It may be no coincidence that two months after the Indian armed forces launched drones and missiles deep into Pakistan during a brief but fierce military assault, the country’s defence industry is making a push into overseas markets.

The push to export military wares from both start-ups and established state-owned companies such as BrahMos, whose missiles struck deep inside Pakistan during Operation Sindoor, comes as Prime Minister Narendra Modi’s government seeks to boost manufacturing by exporting home-made industrial products from mobile phones to missiles, under a “Make in India” push.

“It’s not about a particular operation,” said Vivek Mishra, chief executive of Raphe mPhibr, a drone start-up that raised $100mn in June. “But . . . if Indian forces are using systems in harsh terrains and they are happy with the performance, that becomes a validation for other countries as well.”

Venture capital firm General Catalyst led Raphe mPhibr’s fundraising, which gave the company a near-$1bn valuation partly on the back of expectations that the drone company would be increasing overseas sales.

The start-up’s drones include the swarm-capable, vertical take-off and landing mR10 and mR10-IC models, similar to the type deployed by India inside Pakistan as New Delhi attacked what it said were terrorist camps and military bases.

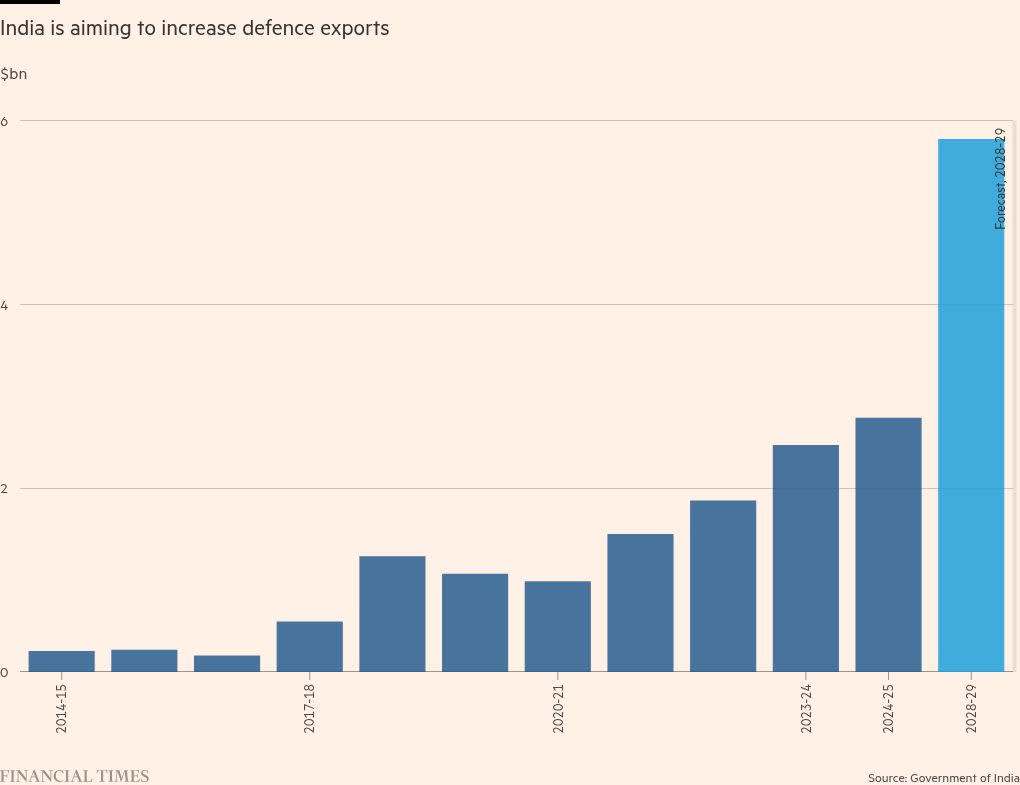

“The global demand for our indigenous products has increased even more after the valour we showed and the capability demonstrated by our domestic equipment in Operation Sindoor,” defence minister Rajnath Singh said at an event in New Delhi on July 8. India is aiming to more than double its defence exports to Rs500bn ($5.8bn) by 2029, up from Rs236bn in the past financial year, he had said earlier.

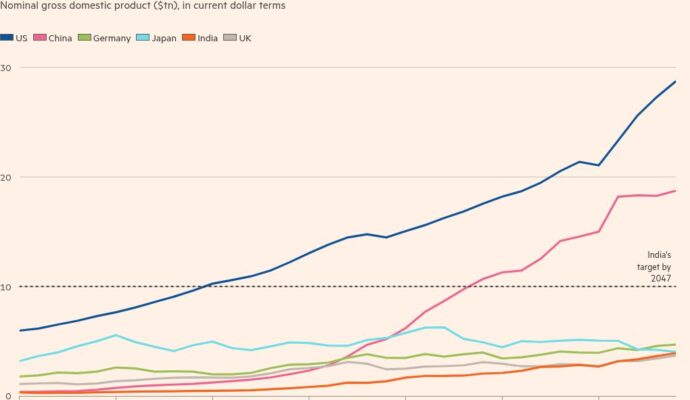

India has for years been one of the world’s largest arms importers, buying weaponry from the US, France, Israel and elsewhere as it bolsters its defence industry against China and seeks to retool a military formerly reliant on Russia.

“The world saw a glimpse of ‘Make in India’ and indigenous weapon systems in Operation Sindoor,” Modi said in a meeting in May in Kanpur, Uttar Pradesh, a hub of India’s defence industry. “Domestic manufactured arms and BrahMos missiles caused massive destruction deep inside enemy territory.”

Modi opened up the defence industry to the private sector after taking power in 2014. Adani is among the leading conglomerates with burgeoning defence arms, alongside Tata, Mahindra and Larsen & Toubro. Under joint venture and “offset” arrangements with foreign producers intended by India to boost “indigenous” defence production, Tata makes Airbus C295 transport aircraft, fuselages for Apache helicopters with Boeing and the cabin for Sikorsky’s S-92 helicopter.

Adani’s defence interests range from small arms and ammunition, anti-submarine systems and multiple types of drones, including the Hermes, in partnership with Israel’s Elbit Systems.

“Our drones became the eyes in the skies as well as the swords of attack, and our anti-drone systems helped protect our forces and citizens,” said Gautam Adani, group chair, at the company’s annual shareholder meeting last month of his group’s products in India’s latest clash with Pakistan.

India exported BrahMos anti-ship missiles, which are made by an Indian-Russian joint venture, to the Philippines in 2022 for $375mn, according to a senior government official, and is now in discussions to sell them to Vietnam and Indonesia.

New Delhi will also be looking to market its Akash air defence systems, made by state-owned Bharat Electronics Ltd (BEL), and artillery guns to “friendly foreign countries”, added the official, who asked not to be named because of the sensitivity of defence sales. He added: “We are not actively going around flogging any particular weapons.”

Before Operation Sindoor, the Modi government successfully brokered other military deals involving state-owned companies. These included the sale of four BEL-made Swathi weapon-locating radars made to Armenia for about $40mn that were deployed in the country’s brief conflict with Azerbaijan that year. Armenia has since bought Pinaka rockets and Akash air defence systems, bringing its arms purchases from India to nearly $60mn.

“Where Indian platform sales have been achieved, it has been through government to government deals,” said Jon Grevatt, head of Asia-Pacific news with Janes. “But India doesn’t yet have the stamp of approval in terms of a large competitive programme that they’ve won.”

Indiavlost out in its bid to supply Malaysia with Tejas light combat aircraft, made by state-owned Hindustan Aeronautics, in a deal that South Korea’s more experienced Korea Aerospace Industries won in 2023.

Exports are crucial given the Indian military’s limited buying power and the defence groups are optimistic about their prospects in foreign markets.

Solar Industries India, a maker of explosives, has moved into making drones and other weapons, and some of its UAVs were used by the Indian military in Pakistan.

“We are expecting more orders from international clients,” Manish Nuwal, the company’s chief executive, told investors on May 30. He said that about half the company’s $1.7bn order book was from international clients.

In May, Amit Kalyani, the joint managing director of industrial group Bharat Forge, whose products include howitzer guns, told investors that most of its $181mn defence revenue last year came from exports.

“There are lots of opportunities both in India and outside,” he said, adding that “a lot of new geographies” will open up this year.