This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

US-India dispute escalates

Singapore tycoon pleads guilty in graft scandal

The cost of USAID’s closure

Donald Trump has said he plans to “substantially” raise tariffs on imports from India because of its purchases of Russian oil, in a new escalation of tensions between Washington and New Delhi.

What happened: The US president criticised India in a social media post yesterday, after India failed to reach an agreement with the White House to secure lower levies on its exports to America last week. “India is not only buying massive amounts of Russian Oil, they are then, for much of the Oil purchased, selling it on the Open Market for big profits,” Trump wrote. Randhir Jaiswal, spokesperson for India’s foreign ministry, said in response to Trump: “The targeting of India is unjustified and unreasonable.”

India-Russia energy ties: New Delhi has been the biggest market for Russian crude since 2023, importing 89mn tonnes last year, according to ship tracking data compiled by Kpler. But Ajay Srivastava, a trade policy expert with the Global Trade Research Initiative, denied Trump’s accusation that New Delhi was selling Russian crude on the open market. “India is a net importer of crude oil, and its global exports of crude stand at zero.” Still, Srivastava said that India exported “refined petroleum products including from Russian oil, such as diesel and jet fuel, after processing crude oil in its refineries”.

Trump-Modi ‘bromance’ no more? The stand-off reflects an extraordinary deterioration in relations between Trump and Narendra Modi, India’s prime minister, in recent weeks. “So much for the bromance between Modi and Trump and the ostensibly close relationship between two budding geopolitical allies,” said Eswar Prasad, a professor of trade policy and economics at Cornell University.

Read more about the escalating dispute.

More India news: The Indian capital markets regulator called for “structural reforms” to the country’s vast derivatives market after the probe into US trading firm Jane Street for alleged manipulation.

Here’s what else we’re keeping tabs on today:

Economic data: Indonesia reports second-quarter GDP. South Korea and the Philippines release July CPI data.

Japan: The Bank of Japan publishes minutes from its June monetary policy meeting.

Results: Second-quarter results are due from BP, which yesterday announced its biggest oil and gas discovery in 25 years off the coast of Brazil.

Five more top stories

1. Billionaire Singapore property tycoon Ong Beng Seng has pleaded guilty to his part in the city-state’s biggest graft scandal in decades. Ong admitted yesterday to offering gifts including a private jet flight to S Iswaran, Singapore’s former transport minister who was jailed last year.

2. Tesla’s board has approved the award of 96mn shares worth about $30bn to Elon Musk as part of a new pay deal after the billionaire chief executive threatened to leave the electric-vehicle maker if he was not given more control. “Retaining Elon is more important than ever before,” the company said in a letter to shareholders.

3. The Israeli government voted to sack the country’s attorney-general yesterday, a move set to trigger a court battle and increase tensions over democratic norms and the rule of law in the country. Prime Minister Benjamin Netanyahu’s cabinet unanimously approved the motion to fire Gali Baharav-Miara, capping a multi-month effort to remove her as the country’s highest legal authority.

4. The US will propose some tourist and business visa applicants post a bond of up to $15,000 as part of an effort to clamp down on visitors who overstay their authorisation. The move marks a further expansion of the Trump administration’s anti-immigration policies. Here are more details.

5. Sharp declines in tourist spending on luxury goods in Japan and Europe are dragging on industry sales, as currency swings sap the spending power of American and Chinese travellers overseas. The sales slump poses another challenge for a sector grappling with the end of a multiyear boom and the fallout from US tariffs. Adrienne Klasa has more.

The Big Read

The abrupt withdrawal of US funding has stranded millions of patients and shattered life-saving programmes in Africa, Asia and Latin America. The pullback in support will have long-lasting effects on many countries for years to come. David Pilling reports from Matsapha, Eswatini, on the costs of USAID’s closure.

We’re also reading . . .

Ukraine conscription: Kyiv’s top brass is under fire after a series of violent recruitment practices.

Populism wave: From Chile to Japan, the siren call of populism is striking a chord. Alec Russell points to Romania for a brush-up course on how to respond.

Pilots’ mental health: Strict monitoring of psychological conditions is meant to protect passengers, but some aviators say it stops them from seeking help.

Chart of the day

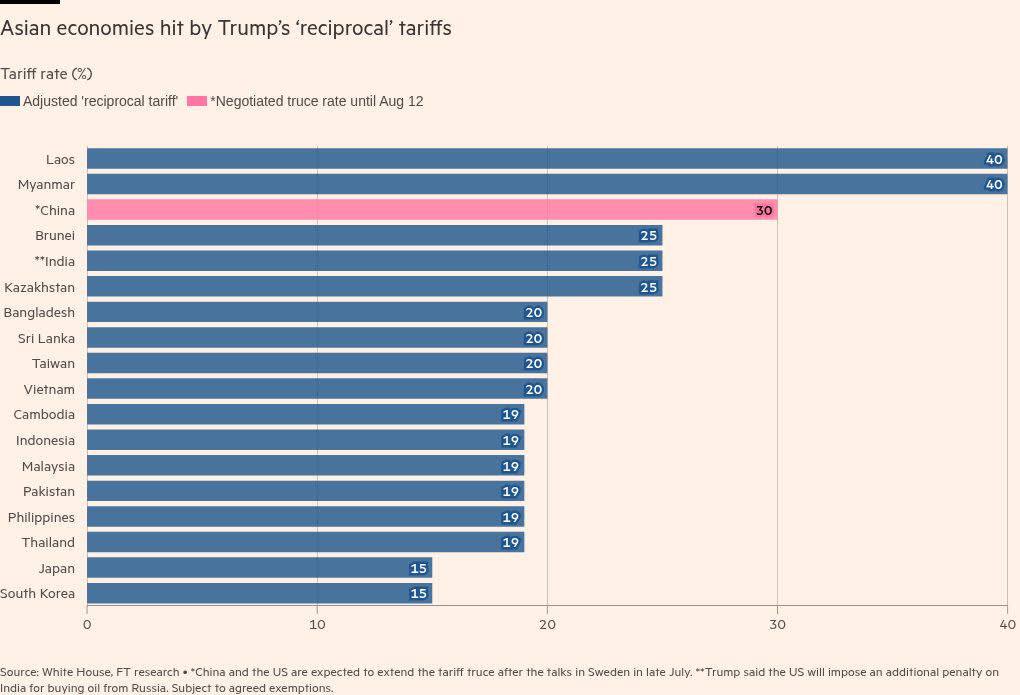

Chinese exporters are reconsidering investment in offshore factories as US tariffs on alternative hubs and new restrictions on “transshipment” force a sweeping rethink of supply chains in Asia.

Take a break from the news . . .

Is it still worth buying a flat in London? It’s the question one buying agent is repeatedly being asked right now. Here is her advice to those eyeing a slice of property in the UK capital.