The consumer electronics groups that led Japan’s golden era and put fear into industrial nations in the 1980s have almost all been reinvented or bought. With one glaring exception: Panasonic.

Once a sponsor of the Olympic Games with its televisions, video players and microwaves in homes around the world, Panasonic is struggling to emulate its peers.

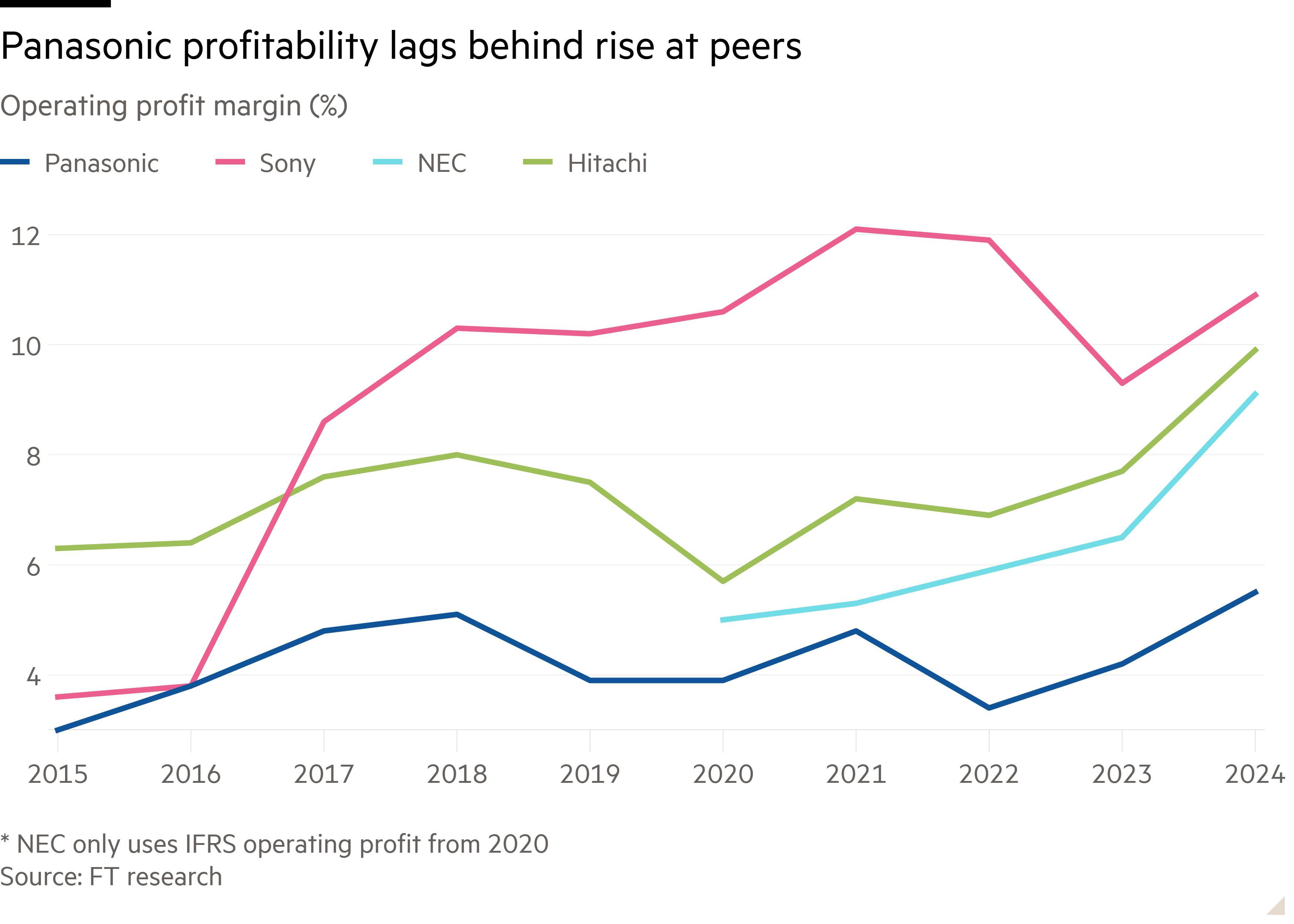

Rivals Hitachi, Sony and NEC have been rewarded for executing painful business transformations, each surging six times in value over a decade, while Toshiba was sold in 2023 for $15bn to Japan Industrial Partners. In contrast, the market value of Panasonic has languished for the past 10 years at around ¥3.75tn ($25bn).

The Osaka-based conglomerate, which produces everything from Tesla’s EV batteries to hairdryers, unveiled a restructuring plan in May to cut 10,000 jobs and streamline its portfolio. But investors want a coherent strategy to boost profitability and sales at the 107-year-old company.

“Panasonic may be at a major turning point if it can formulate a unique growth strategy beyond these reforms,” said Ryo Harada, analyst at Goldman Sachs. “Investors want the growth story — that’s missing.”

Within Panasonic’s six operating companies and hundreds of product lines are industrial technology gems. The company supplies 70 per cent of the world’s in-flight entertainment systems, its facial recognition technology is being used to measure brain health, and its EV battery plants are among the world’s most efficient, according to auto industry insiders.

“They have diamonds in the rough in there but they never manage to tell that tale properly,” said a Tokyo-based banker who has worked on deals with Panasonic.

Buyout funds have started circling the company, which generates $57bn of annual revenues. US private capital group Apollo took a majority stake last year in Panasonic’s auto components unit, which was valued at $2.1bn.

In 2024, Panasonic hired Blackstone Japan chair Ryusuke Shigetomi to sit on its board, an appointment analysts said indicated the company was considering selling more business units or a break-up.

“We’ve talked with them but they don’t make any decisions. They’re siloed,” said another private equity executive in Japan. “We don’t have a clear picture of how that company will transform itself. It’s drifting.”

As companies such as Apple, Samsung and Huawei came to dominate consumer electronics, Panasonic made two major reinvention bets that have faced challenges: an EV battery partnership with Tesla and the $7.1bn acquisition of supply chain software provider Blue Yonder in 2021.

Tesla went on to create its own batteries independently of Panasonic while Elon Musk’s controversial foray into US politics has hit sales, leaving the company battling to diversify its customer base and defend its market share from Chinese rivals CATL and BYD.

Its battery business remains reliant on ¥121bn of annual Inflation Reduction Act tax credits, equivalent to a third of Panasonic’s net profit, which will taper off by 2032.

The Blue Yonder deal has also been a disappointment, said analysts. A touted listing has gone quiet and last month Panasonic announced that Yasuyuki Higuchi, who was responsible for the Blue Yonder takeover, will step down.

The Japanese group appears now to be targeting a third reinvention. Chief executive Yuki Kusumi said in January that artificial intelligence-driven hardware, software and solutions would account for 30 per cent of revenues by 2035, from 2.5 per cent today.

Panasonic wants to offer packages of hardware and software to automate factories, power data centres and turn video into text for AI using imaging technology, according to the company. The reinvention would be supported by two steadily profitable businesses: consumer electronics and devices such as batteries.

Its chief technology officer Tatsuo Ogawa told the Financial Times that “it will be an important strategy to evolve into a platform-based business”.

Yet the legacy of unbridled success in the 1980s and founder Konosuke Matsushita’s ingrained “water tap” philosophy — to make products as abundant as water in order to capture a large share of the market — has made it hard for the company to evolve.

Ogawa added: “Making that mindset shift is extremely difficult.”

Panasonic is late to the race. Apple’s ecosystem provides a seamless experience for users, Chinese manufacturers are applying DeepSeek’s AI models to appliances, and Amazon sells Echo home devices with AI assistant Alexa.

Francis McInerney, who advised Panasonic for a decade in the 2000s, said that the shift is “a life-or-death question” because of how far the company had fallen behind. “This was one of the world’s biggest brands at one time. The question is how much time do you have left.”

Atul Goyal, analyst at Jefferies, said that Panasonic’s “real transformation begins when they decide what businesses they’re good at” and prioritise allocating capital to areas of high-tech manufacturing competence.

One big decision shaping Panasonic’s future will be the extent to which it offloads or discontinues low margin consumer electronics that turned it into a household name. Panasonic was attempting a “China cost, China speed and Japanese quality” revival, said Ogawa.

Kusumi said in February that the company was prepared to sell its TV business. Months later, however, he suggested that it may keep the business because of its importance to “smart” appliances.

Neil Newman, head of strategy at Astris Advisory, has no doubt that Panasonic can push into new technology areas like AI but he said the issue was “they always bring their baggage with them”.

“Either they risk everything on a real restructuring and get rid of the consumer electronics,” said Newman. “Or they just don’t . . . and never set the world alight but risk gradual decline towards vulnerability and obscurity.”