Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Good morning. Video game maker EA is close to a deal to go private in a deal worth as much as $50bn. If successful, it would be a larger leveraged buyout than when TXU went private in 2007. Anyone remember how that one turned out? Send us your thoughts: unhedged@ft.com.

Inflation, tariffs, and growth

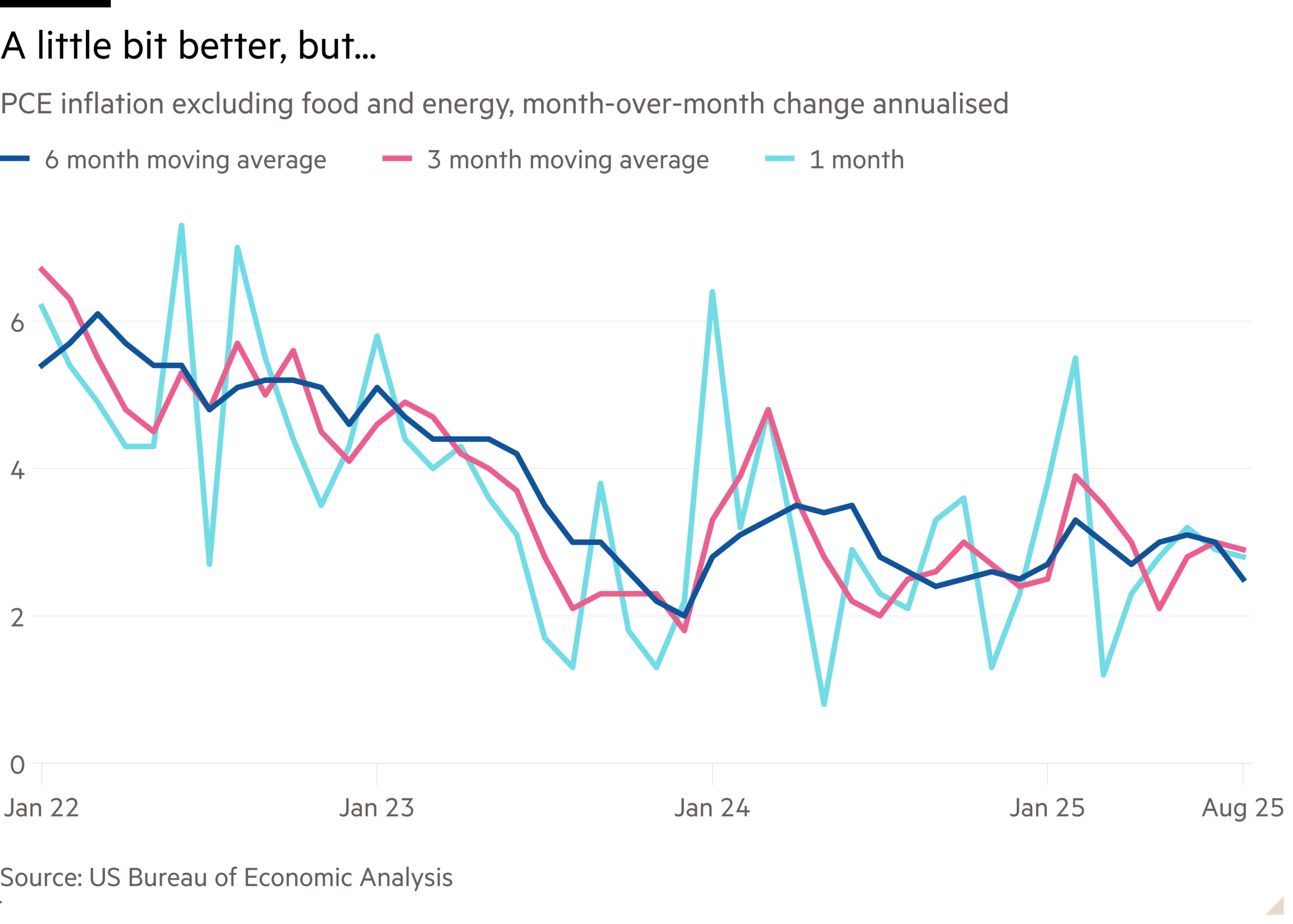

Core PCE inflation got just a touch cooler, on a month-over-month basis, in August. But the trend is still basically sideways, at a level about a percentage point above the Fed’s 2 per cent target. This is not too bad. But things may get worse in the remainder of the year. As you can see on the chart below, there tends to be a seasonal increase in inflation towards the end of the year:

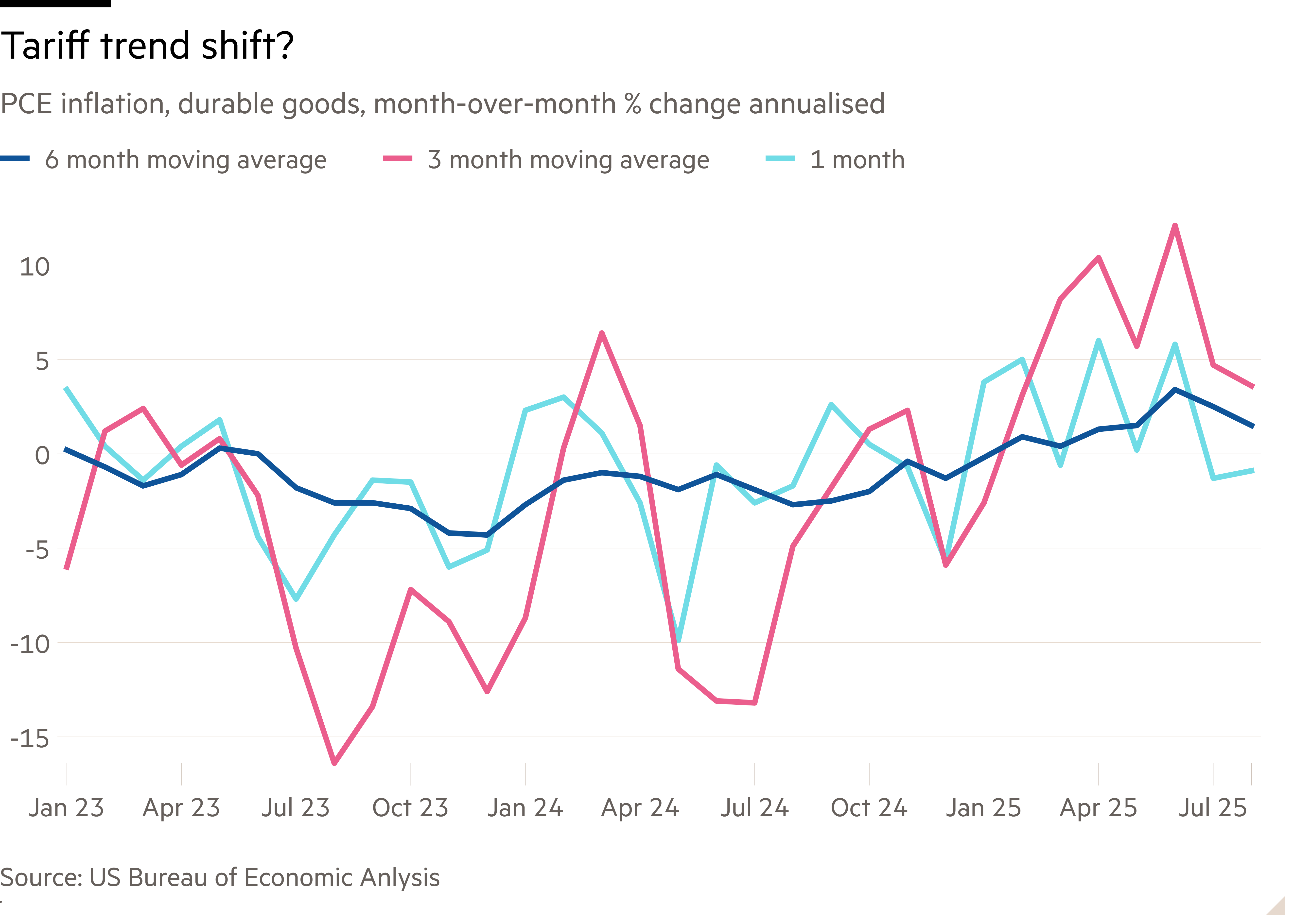

There is another issue to think about, too, pointed out by the Brookings Institution’s Robin Brooks. The standard argument for not worrying too much about inflation running persistently above target — heard from both Fed governors, Unhedged, and assorted others — is that tariff inflation in imported goods is probably transitory. But inflation in things like furnishings and recreational equipment, where tariffs inflation had been evident in the spring and early summer, cooled notably in July and August. You don’t need to dig too deep into the subcategories of durable goods to see the trend. It’s visible at the headline level:

This is good news. But it does imply that the rest of the inflation we are seeing is not a tariff effect. Meanwhile, the Atlanta Fed’s GDPNow real GDP tracker is running at 3.8 per cent for the third quarter. Some of that hot reading is likely a relic of swings in net imports, but not all of it. This raises the possibility that, in Brooks’ words, “Our inflation is the homegrown overheating kind.” If this thesis is confirmed in the coming months, the Fed will have hard choices to make.

(Armstrong)

Korea/Japan US FDI

Both Japan and South Korea promised significant direct investments in the US as part of trade deals with the Trump administration: $550bn for Japan and $350bn for Korea. The US and Japan have signed their agreement; Korea is still finalising the details. But there’s rising discontent in Korea over the deal, as laid out in a recent FT op-ed:

Having watched how quickly handshakes at a summit in Washington can turn into handcuffs in an immigration raid in Georgia, public sentiment in Seoul towards the deal is showing signs of hardening . . . In this climate, a debate has emerged over whether Seoul should resist “buying down” the tariff and instead consider swallowing the 25 per cent [tariff] hit

What will constitute the $350bn investment is contested. Here is Marcus Noland of the Peterson Institute for International Economics:

Originally, Korea thought it could count investment guarantees and things like that as part of the $350bn — such as the battery factory down in Georgia, some investment guarantees or some loans from the state bank — and count that. But the US has now come back and said it wants equity; and not only does it want equity, it wants equity that will be controlled by the White House and it will not necessarily be invested in Korean firms; the US just invests it any way they want . . . it’s a bizarre idea

The concern for Korea, however, is that it simply does not have the foreign currency reserves to meet the White House’s equity demands. Unlike the Japanese yen, the Korean won is not a reserve currency. Officials from Seoul have stated that Korea’s equity commitment would remain below 5 per cent of its pledge, with Japan similarly indicating that just 1 to 2 per cent of its $550 billion pledge would be in equity. Meanwhile Trump doubled down on his equity demands last week, referring to it as a “down payment, upfront.” Korea has $416.3tn in international reserves, meaning that $350bn investment primarily of equity would be equivalent to signing away all of its forex reserves to the US. This prospect is not going over well, particularly considering the bitter memories of the 1997 Asian Financial Crisis when Korea’s foreign reserves collapsed, leading to an IMF bailout that was viewed as a national humiliation.

There are alternatives short of abandoning the deal altogether. The Bank of Korea could receive swap line guarantees with the Federal Reserve, or Korea can issue dollar bonds and use the proceeds to fund its investments in the US. “But you’re going to create dollar liabilities, no matter how you finance it. The Bank of Korea is looking at this in horror,” says Noland.

Is it possible that paying the 25 per cent tariff rate is a better deal than a $350bn investment that could destabilise the national economy? Dean Baker at the Center for Economic and Policy Research has argued that Korea and Japan should ‘eat the tariffs’; his calculations do include some conjectures due to the unpredictability surrounding their impact. Noland argues regardless of whichever is a better deal on the numbers, both countries probably won’t just accept higher duties because of their reliance on the US security umbrella: “They cannot risk a fundamental rupture with the US for security reasons, so they will do what they can to placate the Americans.”

As with many Trump deals, it may be possible to negotiate a softening of the headline demands. But slow walking a deal also runs the risk of irritating Trump, and a re-escalation of tariffs. There are no riskless options.

(Kim)

One good read

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.