Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Good morning. Yesterday, Alphabet reported that its quarterly profits jumped 20 per cent from this time last year, propelled by stronger than expected cloud and ad revenues. Tesla, meanwhile, announced that its profits sunk 23 per cent, dragged down by waning car sales. Tesla was expected to underperform, but even this was pushing the bill; its share price fell by more than four per cent after hours. Alphabet’s earnings were a major positive surprise, but its capex ruffled feathers: spending on data centres and chips increased 70 per cent from this time last year, and the company announced plans to spend an extra $10bn by year’s end. Its stock was up 2.3 per cent in after-hours trading.

Please make sure to look out for our Chart of the Week this Saturday, a new weekly instalment where we will tell a market story with one visual. Email us: unhedged@ft.com.

Japan

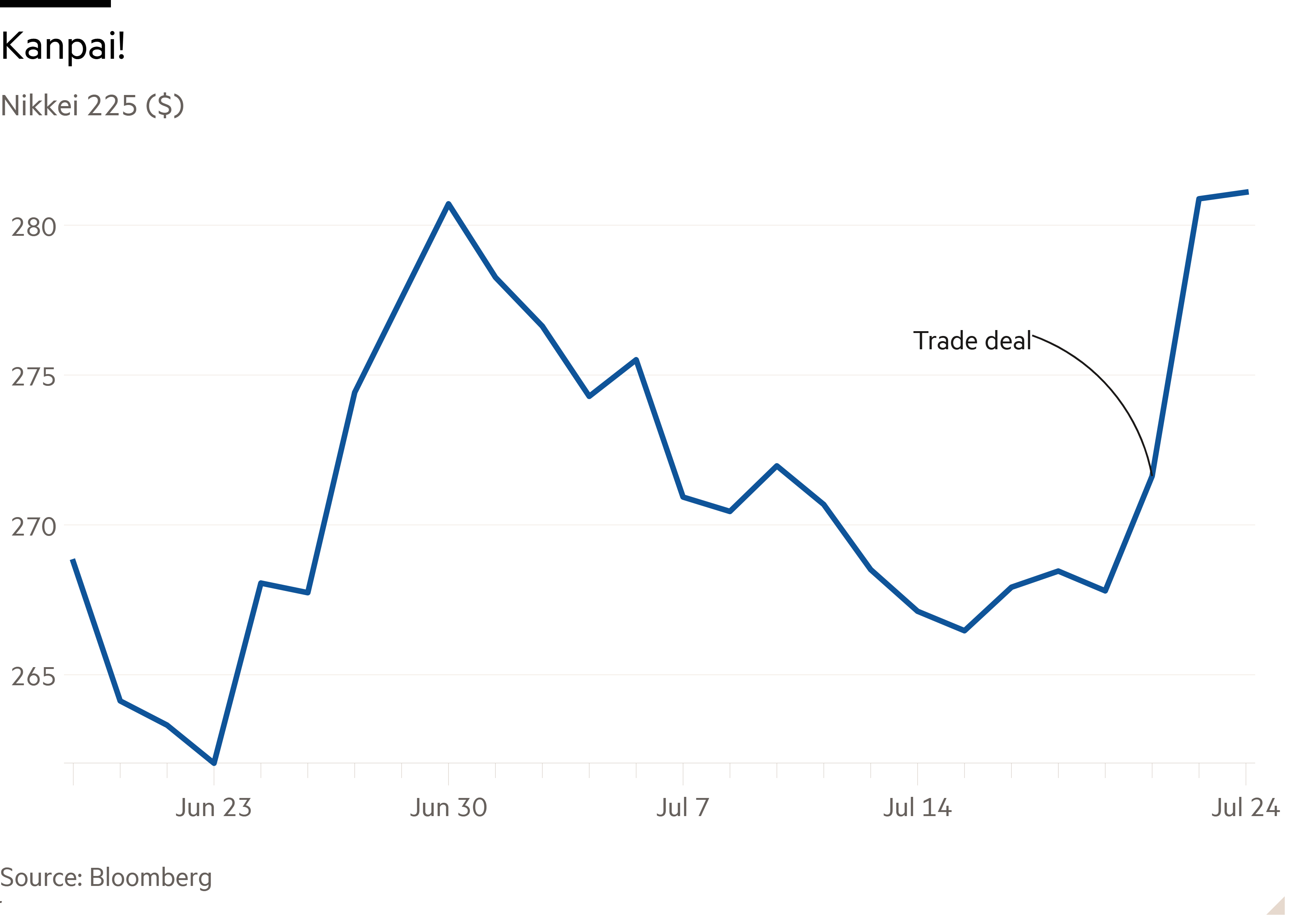

Japan is now the third US trading partner to strike a deal with Donald Trump, and the second — after the UK — to actually acknowledge it. The deal lowers US “reciprocal” tariffs on Japan from a threatened 25 per cent to 15 per cent, and reduces Trump’s global 25 per cent auto tariffs to just 15 per cent for Japanese vehicles. There were other provisions, including a $550bn fund for Japan to invest in the US, and unanswered questions around defence obligations and steel tariffs. But the main message was clear: Japan will face lower tariffs. Japanese equities rejoiced. The Nikkei 225 rose 3.5 per cent in dollar terms:

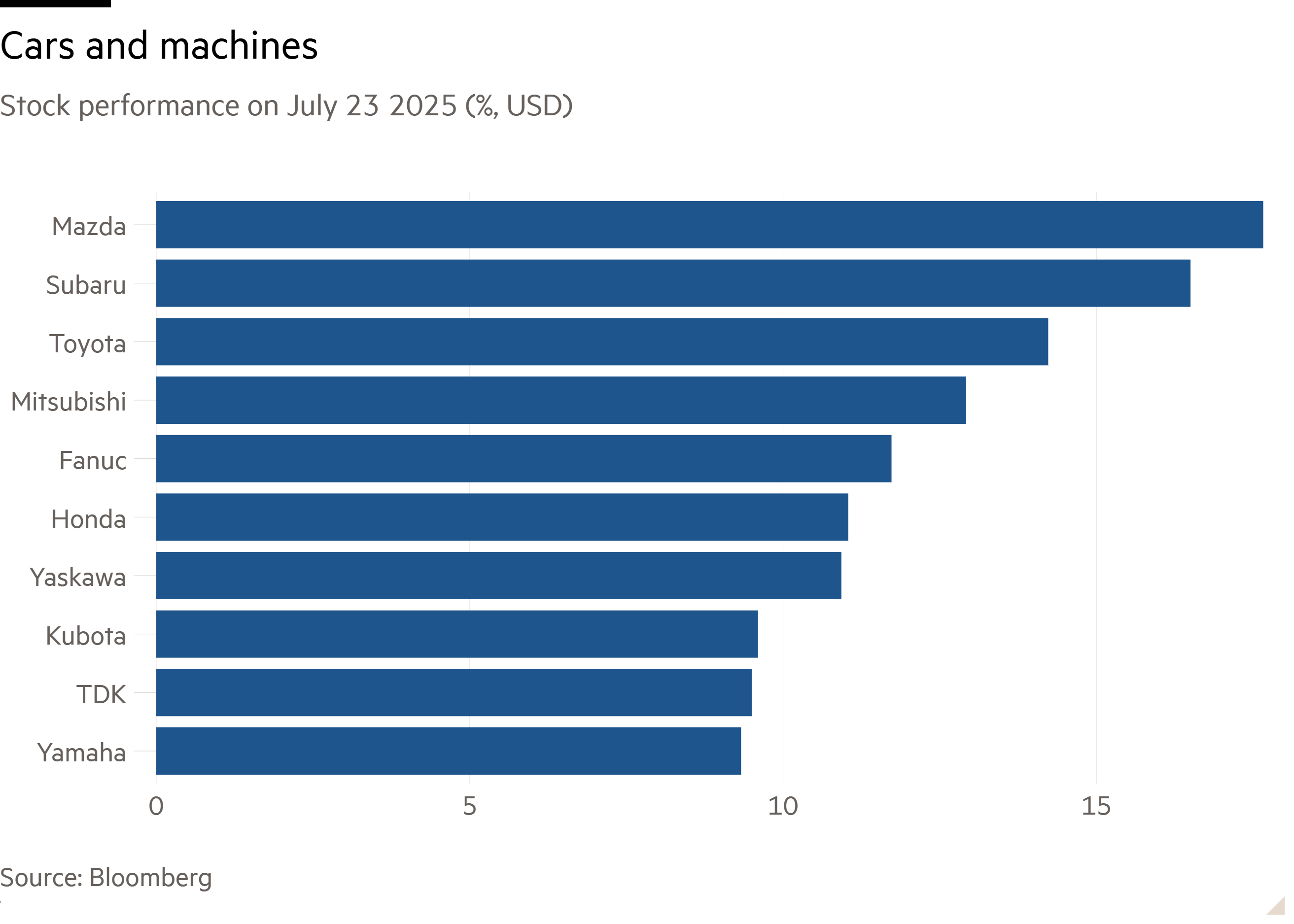

The stocks of companies that count US groups as major customers led the gains: autos (33 per cent of total Japanese exports to the US in 2024) jumped the most, while industrial companies (24 per cent), such as Fanuc and Yaskawa, rose, too:

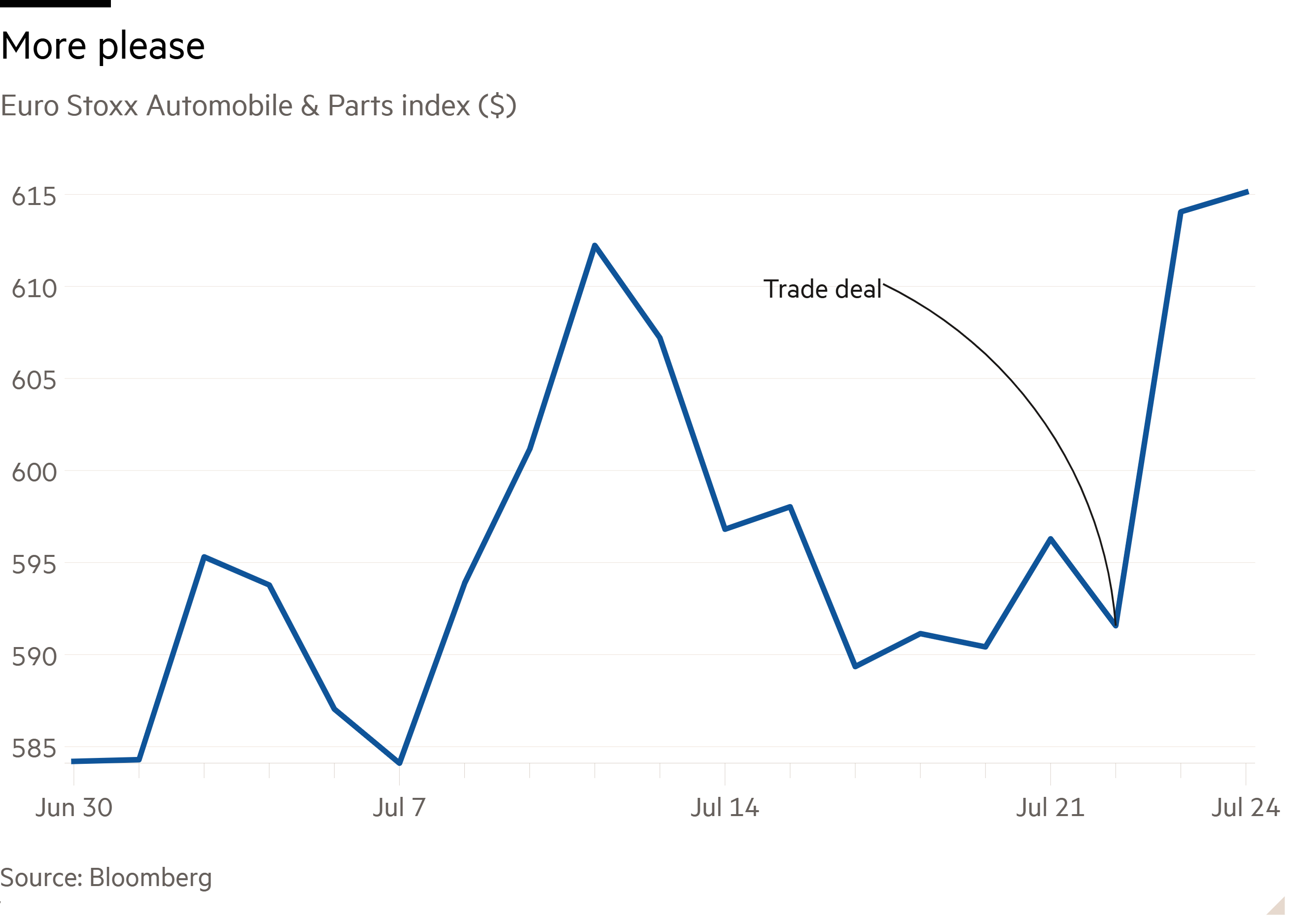

Global markets also got a small lift. Japan’s arrangement gives other countries reason to believe they could also get a deal before August 1, and the carve-out for Japanese vehicles suggests that the Trump administration is swayable on sectoral tariffs, particularly car duties. The Euro Stoxx automotive sub-index rose 3.8 per cent, as investors bet on the EU getting a similar exception:

While this is certainly good news for Japan, the change to the outlook — for equities, and for the economy — is only marginal, or so says Rory Green at TS Lombard:

For equities, this is a one-off re-rating, which may only continue for a few days. In general, the macro outlook remains poor for Japan. [I have often] characterised Japan as a sailing ship: just as the ship is dependent on trading between ports and the wind, so is Japan. [The recent pick-up in] domestic demand has added an outboard motor. But real wage growth is being crushed by CPI and rising rice prices. Japanese exporters still face tough competition from China. And an upcoming soft patch in US growth limits how much they can sell to [America].

The trade deal does help solidify Japan’s rate outlook, however. While Trump’s tariffs are inflationary for the American economy, they are disinflationary for most others: supplies meant to be exported to the US flood back into the domestic market, lowering prices. Also, as Thierry Wizman at Macquarie Group pointed out to us, higher tariffs were leading to concerns about Japanese companies’ profitability, and, by extension, wage growth. “The BoJ [was] hesitant to tighten further without clarity, but [the deal] will lessen concerns about disinflation and poor wage growth. This could set the stage for a rate hike this year,” he said. Two-year JGB yields rose 8 basis points, 10-years rose 7 basis points, and 30-years rose five basis points on the day.

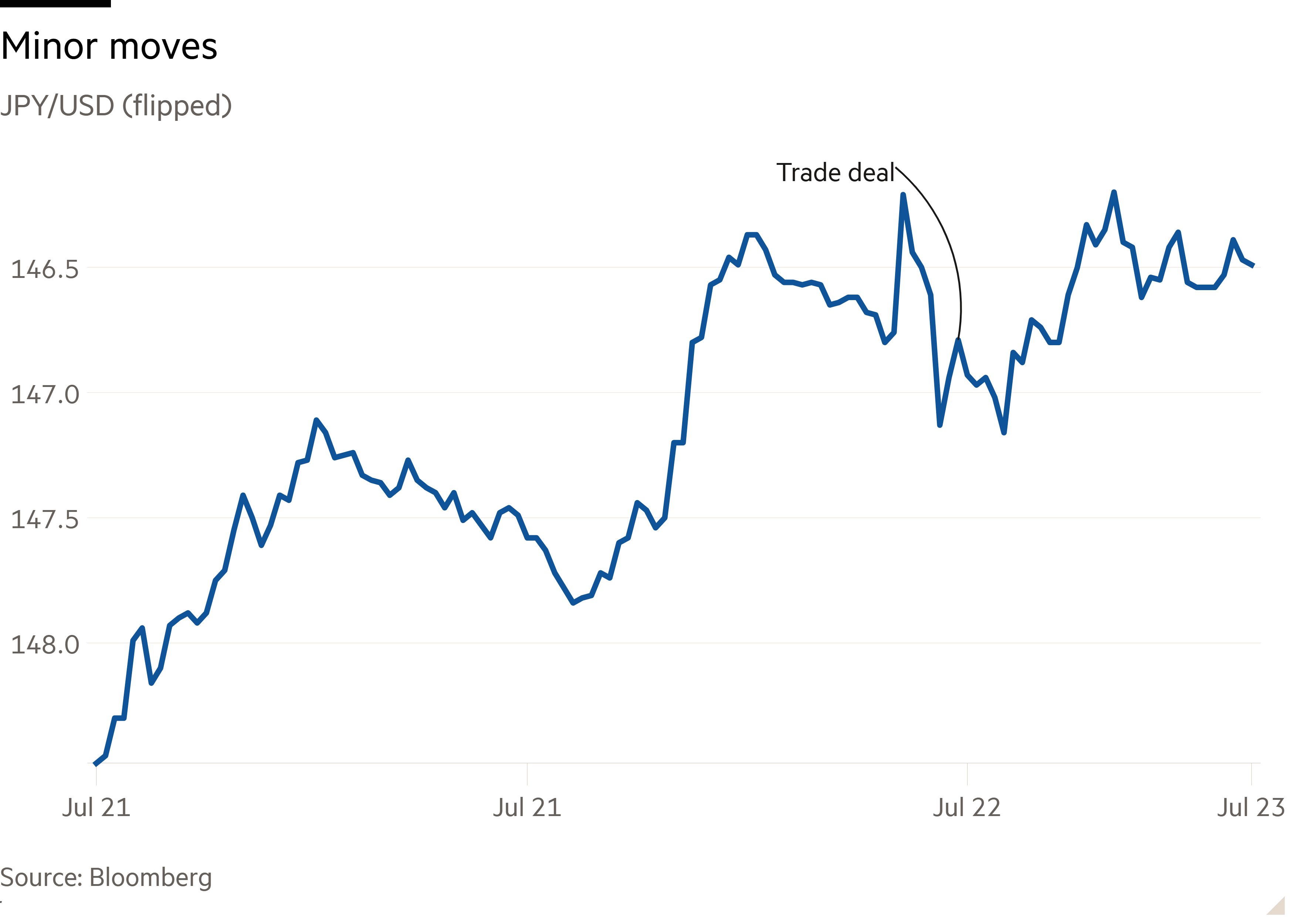

The yen, on the other hand, was more muted. It strengthened 1.5 per cent against the dollar:

Higher bond yields should, eventually, draw in more capital to Japan and strengthen the yen. The yen’s restraint yesterday could be due to lingering domestic political uncertainty; Japan’s ruling party just experienced a historic defeat, and markets are still sorting through the implications. It might also stem from ongoing questions around demand for JGBs. The BoJ is shrinking its balance sheet and not buying as many JGBs as it used to. The market is still learning to cope.

As we learned last summer, moves in Japan’s rate environment tend to reverberate out. The carry trade — borrowing inexpensively in yen to buy higher-yielding global assets — is believed to have contributed to higher global asset prices, including Treasury prices, over the past decade. Another increase by the BoJ and a further rise in yields will shrink the rate differential between Japan and the rest of the world. In theory, that should make the carry trade less appealing, strengthen the yen and draw demand away from US Treasuries and other global bonds.

It’s hard to quantify the size of the carry trade and how much it is still at play in global markets broadly, and US Treasury markets in particular. But, as Freya Beamish at TS Lombard wrote to Unhedged, the combination of rising Japanese rates and expected tariff price increases in the US point towards a rising US term premium, higher US inflation expectations, and, all else equal, softer US Treasury demand. Benchmark 10-year Treasury yields did rise 4 basis points yesterday, though it’s unclear if Japan is partially to blame.

There is still so much that can change from here — for Japan, and the rest of the world. It could be naive to assume that Trump will give other countries deals similar to Japan’s. And Japan’s economy could face even more pressures. But, at the very least, it looks like Japanese inflation is here to stay.

One good read

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.