Stay informed with free updates

Simply sign up to the Indian business & finance myFT Digest — delivered directly to your inbox.

In the first-half of this year. India saw nearly 700 mergers and acquisitions worth around $24bn, excluding private equity investments and exits. But Indian banks earned absolutely nothing from directly financing the deals.

India’s regulators have long blocked the country’s public and private banks from providing loans to domestic companies to buy equity in other businesses. That has pushed acquirers turn to bond issues, non-banking financial institutions and foreign lenders to raise funds.

Now Indian bankers, frustrated at being locked out of the country’s booming M&A market due to outdated rules, want change, with some seeing the ban as outdated in modern financial system.

Challa Sreenivasulu Setty, chair of India’s largest lender, the State Bank of India, last month publicly advocated for a lifting of the restrictions, at least for large listed companies. He says the Indian Banks Association will ask Reserve Bank of India to do so, indicating broader support for the change.

It is overdue, says Samir Ojha, an EY partner, adding that Indian “companies are making large acquisitions, but our financial system is kind of one step behind”. He says it is potentially a very big market that the banks are losing out on.

Rules dating back to the mid-90s have put strict restrictions on how much the Indian banks can lend against equity. Senior bankers suggest that as India’s private sector began to flourish after the government opened up the economy in 1991, regulators wanted to prevent banks from funding large corporate groups from taking over smaller companies. Regulators also thought lending by banks against such deals was too speculative.

“Now the Indian economy, the banking system and corporate India are much more evolved,” said Ashish Gupta, the chief investment officer at Axis Mutual Funds. He said the foreign banks and bond markets are allowed to fund M&A, so “why should you preclude only one financial segment”, adding that change would allow domestic banks to compete on a level playing field.

Some bankers also see these restrictions as symbolic of the misalignment between different regulators — like the central bank that governs the banking industry and the markets regulator overseeing the securities trade — that is holding back the country’s financial industry.

A top banker in Mumbai points out that banks can only lend up to Rs2mn ($22,700) against shares, including for acquisition finance. On the other hand, he said, retail investors can take huge leverage in equity markets even if they don’t understand the risks.

But why has it taken so long for the Indian bankers to target this opportunity, or at least start speaking up about it? Lack of confidence in corporate books and an unreliable mechanism to recover money in the past in disputes or bankruptcy may be some of the reasons.

In the decade beginning 2010, India invested heavily in infrastructure to turbocharge its economy, much of it being funded by these banks. More than 10 per cent of those loans turned sour by 2018, a large part of that was attributed to cronyism, according to a recent paper by the Centre for Social and Economic Progress. For public sector banks, the non-performing loans were even higher at 14 per cent. It took the banks years to clean their books and India introduced the insolvency and bankruptcy code in 2016, which in the last nine years has proven to be a success.

Now bankers seem prepared to step into riskier terrain and they have found their voice at a serendipitous moment. The Indian economy grew at an unexpected 7.8 per cent in the June quarter, reinforcing India’s position as the world’s fastest-growing large economy. But the Indian finance ministry warned slow credit growth and private investment appetite may restrict acceleration in the country’s economic momentum. M&A activity might help counter those trends.

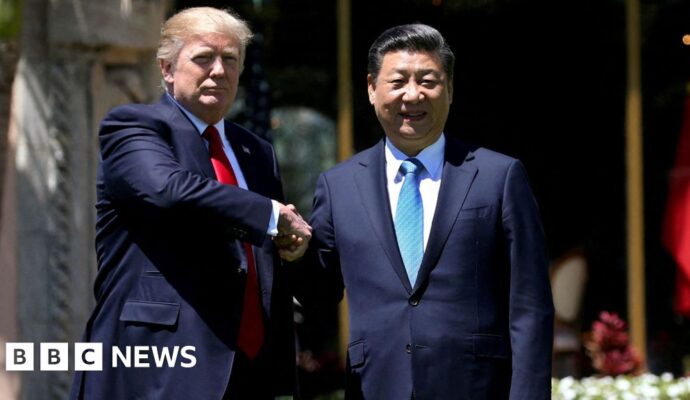

And US President Donald Trump’s move to punish India with 50 per cent tariffs on goods for buying cheaper Russian oil has spurred calls for the country to become more self-reliant across sectors. That might give Indian banks the chance to crowbar themselves into areas that regulators have so far barred them from while foreign banks profit.

Regulators need to trust that Indian banks have matured to take calculated but riskier bets. But Ojha says risks arising out of lifting the ban on M&A financing could be managed “very, very easily”.