Advertisement

The US pledged last week to do “what is needed” to aid its ally, including providing a US$20 billion swap line with Argentina’s central bank to stabilise the peso and bolster its reserves.

But the offer came with a condition: cancelling Argentina’s arrangement with China, which was established in 2009 and is now worth US$18 billion. The demand was first reported by local newspaper Clarin and confirmed by the Post.

A currency swap is a financial agreement in which two parties exchange foreign currency at a predetermined rate, hedging against the risk of future fluctuations. The pact with China has served as a financial lifeline for Argentina, helping it manage foreign exchange reserves, pay for imports and settle international debts, including a repayment to the International Monetary Fund.

“If Argentina succumbs to coercion from the United States, the greatest loss will be borne by Argentina itself,” said Xu Shicheng, a Latin America expert at the Chinese Academy of Social Sciences.

Advertisement

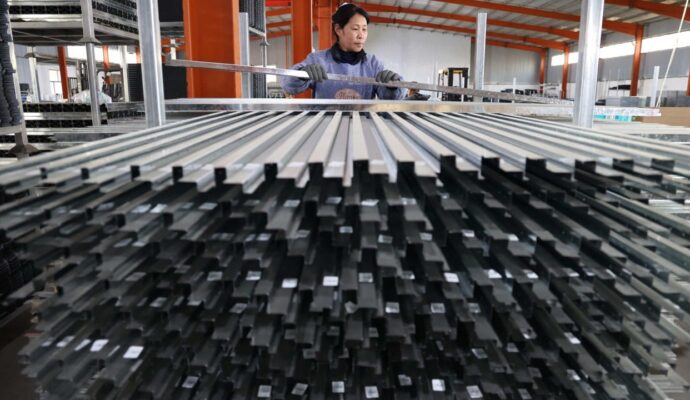

“For China, it may impact Sino-Argentine trade and economic cooperation, such as the progress of projects related to China-Argentina collaboration under the Belt and Road Initiative,” Xu said.