Advertisement

Stablecoins, which are digital tokens backed by fiat currencies or other reserve assets, could make anti-money-laundering (AML) work and banks’ task of knowing their customers more difficult because of their cross-border, pseudonymous transactions, said the Bank for International Settlements (BIS), the organisation that is often dubbed the “central bank of central banks.”

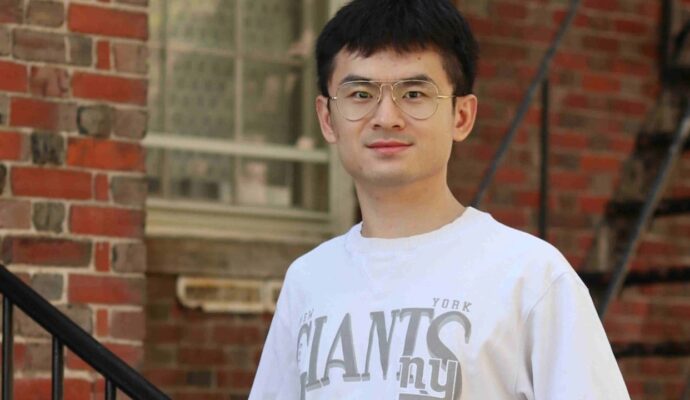

“The rules of the monetary system are changing and stablecoins are right at the front line of the policy debate,” said Shin Hyun-Song, BIS’ economic adviser and the head of its monetary and economic department, during an interview with the Post on Monday in Hong Kong. “[Stablecoin] is a borderless instrument used mainly as the gateway to the crypto ecosystem and other decentralised finance platforms, but it also generates many new types of challenges.”

Advertisement