Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

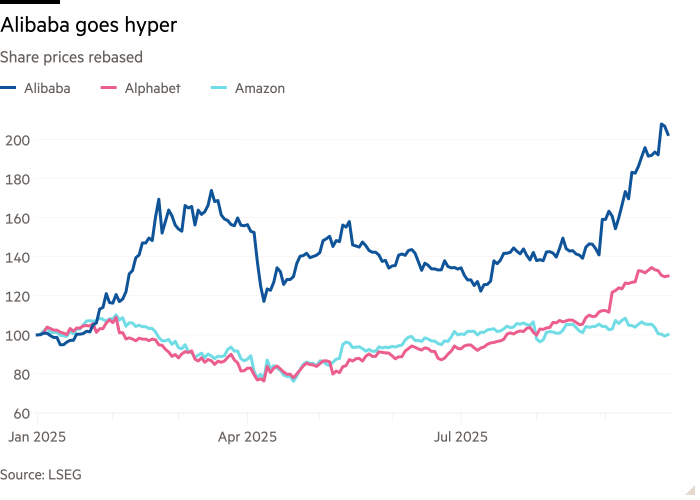

Rocketing share price, ambitious investment plans and a liberal peppering of artificial intelligence jargon? It took a while, but China’s Alibaba is taking its place among the high-rolling hyperscalers.

This past month US-listed shares in the group, which started as an online retailer but has branched out into entertainment and cloud computing, are up some 40 per cent. Alibaba has been a better investment this year so far than US tech giants such as Nvidia, Meta Platforms and Palantir.

Its tardiness is partly the result of provenance. Foreign investors shunned Chinese equities for years, deterred in part by a lacklustre economy and interventionist government policies. But companies based in the People’s Republic are now starting to win customers abroad, from electric vehicle maker BYD to AI model upstart DeepSeek. The latter showed China can create credible technologies, even without state-of-the-art US chips.

Alibaba’s Qwen is no DeepSeek, but it is not far behind, according to rankings by researchers Nathan Lambert and Florian Brand. Since 2023, Alibaba has released more than 300 open-source models, broadly split into language-based and visual-based types.

For now the big difference with the Metas and Googles is that China’s tech giants remain largely domestic beasts. On the retail side, Alibaba’s international revenue last year was less than a third of domestic sales and, while it dominates the home market for cloud, globally it ranks a distant fourth with a 5 per cent or so market share. Competition from local players like Tencent, Huawei and ByteDance is mounting.

Nor do the numbers at stake yet rival Silicon Valley’s in their grandeur. The $50bn Alibaba intends to spend on AI and cloud infrastructure over three years is impressive, yet is half what Google and Meta are each spending this year.

Add in politics, every bit as quixotic as those in 2025 America. When founder Jack Ma fell foul of the Chinese government in late 2020, regulators torpedoed the $37bn listing of fintech arm Ant Financial. Ma himself slid from public view and Alibaba shares sank, halving over the next two years.

If Alibaba is playing second fiddle to the US titans, and spending less than them too, it is at least priced accordingly. The company’s stock trades at 21 times next year’s earnings, where Google parent Alphabet and Meta are closer to 26, and Amazon and Microsoft above 30 times. But having belatedly joined their ranks, there’s no reason to think the company Ma founded is any less ambitious.