Good morning. War rhetoric continues to be the dominant narrative of the day, after India launched air strikes against Pakistan on Wednesday over last month’s deadly militant attack in Pahalgam. Pakistan’s Prime Minister Shehbaz Sharif promised to “avenge every drop of blood” and authorised his country’s armed forces to take measures at “a time, place and manner of its choosing”. Yesterday, both Pakistan and India said they had shot down several enemy drones.

Wednesday’s operation was India’s most extensive military action against Pakistan in decades. The international community is calling for de-escalation, especially as heightened tensions can be particularly devastating with nuclear arms on both sides. Although popular opinion in India seems to be in favour of military action, a sustained exercise will have a significant impact on the country’s psyche and economy. For now, we can only wait and watch.

In today’s newsletter: India’s Supreme Court has to decide whether online card games like rummy involve skill or luck. But first, in what could have been the biggest headline of this week, India and the UK strike a trade deal after three years of negotiations.

One down, two to go

Of the three trade deals that India was working on, the one with the UK has been finalised this week. The two countries concluded negotiations and announced the deal, to much mutual (and self-) congratulation. India’s commerce ministry announced that 99 per cent of Indian exports will face zero duties in the UK. In return, Britain’s exports to India will see a 90 per cent cut in duties, with most goods becoming fully tariff-free within a decade.

India has opened up its market to several categories of consumer goods, including chocolates, biscuits, meats and cosmetics, and in return will get to export textiles, footwear, sports goods and toys, among others. I don’t want to reduce this story to a list of goods and services, but some call outs are significant.

First, India has reduced tariffs on automotive goods from 100 to 10 per cent (with a yet-to-be-revealed quota in place). This is great news for Tata Motors, which owns Jaguar Land Rover in the UK. Its shares have gone up more than 7 per cent since the announcement. However, other automotive suppliers in India are worried that this will open the doors to competition from Chinese cars, which could potentially be shipped to India via the UK.

Second, Indian companies operating in the UK won’t have to pay national insurance for up to three years for employees who move there from India. This will enable Indian IT companies and other such service providers to easily move staff from off-site to on-site projects. The removal of this provision has not gone down well in the UK, as rightwing parties see this as paving the way for more immigration. Overall, the UK government is estimated to lose £100mn-200mn per year in revenue on account of this.

Prima facie, it looks like India has negotiated this deal quite strategically, with an intent to open new markets for those segments of exports which will lose business in the US. Gems and jewellery, for example, as discussed in Tuesday’s newsletter, are reeling under Trump’s tariffs, but will now have easier access to the UK market. The FTA also removed tariffs on India’s exports of apparel, bringing us on par with Bangladesh, while China incurs 12 per cent. Both these sectors will face challenges exporting to the US, even if tariffs are reduced from the current levels.

This week, finance minister Nirmala Sitharaman also said that India was looking to conclude its deal with the EU before the end of the calendar year. The first tranche of the bilateral trade agreement with the US is expected by October as well. (We were hoping to be the first to land a deal, but yesterday the UK beat us to it.) India has been swift and sharp these past few months in getting these trade talks on track, and setting off losses in one geography by gains in others. That’s enough reason to break open bottles of (cheaper) whisky and gin that are coming soon to our shelves.

Recommended stories

Here comes the big one! This weekend, Chinese officials will sit down with their American counterparts in Switzerland for the first round of trade talks.

Alphabet shares fall after Apple said it was looking for AI alternatives to Google search.

Bill Gates is giving away $200bn. Can his plans survive in the Trump era?

Trump has proposed raising income taxes on wealthy Americans.

A Swatch investor is taking aim at the family behind Omega and Longines.

Tiny cocktails are big news in the bar world right now.

Skill vs luck

Does the popular card game rummy require luck or skill? This is the central question in a long-running dispute between gaming companies and Indian tax authorities. India’s top court now has to weigh in.

More than 70 online gaming companies are challenging a tax notice of Rs1.2tn ($14bn) in penalties and additional goods and service tax, claiming that their business does not involve gambling. The definition matters: if what these companies provide counts as a “service”, they will be taxed at 18 per cent, but if it falls under betting or gambling, the tax burden goes up to 28 per cent. The goods and service tax authority’s argument is that it is gambling, because it involves playing a game for money without knowing the outcome in advance.

The companies, who have brought the case to the Supreme Court, argue that it depends on how much skill a game like rummy involves. According to them, if it is “substantial” or “preponderantly” based on skill, then betting on it does not count as gambling. The result of this case will have far-reaching consequences in the industry. Already, several gaming companies have moved their headquarters outside India because of what they see as an extortionate tax structure. But in 2023, the government made it mandatory for even offshore companies to register in India if they were doing business here.

A higher tax structure, while not ideal for gaming companies, will provide some amount of protection from financial losses for the middle and lower income players of these games, as it deters participation. In the past, there have been several instances of people, especially young men, who have been financially ruined by betting on these games. The government sees higher tax as win-win, a measure to keep gaming in check as well as earn some revenue from it. That’s a skilful move. We’ll see if they get lucky with it.

What do you think? Is rummy a game of skill or chance? Hit reply or write to us at indiabrief@ft.com

Go figure

The Federal Reserve has kept US interest rates on hold for the third meeting in a row, as it worries that Trump’s tariffs will trigger inflation and weaken the jobs market. Here are some highlights.

4.25-4.5%

Benchmark rates

2.3%

Rise in consumption price index

4.2%

Unemployment rate

Read, hear, watch

The book in the news this week is India@100: Envisioning tomorrow’s economic powerhouse, written by India’s former chief economic adviser Krishnamurthy Subramanian. Public sector lender Union Bank reportedly spent a whopping Rs72.5mn on 200,000 copies of the book, to distribute to customers and local libraries. The bank has subsequently acknowledged that there were “lapses” in this procurement.

Last week, Subramanian was removed from his position as executive director of the IMF, which, according to local media, is partly because of his alleged improprieties in promoting this book. Only his publisher Rupa is laughing all the way to the bank (sorry, not sorry). I have not read the book, nor do I plan to (life is too short), but let me know if you have.

I am watching The Residence on Netflix. It’s a murder mystery set in the White House, and it is the perfect mix of comedy (wit, to be precise) and intrigue for me. I highly recommend it.

Buzzer round

Which art form, recently all the rage on social media, is said to have descended from pictographic scrolls in the 12th century?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

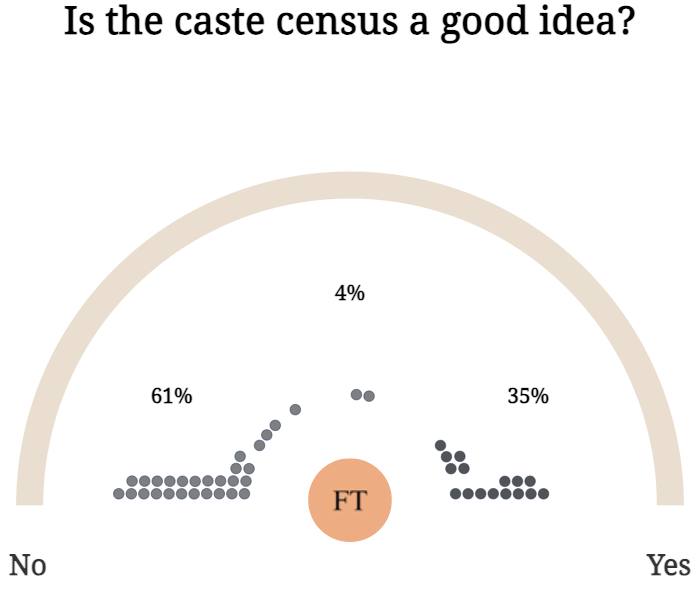

On Tuesday, we asked: is the caste census a good idea?

Here are the results. More than 60 per cent of you think it’s not.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.