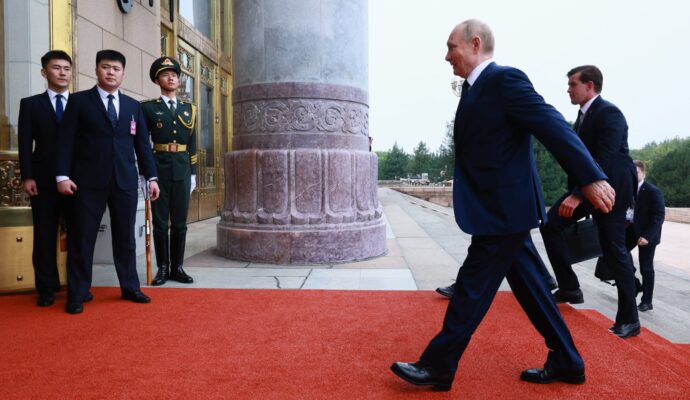

Good morning. At a time of rising geopolitical and trade tensions, China’s Xi Jinping has called on India, Russia and other countries in the region to join hands in leveraging their economic influence to challenge the west. In Tianjin, Prime Minister Narendra Modi and Xi sought to reassure each other that they were “partners, not rivals”, and Modi later met Russia’s Vladimir Putin and said that close ties were important for global peace. The summit being held by the Shanghai Cooperation Organization, the regional security forum, is especially significant as global powers shuffle and realign to deal with the new realities, especially those unleashed by Donald Trump in his chaotic second term in office.

Meanwhile, back home, the GST council is in session, and we will know more details tomorrow about the rate rationalisation exercise that Modi had announced in his Independence Day speech. While all the states are supportive of the initiative to simplify the tax rates and make compliance easier, there are still many issues that need to be addressed, the most pressing of which is whether New Delhi will compensate the states for their loss of revenues.

Thank you for all your emails and comments about the Q&A series. I’ll reply to them soon.

GDP jumps but is all well?

India’s growth numbers, which were announced on Friday, delivered a positive surprise by coming in at 7.8 per cent, with manufacturing, construction and the services sector posting higher than expected numbers. Part of the growth for the quarter came from an increase in government spending, which was at 7.4 per cent compared with -1.8 per cent the previous quarter.

However, if you scratch beneath the surface, the stress in the economy becomes visible. Nominal GDP, which is not adjusted for inflation, was 8.8 per cent for the first quarter of this fiscal year, only one percentage point higher than real GDP and down from 10.8 per cent in the January to March period. This phenomenon — of nominal GDP slowing while growth has accelerated — has occurred only a handful of times in the past decade.

This shrinking of nominal GDP growth accentuates the worries that economists already have for this quarter because of instability in the domestic and global environment. Trump’s 50 per cent tariffs have kicked in from last week and will have an impact on India’s exports. Significantly, on Friday, the rupee sank to a new low against the US dollar over concerns about the levies, breaching the Rs88 figure for the first time.

On the domestic front, consumers are postponing their purchases with an eye on lower taxes after the announcement of rate rationalisation on the goods and services tax. Already, according to local media, car and white goods dealers are complaining about inventory piling up. There are no signs yet that the malaise in urban consumption is lifting, although the good monsoon this year has helped buoy rural demand.

All told, this has been a difficult year so far for the economy, with each quarter bringing a unique set of challenges. Economists predict an erosion of 0.6 to 0.8 per cent of India’s GDP on account of the tariffs, and a 0.2 to 0.5 per cent boost on account of GST reforms. All hopes of a lift in consumption now hinge on the impact of the new GST rates. We’ll have to wait until the end of the year to get a real picture of the Indian economy — that is, of course, assuming there will be no other big events unleashing chaos on the geopolitical and economic front. As far as this year goes, that would be a pretty wild assumption to make.

Do you think India will be able to maintain this growth rate for the rest of the year? Hit reply or email me at indiabrief@ft.com

Recommended stories

Nestlé has dismissed CEO Laurent Freixe after probe into ‘romantic relationship’.

Here’s how India’s Amul has managed to outpace global dairy giants.

Mukesh Ambani says he will list Jio, India’s largest mobile network, next year.

JPMorgan has poached a record number of senior bankers.

The Indonesian finance minister’s home was looted amid ongoing unrest.

Krafton, of Battlegrounds Mobile fame, is expanding in India.

Join 250+ policymakers, industry executives and investors at the Energy Transition Summit India in New Delhi on September 16 and 17. Register for a free digital pass here or enjoy 20 per cent off your in-person pass here.

Loan through the phone

India’s popular digital payment network, UPI, is widening access to credit for its nearly 500mn-strong user base. Banks can now link the platform to credit lines, or pre-approved borrowing limits, for customers. These loans can be secured credit — gold loans, loans against fixed deposits, etc — or unsecured credit such as personal loans. The National Payments Corporation of India, which runs the UPI interface, is hoping that this will help tap a large, previously uncatered, credit market in India.

Although a provision for offering loans through the network has been available since 2023, banks were waiting for clarifications from the regulator on several aspects. From this month, large retail banks can look at scaling up their loan offerings through payment apps on UPI. This will open access to easy credit for a vast section of India’s small traders, as well as individuals, who can use the money borrowed to make merchant payments, peer-to-peer transfers or cash withdrawals through the app.

The NPCI wants the UPI interface to further penetrate the population, and increase the number of transactions on the platform. “We need investment by banks and fintechs to get more consumers and merchants on UPI,” its chief executive Dilip Asbe told my colleagues. But the trouble is that a natural user segment for this does not exist.

While wealthier UPI users have access to existing banking relationships to use for their borrowing needs, India’s not-so-well-heeled are less likely to use formal credit, and borrow from friends and family instead. NPCI’s ambitions for greater reach also come at a time when authorities are pushing to bring small traders and others who use UPI under the tax net, a move that is in fact prompting these users to abandon the apps and revert to cash transactions. The government has to decide what its priorities are. If it is to bring more liquidity into the system and jump-start consumption growth, it has to resist the temptation to expand the tax base right now.

Do you think loans through UPI is a good idea? Hit reply or email me at indiabrief@ft.com

Go figure

It’s a record breaking week. Gold and silver prices reach record highs as expectations of a rate cut in the US soar. The rupee, meanwhile, is at a record low. Here’s a look.

$3,486

per oz of gold (four-month high)

$40

per oz of silver (14-year high)

Rs88.16

Rupee to USD (Lifetime low)

My mantra

“Our team shares a strong bond that fosters true collaboration. When everyone works together, the pressure is shared — making our work smoother and our clients happier.”

— V Jayasankar, MD Kotak Investment Bank

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

My colleague Pilita Clark has written an interesting column on why you should be glad if your boss is a young striver. I am curious to know, how do you feel about a younger boss? Tell us here.

Buzzer round

On Friday, we asked: If you spot Saint Peter’s Dome or the Palace of Justice, and pass under the Sant’Angelo bridge, which river are you floating on?

The answer is . . . the river Tiber in Rome.

Ram Teja was the first with the right answer, followed by Yaman Singhania, and Rudrajit Dawn. Congratulations!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.