Good morning, happy Friday and welcome back to FirstFT Asia. In today’s newsletter:

South Korea’s ex-president escapes the death penalty

Former British prince Andrew Mountbatten-Windsor arrested

The US court case over a junior banker’s need for sleep

We start in Seoul, where former South Korean president Yoon Suk Yeol has been sentenced to life in prison for insurrection over his failed attempt to impose martial law.

What to know: A three-judge panel at Seoul Central District Court yesterday found Yoon was guilty of leading an insurrection in late 2024 that attempted to subvert the constitution. In their ruling, the judges said Yoon had deployed troops to the National Assembly to impede lawmakers and arrest political rivals. Yoon, 65, had faced the possibility of a death sentence. He is eligible for parole after 20 years.

The verdict caps a dramatic episode that plunged South Korea into its worst political crisis in decades and tested the strength of its 39-year-old democracy. Judge Ji Gwi-yeon said: “The declaration of emergency martial law and subsequent military and police activities severely damaged the political neutrality of the military and police, lowered South Korea’s political standing and international credibility, and resulted in extreme political polarisation.”

Expert insight: Yoon’s conviction reinforces a retributive pattern in South Korean politics, where few former presidents have avoided legal peril after leaving office. This pattern of “extreme factional conflict” was exacerbated by a “winner takes all” system in which the president was entrusted with sweeping powers but was limited to a single term, said Chang Young-soo, professor of constitutional law at Korea University. Read the full story.

Here’s what else we’re keeping tabs on today and over the weekend:

Economic data: Japan publishes January inflation data and Hong Kong reports employment figures for the month.

Monetary policy: China’s central bank announces its loan prime rate decision.

India diplomacy: Brazilian President Luiz Inácio Lula da Silva meets Indian Prime Minister Narendra Modi on Saturday.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Donald Trump says the next 10 days will decide if the US strikes Iran or does a deal with the Islamic republic, as Washington steps up the deployment of a massive military force to the Middle East. The price of Brent crude has jumped more than 6 per cent in the past two days to about $72 a barrel, hitting a six-month high.

Go deeper: Huge complex barriers stand in the way of the diplomatic push to avert a war.

Iran bets on war: Tehran thinks a drawn-out conflict could eventually yield a better deal than what Trump is offering today, writes Vali Nasr.

2. The IMF has called for China to slash state support for industry as international concerns mount about overcapacity in the world’s second-largest economy. The fund estimated that China spent about 4 per cent of its GDP subsidising companies in critical sectors and said it should reduce that by 2 percentage points in the medium term.

3. Former prince Andrew Mountbatten-Windsor was arrested at his home in Sandringham yesterday in a police raid following revelations about his relationship with the late sex offender Jeffrey Epstein. Read more about the arrest — the first of a member of the British royal family in modern times.

4. The Tata scion who chairs the powerful ownership trusts at the $300bn conglomerate is struggling to consolidate his control as factional fighting fuels uncertainty over the stability of one of India’s biggest groups. The ructions at Tata, which employs more than a million people, have caught the attention of India’s government.

5. Trump said the US would commit $10bn to his Board of Peace as he inaugurated the controversial body at a meeting where many traditional US allies were absent. The US president also claimed a group of countries, including the UAE, Saudi Arabia and Qatar, had committed $7bn more for Gaza relief. Here’s more on the gathering.

The Big Read

Billionaire businessman Ricardo Salinas thought he was dealing with financial royalty when he tried to buy crypto. Instead he found himself in a transatlantic legal fight with a convicted fraudster. Paul Caruana Galizia investigates a case of so-called Lombard lending gone wrong.

We’re also reading . . .

Wall Street: A US court will rule on whether a junior banker who demanded at least 8 hours’ sleep a night was fired unlawfully.

Is an AI price war looming? Assumptions underpinning valuations of big US groups might be too optimistic, writes June Yoon.

Syria’s Isis camps: Thousands of women and children have fled facilities holding alleged members of the extremist group after Kurdish forces lost control.

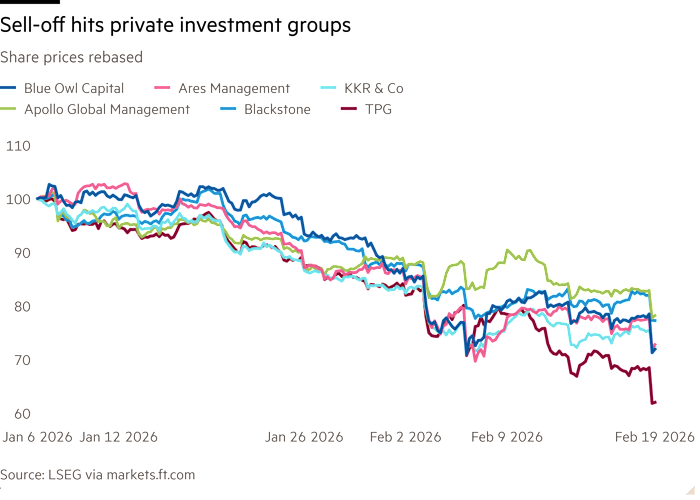

Chart of the day

Shares of the biggest private investment managers on Wall Street tumbled yesterday after Blue Owl permanently restricted investors from exiting a debt fund for retail investors. The sell-off is the latest to rock the fast-growing private credit market.

Take a break from the news . . .

Banned in 2007 following a spate of accidents, Lahore’s Basant kite festival returned this month with stricter safety measures — and much excitement. Read Rahmah Zahid’s dispatch from Pakistan.