Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Bank of Japan has said it will move more slowly on cutting back its bond purchases as it seeks to reassure investors after market turmoil earlier this year.

The central bank added that it would take “nimble responses” to any rapid rise in long-term interest rates, as it attempts to wean the Japanese economy off the huge stimulus programme under which the BoJ became the owner of roughly half the entire Japanese government bond (JGB) market. That dominance significantly reduced liquidity in one of the world’s biggest bond markets.

The BoJ’s comments came as its policy committee concluded a two-day meeting with a unanimous vote to hold short-term interest rates at 0.5 per cent.

In mid-May, weak investor demand at auctions of long-dated Japanese government bonds, along with high volatility in global debt markets sent yields to record highs. Bond yields move inversely to prices.

Traders at the time said the moves reflected growing concerns not only over the global economic outlook, but also over the effects of the BoJ’s plans to taper its bond purchases. The market for very long-dated JGBs has been affected by a marked decline in demand from life insurers and other domestic investors.

Yields on JGBs rose on Tuesday following the announcement, with 10-year JGB yields climbing 0.04 percentage points to 1.48 per cent while those for the two-year bond edged up 0.01 percentage points to 0.76 per cent. Yields on the 30-year JGB rose 0.02 percentage points to 2.91 per cent.

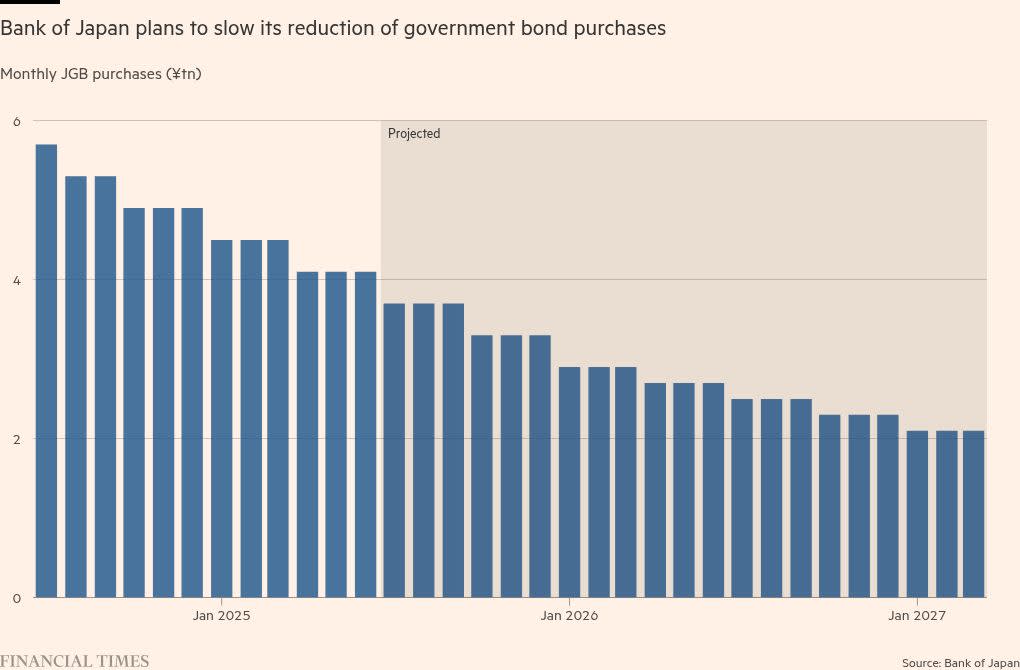

The bank said on Tuesday it would not make any changes to the current tapering programme, which was decided in July 2024 and is set to run until the end of the current fiscal year in March 2026.

Under the plan, monthly bond purchases, which are currently at levels of ¥4.1tn ($28.3bn), are being reduced by ¥400bn a quarter.

But under the bank’s plan for the fiscal year beginning in April, the BoJ said on Tuesday it would reduce its planned purchases by just ¥200bn each quarter, with the aim of reaching a monthly level of ¥2.1tn by March 2027.

The interest rate decision was in line with the expectations of almost all analysts, some of whom now expect the BoJ to delay its rate normalisation plans, forecasting no rate increases until next year.

Benjamin Shatil, senior economist at JPMorgan in Tokyo, said the BoJ was walking a fine line in attempting to contain volatility as it increasingly stepped away from the market and embarked on an unwinding of more than a decade of liquidity expansion.

Shatil added that the BoJ’s gradual retirement of its experiment in ultra-loose monetary policy had implications not just for Japan but for global debt markets. “Market focus is increasingly shifting from the BoJ’s policy rate normalisation path to its multiyear balance sheet rundown,” he said.

Analysts noted that the reductions in monthly purchases from ¥4.1tn to ¥3.7tn between June and July would focus mostly on lower-maturity JGBs of up to 10 years.

Monthly purchases of JGBs dated longer than 25 years will remain the same, in what analysts said was a signal of the BoJ’s determination to maintain stability in the super-long maturity market.

In its statement published after the meeting, the BoJ reiterated previous warnings that it remained “extremely uncertain” how global trade and other policies would evolve, and what impact those measures would have on economic activity and prices.

Additional reporting by William Sandlund in Hong Kong