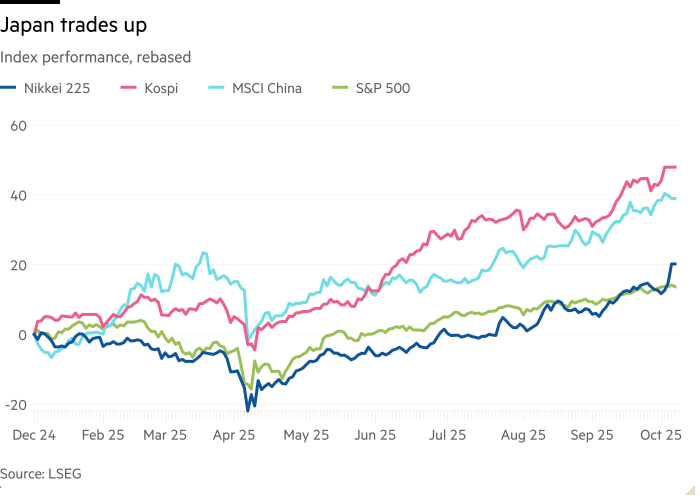

Foreign interest in Japan’s markets has been reawakened in the past few years as companies buy back shares at record levels and pay at least some attention to improving governance and shareholder returns. But strong performance by Tokyo’s neighbours has made it trickier to capture the limelight this year. Chinese and Korean benchmarks have gained almost 50 per cent and 40 per cent respectively against a pedestrian 15 per cent for Japan’s Topix.

Thus there’s obvious appeal in a fresh narrative, which the country’s first female prime minister and echoes of 2012’s Abenomics policies seem to provide.

The problem is Takaichi’s Liberal Democratic party and its junior coalition partner Komeito no longer hold a majority in either house of parliament — losing the upper house in July ultimately paved the way for Takaichi’s victory — so she and the LDP must negotiate support for any policies, likely watering them down in the process.

Whatever “Sanaenomics” might entail, investors seem to think the year’s top trades will continue. Artificial intelligence beneficiaries SoftBank and Advantest added 4 per cent and 14 per cent respectively on Monday. If a Takaichi leadership means a weaker yen, exporters should benefit; if it means a more hawkish foreign policy, defence stocks might get a boost.

Of course, Takaichi isn’t yet prime minister. The shape of Japan’s next government is unclear. On top of that, the country is readying for visit by US President Donald Trump expected later this month — just as the Bank of Japan is due to set interest rates. Japan is a strong candidate for more of investors’ capital; how to spend it is still unclear.