Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

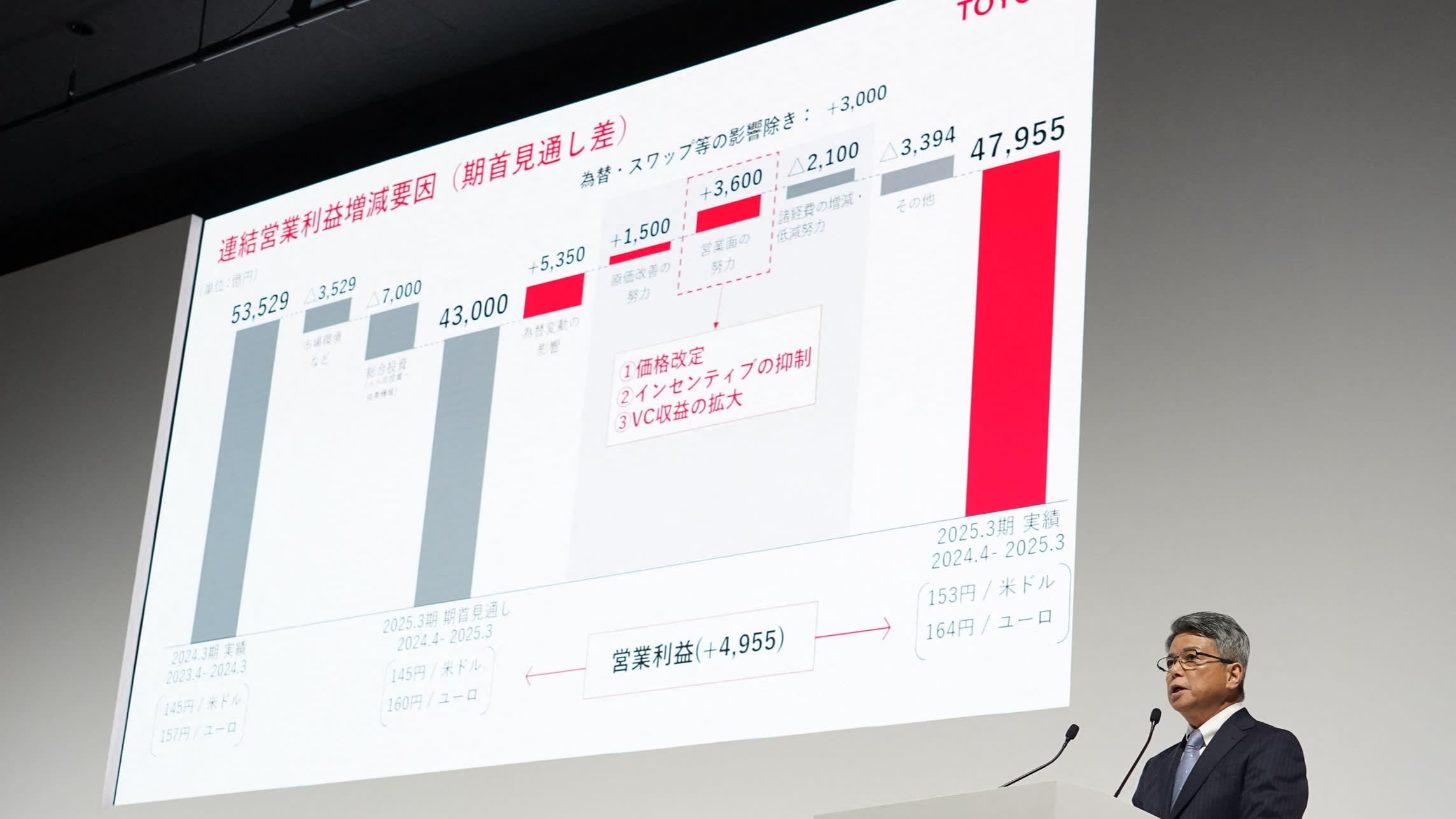

Toyota has warned operating profits will fall 21 per cent this fiscal year due to the fallout from Donald Trump’s trade war, increasing the pressure on Japan to reach a deal on tariffs with the US.

For its year ending in March 2026, Toyota said it expected an operating profit of ¥3.8tn ($26bn) compared with ¥4.8tn in the year just ended. The forecast includes a US tariff impact of ¥180bn for the months of April and May.

The US president has recently offered relief to carmakers to soften the impact of his 25 per cent tariffs on imports of foreign-made cars and parts. Toyota and other Japanese manufacturers export some of the vehicles they sell in the US from Japan.

The evolving nature of Trump’s tariffs has thrown the global car industry into turmoil, with Mercedes-Benz, Volvo Cars and Ford pulling their guidance for this year, while General Motors has warned of an up to $5bn hit from the levies.

In its fourth quarter, Toyota’s operating profit was almost flat year-on-year at ¥1.2tn while revenue increased 12 per cent to ¥12.3tn.

While Toyota grapples with tariff effects, Japan’s biggest company is also considering a $42bn move to take a key subsidiary private.

Akio Toyoda, grandson of Toyota’s founder, is considering investing his personal money to lead a buyout of Toyota Industries, which makes industrial equipment and vehicles, according to people close to the discussions.

Toyota Motors, which has a complex series of cross-shareholdings with its subsidiaries, is also considering investing, say the same people, in what would be one of the world’s largest buyouts.

The move, which came to light last month, has sparked speculation that other big industrial groups would accelerate discussions over potential acquisitions or buyouts of listed subsidiaries.

Toyota Industries shares rose sharply on the news and remain up 36.5 per cent this year. Toyota Motors is down slightly over the same period.

This is a developing story