Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

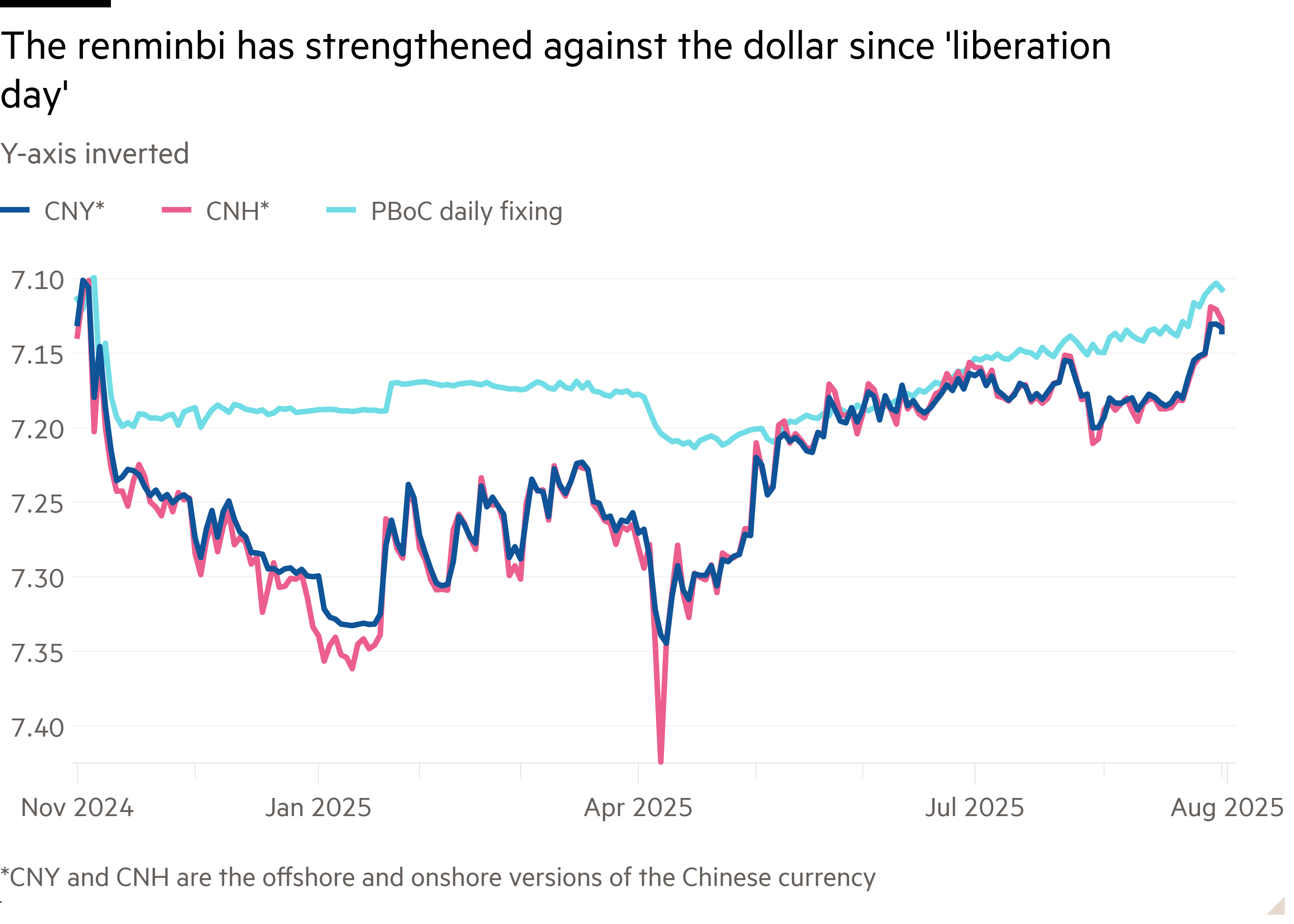

China’s currency has appreciated to its strongest level against the dollar since Donald Trump won the US presidential election in November last year, as Beijing signals to the market that it is willing to allow a gradual strengthening in the renminbi.

The Chinese currency, which had weakened sharply against the greenback in recent years, has rallied 2.3 per cent this year to Rmb7.14 to the dollar.

Strategists said the appreciation was potentially significant for Beijing’s negotiations with Washington over a trade agreement. The Trump administration labelled China a “currency manipulator” during the president’s first term.

“It’s sending a signal to the US,” said Mitul Kotecha, head of foreign exchange and emerging markets macro strategy at Barclays. “China wants to, at least in a good faith way, show they’re not about to devalue the currency.”

The rally comes even as the renminbi has underperformed currencies such as the euro and yen, which have risen 13.2 per cent and 6.2 per cent respectively against the dollar this year.

“It seems very likely that [US officials] have discussed this issue and encouraged countries to allow their currencies to appreciate,” said Andrew Tilton, chief Asia-Pacific economist and head of EM economic research at Goldman Sachs.

The renminbi’s relative stability against the weakening dollar means the Chinese currency has depreciated on a trade-weighted basis, giving a boost to the country’s enormous export sector and putting pressure on manufacturers in a number of other countries.

China’s trade surplus has ballooned in recent years, growing to $685.5bn in the first seven months of this year, which economists argue should be supportive of the currency. For 2024 as a whole, China’s trade surplus was just short of $1tn, a record high.

“In general, if you’re running a very large trade surplus, you would expect over time the exchange rate to work in the direction of equilibrating that,” said Tilton. “The trade surplus is so large, the currency looks so undervalued on traditional metrics.”

China also has long-standing ambitions to increase the international usage of the renminbi. At a time of volatility in the dollar, the country’s policy of a stable, gradually strengthening currency sends a signal to global investors.

“There’s an aspiration to encourage investors, especially state investors and sovereign investors, to consider renminbi as an alternative,” said Edmund Goh, investment director of fixed income at Aberdeen. “This is a good opportunity if the renminbi can stay strong in a volatile environment.”

Nathan Venkat Swami, head of Asia-Pacific FX trading at Citigroup, said the People’s Bank of China was likely to be signalling to exporters to repatriate or hedge dollar assets through stronger daily fixings of the US dollar exchange rate.

“There is an accumulation of unhedged dollars sitting with Chinese exporters. As the fixing drops and the currency follows . . . that also encourages some more people to come out and hedge and this drives these moves,” he said, referring to the renminbi’s rally.

A rally in domestic Chinese stocks has also helped boost the currency, said Jason Pang, a senior portfolio manager and Asia local rates and foreign exchange lead at JPMorgan Asset Management.

Chi Lo, a senior Asia-Pacific strategist at BNP Paribas Asset Management, said that international investors increasing allocations to China would be necessary to push the exchange rate past Rmb7.0 a dollar.

But he noted that for that to happen, Beijing would need to resolve long-running concerns over the property market and deflation.

“They will have to continue with the more assertive policy easing so that the economy and property market can turn around,” Chi said. “That will bring back portfolio flows.”