In 1994, Richard Leiter, a South African entrepreneur, took a gamble on the then unknown Chinese commercial truck maker FAW with the introduction of the first Jiefang CA141 truck into the South African market.

Two decades later, he had transitioned from importer to industrialist, with a sprawling assembly plant in the Coega special economic zone in South Africa’s Eastern Cape. FAW now outsells major brands like Toyota, Daimler and Isuzu in the heavy truck sector in South Africa, driven by affordability and durability tailored to harsh African operating conditions.

During the same period, Massad Boulos, a Lebanese-American businessman, sought to expand his SCOA Nigeria operation from vehicle retail into local assembly via an agreement with Germany’s MAN Truck & Bus. However, while Leiter’s rival company moved successfully into the mass market, Boulos’ premium venture remained a niche operation.

Advertisement

Today, better known as a political adviser to Donald Trump and as his daughter’s father-in-law, Boulos is a minor player in a sector increasingly led by brands like Sinotruk and Shacman, a disparity reflected in SCOA’s 2024 annual report, which shows automotive revenue of just 3.1 billion naira (US$2.2 million).

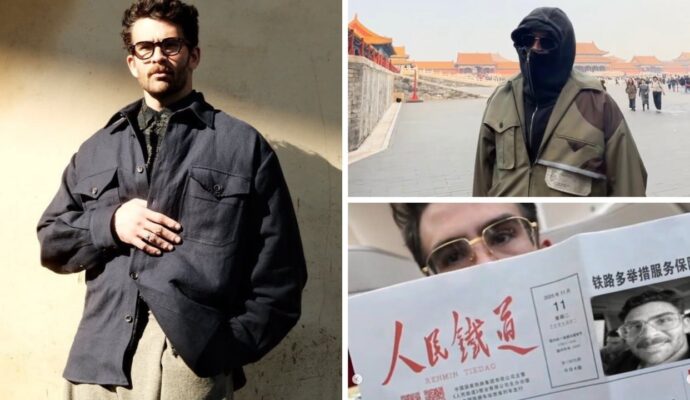

“Chinese vehicles enabled Leiter to become an industrialist, while Massad Boulos was unable to make the same leap,” noted Kai Xue, a Beijing-based corporate lawyer who advises on foreign direct investment and cross-border financing.

Advertisement

Xue said Chinese trucks outperformed used Japanese imports at the lower end by offering guaranteed vehicle conditions and reliable after-sales support at a price-to-lifespan ratio imports could not match.