China’s battery giant CATL is set to raise $4.6bn from Chinese and international investors in Hong Kong, after bankers closed its deal book on Wednesday with an offer price understood to be a top-of-the-range HK$263 (US$33.70) a share.

The share sale will be the biggest of its kind globally so far this year, in a boon for the territory after a dearth of Chinese corporate listings in recent years. Order books were oversubscribed by around 115 times, said one banker who participated in the bookbuilding.

For Robin Zeng, founder of the world’s biggest electric vehicle battery group, the secondary listing marks the culmination of a years-long effort to access foreign capital to fund plans for aggressive overseas expansion.

Why does CATL need more foreign investment?

CATL has a €1.8bn factory in Thuringia, Germany, and is building out its battery materials supply chain in Indonesia, complementing its 11 major manufacturing bases in China.

The group, based in Ningde in the south-eastern province of Fujian, is now constructing a €7.3bn factory in Debrecen, Hungary, and has launched a €4.1bn joint venture with Stellantis in Spain.

The company says the cash raised in Hong Kong will be used to fund its Hungarian manufacturing base, even though it had Rmb304bn ($42bn) in cash as of the end of last year, including $11bn in net foreign assets. Analysts said improving the company’s valuation was probably a more significant motivation.

17.8x

Forward 12-month price-to-earnings ratio

“It is something they’ve wanted to do for some time: diversifying the shareholder base, bringing in foreign international institutions because they’re going to become a much more globally relevant firm,” said Neil Beveridge, who leads Bernstein’s energy research in Hong Kong.

A person close to the company said that despite having a market capitalisation of more than Rmb1tn, bringing in international investors to help establish an offshore financing platform remains “necessary”.

This is because Beijing, wary of the country’s financial sector being destabilised by a surge in renminbi outflows, has strict capital controls.

Citi analysts have noted that obtaining Beijing’s approval for outbound investment risks a months-long bureaucratic process. Beyond possible delays derailing overseas investment plans, transferring cash from China into foreign currencies also bears a high cost.

Over recent years, plans to raise funds through a Swiss secondary listing and tapping sovereign wealth funds have been unsuccessful.

How have investors reacted?

Demand to be “cornerstone investors” listed in the prospectus has been strong, according to one banker working on the deal. Lead bankers on the deal are state-backed China International Capital Corporation and China Securities, as well as Bank of America and JPMorgan.

Chinese oil company Sinopec, the Kuwait Investment Authority sovereign wealth fund and Asian fund Hillhouse Investment led the cornerstone group, which also included US-owned Oaktree Capital Management and Lingotto, an investment vehicle backed by the Italian industrialist Agnelli family, and units of two Chinese state-owned groups, Postal Savings Bank of China and insurer Taikang Life.

Some US investors, wary of scrutiny in Washington, opted to invest after the prospectus release, the person added.

21.1%

Return on equity in 2024

CATL’s issuance is under Regulation S and not 144A of the US securities law. This means American institutions must take part through offshore accounts and exempts CATL from some US disclosure obligations.

That is being perceived as an effort by CATL to limit its exposure to US investors, said a Chinese initial public offering banker. “A Reg S [only] offering is not rare, but usually it is adopted by small ticket issuers who expect no major investments from the US,” he said.

Bernstein’s Beveridge added that based on the group’s recent marketing in Europe and incoming calls, investor interest from overseas has been “high”, with investors attracted by its technology and dominant sales position.

Should investors be worried about US restrictions?

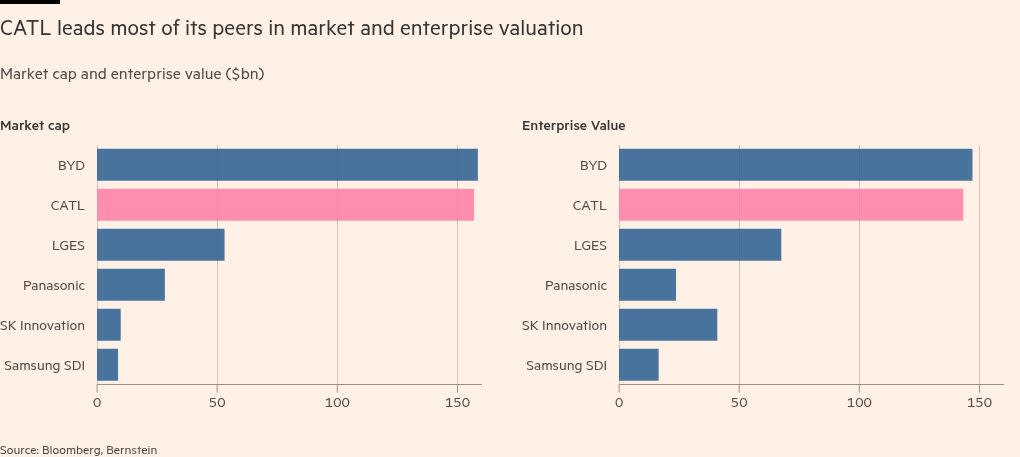

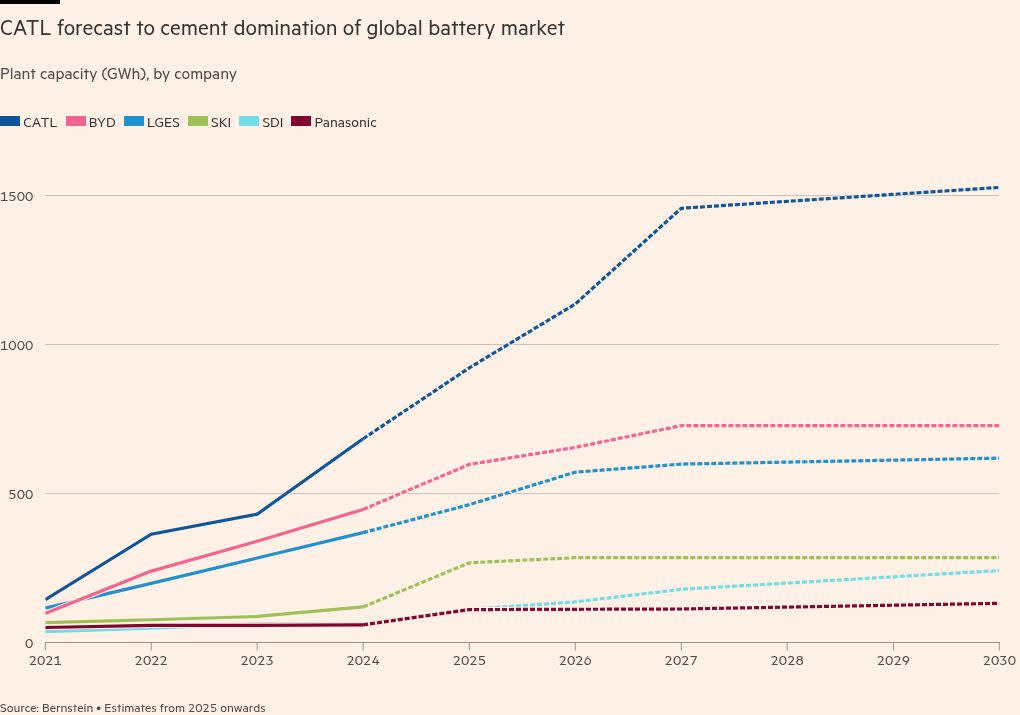

CATL holds a market share of about 37 per cent in the world’s EV and energy storage battery markets. However, of the company’s $50bn in revenues last year, only about 30 per cent came from outside China, primarily from Europe.

The US automotive and energy markets are prized, and CATL has been shipping a growing number of utility-scale batteries there for energy storage, while working with Tesla and Ford to license its battery manufacturing technology for factories on American soil.

This leaves the group exposed to looming Trump administration decisions over tariffs on Chinese exports, as well as uncertainty over Biden-era tax credits for clean energy and possible US government action over national security.

UBS analyst Tim Bush said any changes to the advanced manufacturing production credit will “directly determine” the competitiveness of American battery manufacturing, relative to importing from China.

And CATL’s plan to license technology to US partners, rather than manufacturing or exporting battery cells, does not insulate it from the threat of tariffs.

“All of the materials that are needed to make these batteries come from China,” Bush added. “So the issue becomes, what are the tariff levels on these materials.”

Despite CATL’s denials of Pentagon allegations of security risks and links to the Chinese military, one Asia-based analyst said its batteries were part of systems that had the potential to be compromised.

“It’s not like the battery itself is going to be carrying malicious code into the grid, but the batteries are housed in a system that does include software and that does communicate with the grid,” the person said.

Will more Chinese companies follow suit?

Listing volumes in Hong Kong at the end of April were at their highest level since 2021, according to Dealogic data. EV maker BYD also tapped investors for $5.6bn in Hong Kong in March in a follow-on equity raise.

CATL’s share sale implies Beijing’s approval and comes amid other signs that Xi’s administration is turning to the private sector to help shore up slowing growth in the world’s second-biggest economy.

Amid worsening US-China relations, there is uncertainty over the future of Chinese listings on Wall Street. Earlier this month, Chinese carmaker Geely said it planned to delist its EV unit Zeekr less than a year after the marque’s float in New York.

James Peng, chief executive of Chinese robotaxi start-up Pony.ai, said in a recent interview with the Financial Times that it is “contemplating” a secondary listing less than six months after its US IPO, with Hong Kong a possible option.

“The long-term trend will be for Chinese companies to increasingly depend on the country’s own ecosystem and capital markets for development,” said an executive at another Chinese EV maker, adding that Hong Kong still had “unique advantages” in helping domestic businesses secure offshore funding.

However, Tim Buckley, director of Climate Energy Finance, a Sydney think-tank, noted that few Chinese cleantech companies would be as attractive to international investors.

“CATL is an exception; even as they’ve delivered very strong growth, they’ve also delivered good profit margins,” he said, adding: “For the solar, wind and lithium companies . . . profit is one of the least important drivers.”