Good morning. Later today, the Reserve Bank of India will announce its interest rate decision. Most analysts expect the central bank to leave rates unchanged this time around; the repo rate has been cut by 125 basis points since February last year. However, inflation continues to be under control, so there is a sliver of possibility of a cut. We will be keeping an eye.

In today’s newsletter, India’s supreme court comes down heavily on WhatsApp’s user data policies. But first, will the Indian stock market have another difficult year?

Market watch

What’s going on in the Indian stock market? After a couple of years of muted performance, analysts and market experts were expecting 2026 to be the year of a turnaround on the Indian bourses. But the rollercoaster ride in the market in the past few days raises more questions than answers. Let’s break it down.

The week started early, as markets opened on Sunday when the union budget was being presented. Finance minister Nirmala Sitharaman’s business-as-usual budget did not offer any big-bang reforms or cause for optimism. Benchmark indices lost nearly 2 per cent in trade. But the fireworks arrived on Tuesday, after India and the US announced that a trade deal had finally been secured. Key indices rose more than 5 per cent during trade, before closing up around 2.5 per cent. Alas, the exuberance was shortlived. On Wednesday, the markets barely managed to stay in the green as the global stress on technology companies came for India’s IT sector. Anthropic launched AI tools aimed at automating various workflows, stirring fears of revenue shrinkage in Indian software services. By yesterday, positive sentiment in the markets seemed to have run out of steam entirely.

The big cues for the quarter are mostly behind us, apart from the RBI decision today. Most large corporations have announced their quarterly results, which have largely been unimpressive. Other than the automobile sector, companies operating in the domestic market are yet to see a significant impact from the rationalisation of tax rates that the government introduced in September last year. If the Indian economy is growing at 8 per cent, there are no signs of it in the country’s stock market.

The rupee, which recorded its biggest one-day gain in seven years on the announcement of the trade deal, has also failed to build on the momentum since. Currency dealers attribute this to a lack of follow-through buying by overseas investors, implying that foreign institutional investors are not returning any time soon to the Indian market. After selling $19bn in Indian stocks in 2025, FIIs have continued the trend, withdrawing $3bn in January.

The general sense I get from my conversations with analysts is that they would like to maintain a positive bias but are unable to come up with specific events or reasons to base this on. The real impact of the reforms may take another quarter to become visible, some say. Others think that valuations in the Indian market will at some point become attractive to foreign investors. But, as the old adage goes, hope is not a strategy.

There will probably be an impact on some sectors when the details of the trade deal with the US are made public, something that will take two days or two weeks depending on who you ask. Some big IPOs are in the offing. But barring these, there seems to be very little in terms of actual events that are likely to bring in some optimism in the markets in the near term. Geopolitical tensions continue to be an overhang.

Overall, I do agree with the view that this will not be a muted year for the Indian markets. (I am an aspiring market optimist, but excuse me for a minute while I look at my portfolio and weep.) All indications seem to suggest that even if you can’t predict the direction of the market, it is certain to be a more volatile one than previous years. If this week was any indication, the rollercoaster has just begun. Strap yourselves in.

What’s your prediction for Indian stocks in 2026? Hit reply or email me at indiabrief@ft.com

Recommended stories

India has hailed the Trump “deal” but has avoided discussing the Russian oil ban.

Google will double its AI spending to $185bn after reporting more than $400bn in annual revenue for the first time.

From Russia, colourful imitation banknotes are moving billions across borders in spite of western sanctions.

China has banned Tesla-style hidden door handles in cars. Also, meet Leapmotor: China’s no-frills EV maker aiming to become the next BYD.

US tech stocks hit by fresh wave of selling as chipmakers Qualcomm and AMD tumble.

What I’ll be reading tonight — how to beat insomnia.

What’s up WhatsApp

On Tuesday, India’s supreme court came down heavily on Mark Zuckerberg’s Meta for data privacy issues in its popular messaging app, WhatsApp. Judges said that citizens’ right to privacy should not be compromised for the business interests of a multinational corporation and that the company should leave India if it cannot respect the country’s constitution.

Meta is challenging a 2024 order by India’s competition commission, which penalised the company for abusing its dominant position in mobile messaging applications. This order was later upheld by an appellant body.

There are two key issues at play here. One is WhatsApp’s change in policy in 2021 to share user data with Facebook and other Meta businesses. This meant that users could get advertisements on Instagram based on data from their WhatsApp, for example. The original order from the competition watchdog prohibited the company from continuing with this practice, but the appellant body set this directive aside while upholding the rest of the order.

The other issue is whether, in practice, users were meaningfully informed that they could opt out of sharing their data (or whether anyone can truly opt out at all). The judges took particular umbrage at the company’s practice of using newspaper advertisements to inform users about their rights to data privacy, while other less significant information was usually sent as in-app notifications.

The case is crucial since the judges are also keen on examining what they call the “rent-sharing” aspect of data, which is the company’s ability to monetise behavioural trends by analysing user data. This goes beyond what the newly notified digital personal data protection legislation covers. With more than 800mn users according to some estimates, WhatsApp has become integral to Indian lives, with personal, commercial and often even government communication favouring this channel. Limiting its use of private data will set a significant precedent in India, which has thus far been rather lax about protecting personal data. I’ll be keeping an eye on the final hearing for the case on Tuesday.

Go figure

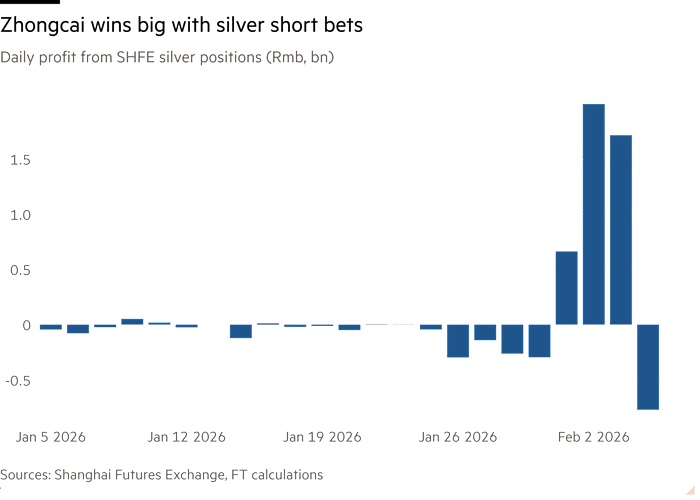

A Chinese trading firm, Zhongcai Futures, made more than half a billion dollars by betting that silver prices would fall. Zhongcai’s profits highlight the recent wild volatility in precious metals trading, particularly in China, where regulators have been working to tamp down on speculative activity.

Read, hear, watch

Steeped in post-vacation ennui, I haven’t done much reading or watching this week. While in Australia though, I read The Mushroom Tapes: Conversations on a Triple Murder Trial, which is a book about the conversation that three writers (including my favourite Helen Garner) had about the black cap mushroom deaths case. The format is a bit bizarre, but I guess that is the new world we live in, where a book is a transcript of a podcast that became an audiobook (seriously!). The case itself is fascinating; it’s about a woman who cooked a dinner for her in-laws with poisonous mushrooms. Three of her four guests do not make it out of the hospital alive. Was it an accident or murder?

Buzzer round

Which flagship annual event frequented by political leaders and billionaires is considering moving its venue from its current iconic Alpine location?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

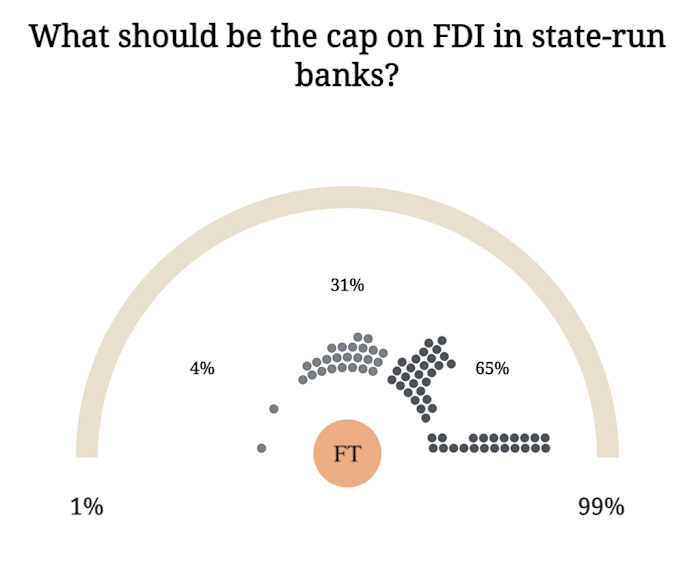

On Tuesday we asked: To what level should India raise the foreign direct investment cap in publicly owned banks? A majority of you seem to be aiming for the 75 per cent mark.

Thank you for reading. This India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.