Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Mitsubishi Corporation has agreed a $1bn takeover of salmon farms from Norway’s Grieg Seafood, as corporate Japan continues on a record-breaking M&A trail and increases its influence over global food supply chains.

The deal by the trading house’s Norwegian subsidiary, Cermaq, for aquacultures in Norway and Canada, will create the world’s second-largest salmon farming group, with annual production of 280,000 tonnes by 2027 helping to meet the world’s growing demand for protein.

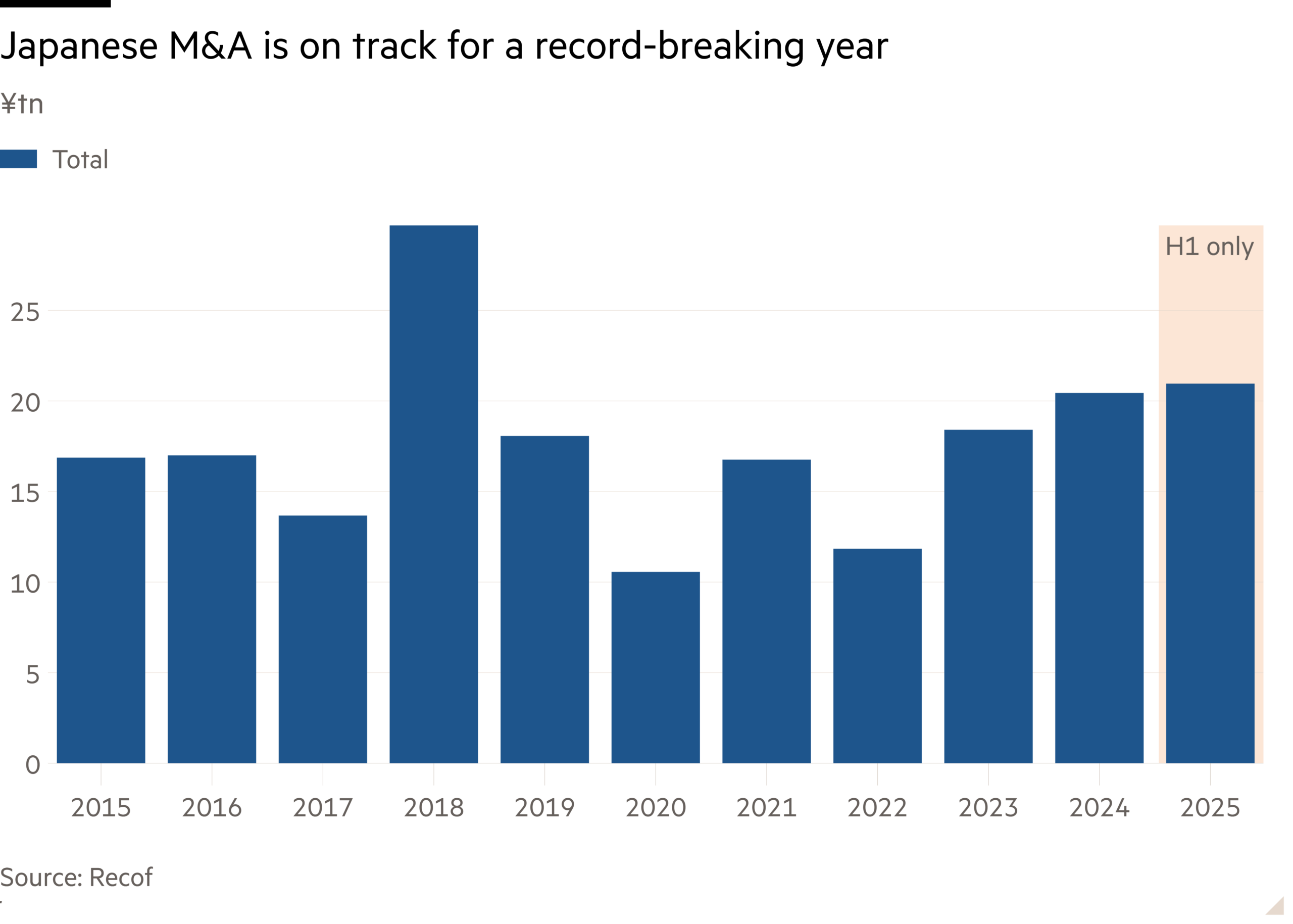

The transaction carries on a scorching streak of M&A involving Japanese companies, after a first-half record of 4,700 deals worth a total of Y20.9tn ($140bn), according to Tokyo-based consultancy Recof. That surpassed the entirety of last year, and just over half the deals were Japanese groups reeling in foreign competitors.

Japanese management is defying the gloom in the rest of the global M&A market as it pursues growth, with corporate governance reforms gathering momentum and putting it under pressure to put its cash hoards to work.

One M&A lawyer, who has worked closely with two of Japan’s largest food producers on recent deals, said there was still a “significant” underlying demand for more overseas acquisitions, as companies continue to adjust to the shrinking domestic market with its increasingly strained household budgets.

Some Japanese companies are holding back temporarily, said the lawyer, while they wait for more clarity on the US tariff situation, “but in principle we have clients that are raring to go and buy businesses in America and Europe”, the person said.

Japanese food companies have been quietly strengthening their grip on the supply chain, in part by leveraging a growing craving around the world for Japanese food such as sushi, katsu curry and ramen.

Mitsubishi is making a bet on the increasing popularity of salmon. It requires significantly less feed than other animal proteins, such as chicken, pork or beef, and therefore has a substantially lower carbon footprint. Its production will be lifted 40 per cent with the acquisition.

Japanese condiment groups Kikkoman and Kewpie have been building large US factories to expand their reach into western markets, while Japanese restaurant operators have been on a furious overseas expansion drive as their home market shrinks.

Another Japanese trading house, Marubeni, announced last month it was buying Bubbies, an Arizona-based mochi ice cream company, for an undisclosed sum, as it aimed to tap into the US $9bn novelty ice cream market.

Keisuke Ito, general manager of food products at Marubeni, told the Financial Times that it was already working on another “two or three acquisitions” within the next two years.