Good morning. It’s another week of trade deals. The 14th round of trade talks towards an India-EU free trade agreement began in Brussels yesterday. EU ambassador Hervé Delphin struck a note of caution, calling the talks “challenging”, with some key issues remaining unsolved. Meanwhile, commerce minister Piyush Goyal is in Qatar to fast track New Delhi’s free trade pact with the gulf nation.

In today’s newsletter, China is “encircling” India by building key relationships in the neighbourhood. But first, is the government finally open to regulating cryptocurrency?

Signs of thaw

In the first signs of a softening stance, finance minister Nirmala Sitharaman has said that India must prepare to engage with cryptocurrencies such as stablecoins. Speaking at a conference on Friday, Sitharaman said digital assets were “transforming the landscape of money and capital flows” and countries could be forced to “adapt to new monetary architectures or risk exclusion”.

Before this, India had been pretty closed to the idea of allowing private cryptocurrencies to be freely transacted. This includes stablecoin, which is crypto backed by fiat currencies. A significant reason for the thaw in the government’s views can be attributed to Donald Trump’s embrace of crypto. With the US president and his sons talking up the virtual currency consistently, countries like India have no recourse but to follow suit. This weariness (and wariness) was evident in Sitharaman’s speech, too. No nation can insulate itself from systemic change, she said, before adding: “Whether we welcome these shifts or not, we must prepare to engage with them.”

There are no signs of this preparation, though. Acceptance of virtual digital assets did not feature in the 22 reforms that the Reserve Bank of India announced last week. The Indian government has not laid out any regulation to regularise cryptocurrency, but it does tax transactions involving them. Publishing a regulation framework would legitimise crypto and the worry is that a legitimate framework would raise systemic risks that cannot be easily controlled because it would involve integrating a complex and volatile asset class into the financial system. This leaves cryptocurrency in a weird no man’s land in India, where it is neither fully accepted nor banned outright.

The Indian government’s reluctance is understandable as it will unleash a volatile currency to hundreds of millions of people, a significant chunk of whom do not have the information or technical savvy to understand the risks. In fact, in 2021, the government drafted a bill to ban all virtual currencies, but then did not go ahead with it. In 2023, India called for a global framework to regulate virtual currencies, but one is yet to emerge. Meanwhile, the RBI has launched a digital rupee — a central bank digital currency that can be used for transactions between people and with merchants. However, this has yet to catch on; people are hardly aware of its existence, much less willing to transact on it.

India will have to take a stance sooner than later on virtual digital currencies. Under the current global circumstances, it is quite clear that banning them is not an option. Therefore, the only logical course of action is to regulate them. The government will be able to kick this down the road only for so long. It’s clear from Sitharaman’s speech on Friday that it, too, is aware of this.

Do you think India should legitimise crypto? Hit reply or email us at indiabrief@ft.com

Recommended stories

France’s latest prime minister quit yesterday after less than a month. Can President Emmanuel Macron stop the country’s political unravelling?

India is pushing to join the nuclear power club.

The impact of Trump tariffs is beginning to show in US consumer prices.

Jewellers explore market openings after the UK-India trade deal.

Keily Blair, the chief executive of OnlyFans, has lunch with the FT.

Can the global economy withstand new shocks? Submit your questions and take part in a live Ask an Expert Q&A with the FT’s Tej Parikh and Martin Sandbu this Thursday at 1pm BST/5.30PM IST

Neighbourhood watch

India has long seen itself as the giant of south Asia, but its foreign policy failures have handed openings to China to make strides in the neighbourhood, wooing countries with investment support and military equipment. FT research shows that Chinese officials have held at least seven high-profile meetings with Bangladeshi politicians in the 14 months since the interim government of Muhammad Yunus took office. And so far this year, officials in Beijing have met their counterparts from Pakistan 22 times, and conducted at least six high profile meetings with Nepal and five with Sri Lanka.

India, on the other hand, only has good relations with the Maldives, Sri Lanka and Bhutan — all countries where China is also present. Though India has a framework for engagement in the region with its Neighbourhood First policy, conceived during the last Congress-led government but implemented in Narendra Modi’ s first term in 2014, it has not been able to put it to optimal use.

As India sees it, political instability in the neighbouring countries is the reason New Delhi is unable to build enduring relationships. Every time there is a regime change, the relationship suffers. The most significant of these, currently, is Bangladesh. India was a longtime supporter of Sheikh Hasina’s government, and chose to ignore the growing authoritarianism of her government. The end of her regime was a significant setback for New Delhi. This “complicated” relationship status is illustrative of India’s engagement with countries such as Sri Lanka and Maldives too.

The long-running stand-off with Pakistan is also a constant overhang in the region. On this front, the diplomatic realignment this year has been particularly unfavourable to India. In the military escalations of Operation Sindoor, it was clear that China was arming Pakistan. After the operation, Pakistan has drawn close to the US. And now, according to an audacious plan seen by the FT, Islamabad has approached Washington with plans to build and run a port on the Arabian Sea to capitalise on the sweeping geopolitical upheaval in south Asia of recent months.

India’s engagement with the neighbourhood has traditionally been from a security-first principle. It needs to amend this to an economic model, which is far more sustainable. China has been a big investor in major infrastructure projects in most south and south-east Asian countries. India has been more cautious about these. India also made the strategic mistake of not taking trade with these countries seriously, with commerce minister Piyush Goyal ridiculing deals with Asean countries as “silly” as recently as June. The realignment of global power structures happening now is an opportunity for India to recommit to its Neighbourhood First policy. But it has to act now.

Do you think India is losing influence to China in the neighbourhood? Hit reply or email us at indiabrief@ft.com

Go figure

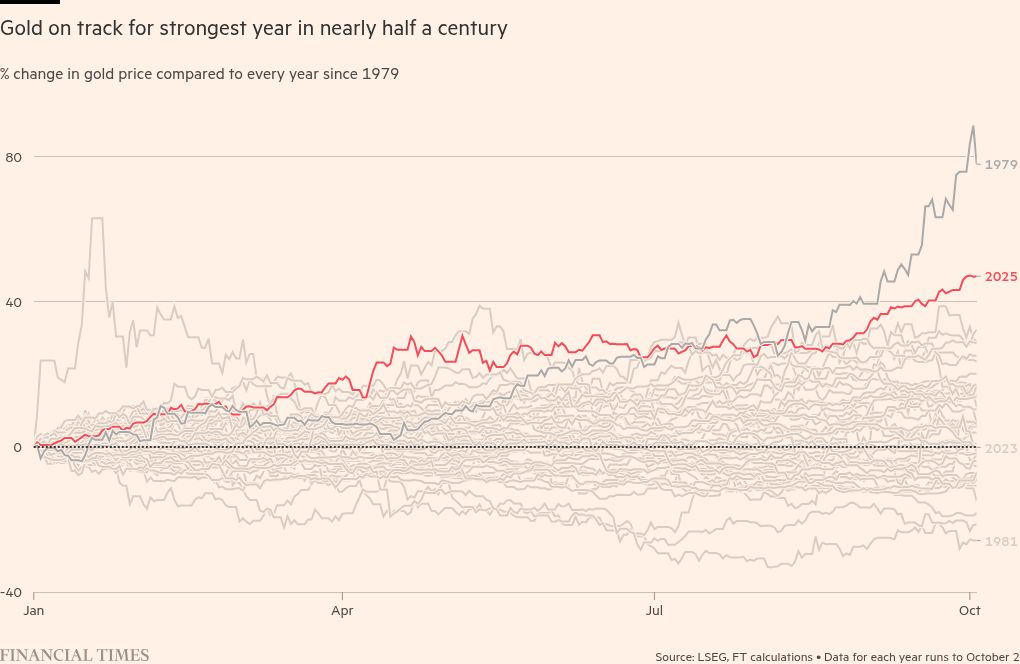

This year is gold’s biggest rally since the 1970s and it is largely being stoked by FOMO — a fear of missing out by investors. The bullion price has rocketed nearly 50 per cent this year to a record high of $3,930 a troy ounce after Trump’s trade war sparked a rush to haven assets and sent the dollar tumbling.

(I know I feature a lot of gold in this section these days, but this chart is so beautiful. It’s a work of art!)

My mantra

“Keep things really simple. Most productivity or efficiency losses are incurred because we try to overcomplicate simple things. So keep it really simple and straightforward.”

— Abhiraj Singh Bhal, chief executive, Urban Company

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

Is it too late now to invest in gold? Tell us here.

Buzzer round

On Friday, we asked: Whose interest in video games led to the $55bn acquisition of Electronic Arts this week?

The answer is . . . Saudi Arabia’s Crown Prince Mohammed bin Salman.

Anuj Balaji was first with the right answer, followed by Prasanna Venkatesh. Congratulations! Ranjan Kumar Sinha went with Jared Kushner, who was the architect of this deal, but we don’t know much about his interest in gaming.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.