Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Multinational companies in Hong Kong are taking advantage of decade-low lease rates to expand or upgrade their premises, as agents and landlords hold out hope that the Asian financial hub’s prime office market might be bottoming out.

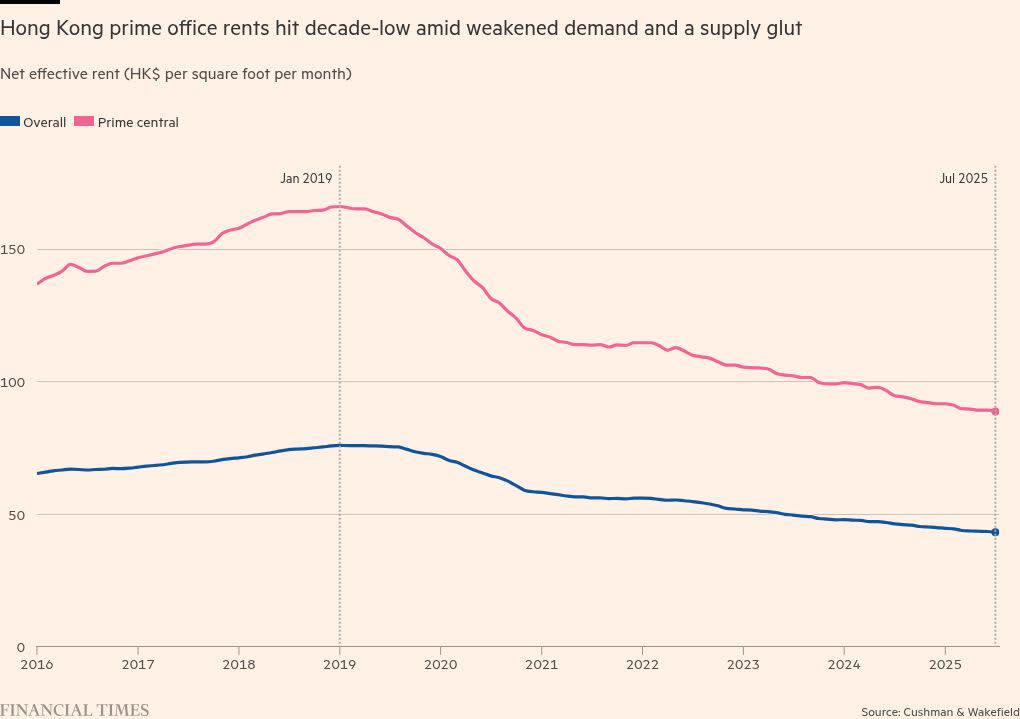

Companies including private equity group General Atlantic, hedge fund Point72 and law firm Akin Gump have planned moves to newer, more centrally located facilities in recent months, according to property agents and industry executives, as rents have fallen by nearly half from their 2019 peak.

Hong Kong-based insurer FWD on Wednesday said it had signed the city’s “largest office lease” of the year — a decade-long contract for 330,000 sq ft in Swire Properties’ Taikoo Place — but did not disclose the rental terms.

The city’s property market has suffered from weak demand after tough pandemic restrictions and a crackdown on political dissent by Beijing starting in 2020 led to an exodus of expatriates and foreign companies.

A wave of new office towers coming into the market has exacerbated the supply glut. Average monthly prime office rents in Hong Kong’s financial district fell to about HK$90 (US$12) per sq ft in June, compared with HK$166 in 2019, according to commercial property group Cushman & Wakefield.

“Many tenants want to seize this opportunity as rents are bottoming,” said Fiona Ngan, head of occupier services at property agency Colliers in Hong Kong. “Given that rents at [better locations] are now at similar levels as their current premises, they’d think: ‘Why won’t I move and upgrade my office?’”

Hedge funds, quant funds and asset managers have been among the most active in the market, said Sam Gourlay, head of office leasing advisory at JLL in Hong Kong.

Trading firm Jane Street in June signed a $4mn-a-month lease for a 223,437 sq ft harbour front office, more than doubling its presence in Hong Kong, according to people with knowledge of the transaction.

General Atlantic and Point72 are set to move into one of the city’s newest skyscrapers, The Henderson, this year, according to people with knowledge of the leases. Akin Gump has also relocated to the glitzy building designed by Zaha Hadid Architects to reflect its “long-term investment in the region”. The National Bank of Canada said it would move into a bigger facility because of “higher business activity in the region”.

The property moves coincide with a revival in Hong Kong’s stock market and record inflows of Chinese investment after a post-Covid slump. More than 200 companies have applied for a Hong Kong listing this year, many of them Chinese groups seeking offshore funding for overseas expansion.

Analysts said they expected the flurry of equity market activity to boost prime office leasing by mainland Chinese companies. Xiaohongshu, China’s Instagram-like social media platform, recently opened a 7,000 sq ft office in Hong Kong. It has been hoping to list in the city, the Financial Times previously reported.

A growing wealth and asset management sector — which official data suggests has $4.5tn under management — is expected to bring about new office expansions at financial groups and law firms, said agents.

Vacancy rates in prime office buildings hit a record high of 17.4 per cent at the end of last year, according to official data. The amount of new letting area available for rent reached its highest since 2019 in the three months to June, data from Cushman & Wakefield showed.

The recent market activity has made building owners hopeful. Hongkong Land, one of the largest landlords in the city’s Central district, said in its earnings in July that it had started to see “early signs of stabilisation of prime office rents”.

Swire said it had noticed a “considerable pick-up” in premium office enquiries in recent months, although rents were expected to still be under pressure “in the near to medium term”.

Ada Fung, head of leasing at CBRE Hong Kong, warned that average prime office rents could still fall a further 5 to 10 per cent by the end of this year as more new buildings are completed.

“We cannot ignore the oversupply,” she said. “There may still be room for rents to go further down because of the vacancy pressure.”

Jane Street, General Atlantic and Point72 declined to comment. Xiaohongshu did not respond to a request for comment.