Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

As investors rush to price in Sanae Takaichi’s stunning general election win in Japan, they will be looking closely at what the prime minister’s historic two-thirds supermajority means for households. Food prices and the banking system will be where politics most directly meets markets.

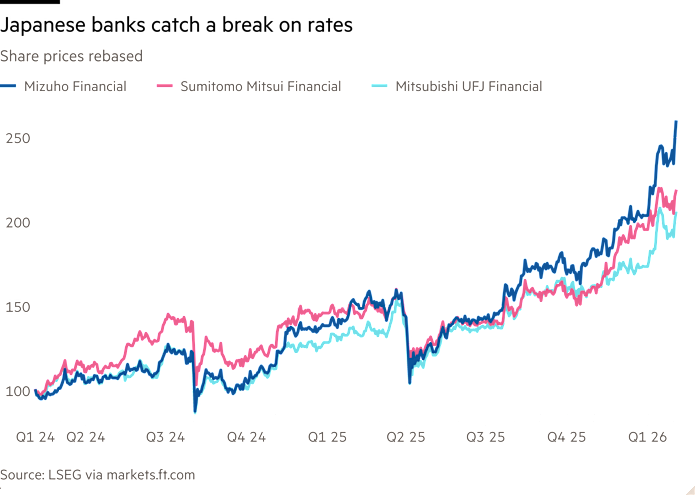

The investment case for big banks such as Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group and Mizuho Financial Group is straightforward. For more than a decade, elections had little effect on the local financial sector mostly because ultra-low interest rates prevailed, untouched by political pressure. Japanese bank stocks languished as net interest margins — the gap between what they make and what they pay — remained thin and returns stayed low.

Now, inflation has returned: Japan’s consumer price index was up 3.2 per cent in 2025. That gives the Bank of Japan a more credible path towards higher rates. Shares of the largest local banks are up more than 50 per cent in the past year, reflecting an ongoing reassessment of what they might earn if interest rates are no longer held down.

The banks will need to raise their return on equity. Mitsubishi is expected to make 10 per cent in its financial year ending in March, according to Visible Alpha. That only goes some way towards justifying its valuation of about 1.6 times forecast book value, based on LSEG data, the highest level in more than a decade and significantly higher than regional peers.

Healthy banks are crucial for a healthy economy, but as far as so-called kitchen table issues go, food prices are a much bigger issue. Takaichi says she wants to advance discussions on suspending the 8 per cent consumption tax on food for two years. The tax, Nomura analysts think, is worth about $32bn in fiscal revenue a year.

A reduction in food taxes would boost food retailers, restaurants and consumer staples companies, as it supports demand and improves sentiment, particularly in an environment where consumers have become increasingly price-sensitive.

This ought to benefit local retail groups Aeon and Seven & i, which dominate Japan’s food distribution system. Names such as Seven & i have underperformed the broader benchmark amid weak consumption and pressure on household spending. The low-margin nature of retailing means a small increase in revenue can quickly become a large boost to profit.

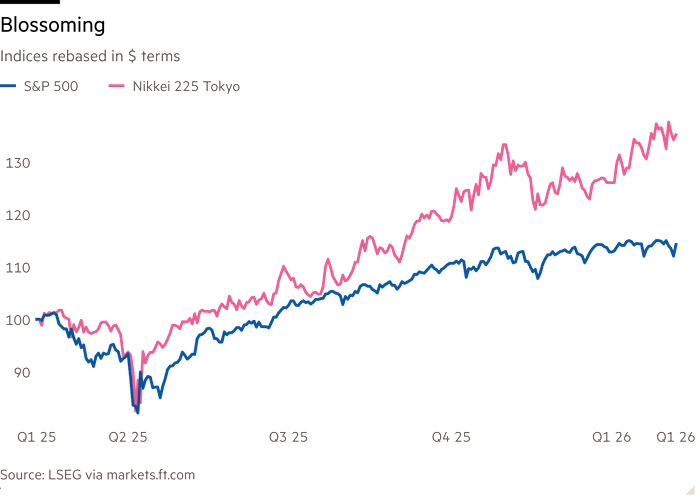

True, Japan still faces challenges that will be difficult for any simple policy to solve, including weak growth and limited increases in inflation-adjusted wages. But even before Takaichi’s landslide victory, Japan’s markets and interest-rate environment were already changing. In markets conditioned by years of stability, even small policy changes can have outsized effects.