Even as China’s BYD moved ahead of Elon Musk’s Tesla in the world’s EV race in 2025, a less known local rival has been in the rear-view mirror.

Leapmotor has produced no-frills, low-cost EVs that have proved a hit with many Chinese consumers.

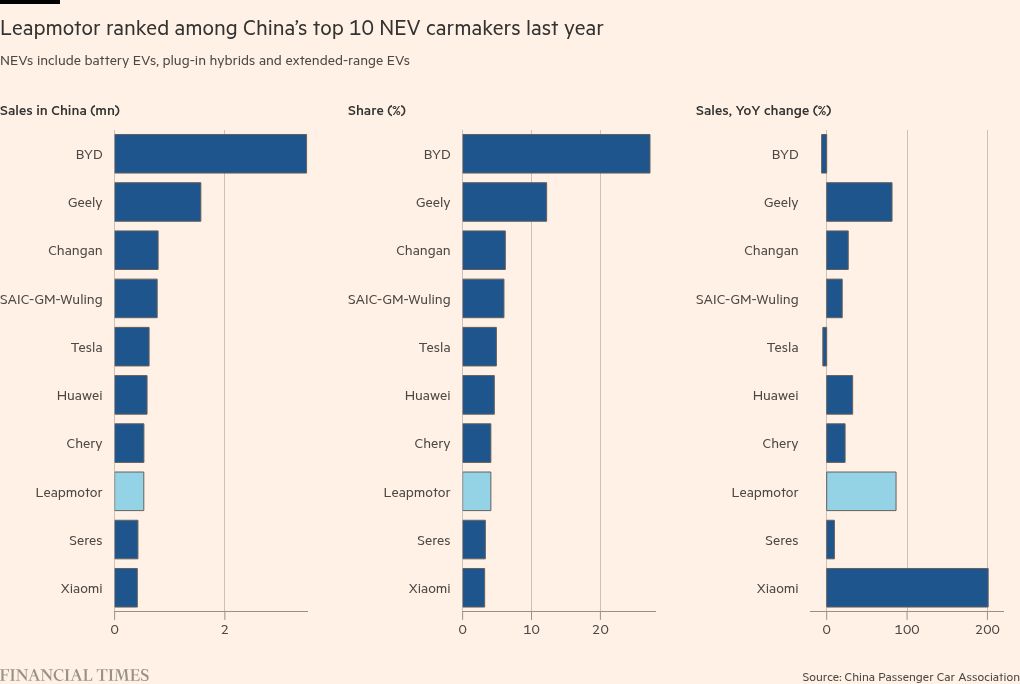

Leveraging its experience from manufacturing security cameras and walkie-talkies, the carmaker has notched sales of nearly 600,000 plug-in hybrids and pure battery EVs last year, double its sales of 2024 and four times that of 2023.

Regarded by some industry experts as the next BYD, Leapmotor is following its lead and turning to international markets.

With ambitions to eventually sell 4mn cars worldwide to rank among the world’s top 10 carmakers, the group aims to grow sales by almost 70 per cent this year to 1mn, turbocharged by its partnership with Stellantis to build and sell cars in Europe.

“Leapmotor’s overseas footprint will expand rapidly and become a key sales growth driver in the coming years,” Leapmotor’s founder Zhu Jiangming said in a speech at Leapmotor’s 10th anniversary event in December, adding that the company plans to enter more markets in South America, Africa and the Asia-Pacific region.

In 2023, it sold a 20 per cent stake to European carmaker Stellantis for €1.5bn. As part of the agreement, the Chinese group began selling and producing EVs through its partner’s European dealerships and manufacturing facilities.

Leapmotor exports jumped more than fourfold in 2025 from a year earlier to more than 60,000 cars, though the scale remains relatively modest compared with BYD’s 1mn overseas sales.

Before inking the deal with Stellantis, Leapmotor also held discussions with Volkswagen.

“We chose to proceed with Stellantis because we appreciated their open, international mindset,” said one Leapmotor executive. “Volkswagen’s structure is more akin to that of a Chinese state-owned enterprise.” VW declined to comment.

Following rapid sales growth in Europe since its debut in late 2024, Leapmotor plans to produce its B10 electric SUV at a Stellantis plant in Spain this year and is also considering building its new B05 electric hatchback there.

“I think we will maintain the same level of cost competitiveness [with vehicles built in Europe],” Tianshu Xin, who leads the joint venture between Leapmotor and Stellantis, told the FT on the sidelines of the Brussels Motor Show.

Zhu set up Leapmotor in 2015 after the telecoms engineer, now 58, amassed a fortune as one of the co-founders of Dahua Technology, launched just ahead of China’s internet boom.

Started out of a classroom at a local elementary school with Rmb5,000 ($717) in capital, Dahua found success producing walkie-talkies and apartment intercoms, riding the wave of the rapid expansion of China’s surveillance state.

In the early 2010s, Zhu was among a group of Chinese entrepreneurs to recognise the potential gold mine in clean technology, in his case finding inspiration after seeing an early electric Renault car on the streets during a trip to Spain.

In 2015, backed by early funding, Zhu took a team of Dahua engineers to establish Leapmotor in Hangzhou, the eastern China city which is home to tech giants including Jack Ma’s Alibaba. It later secured investments from US venture capital firm Sequoia and state funds linked to the government in Zhejiang.

The group’s first five years were in many ways a comedy of errors.

Zhu was initially unaware that carmakers needed to obtain a production licence from Beijing before opening their factories.

In 2019, it hired Hangzhou Changjiang Passenger Vehicle, a local carmaker that secured the scarce licences from China’s top regulators as its contract manufacturer, only for Changjiang to go bankrupt the following year. Leapmotor was then forced to acquire a state automaker in the southern province of Fujian to obtain the necessary credentials.

By 2020, as the EV market in China started to take off, Leapmotor was in better shape with Zhu and his lieutenants focusing on manufacturing as many of the high-margin components that they could.

“In the internal combustion car era, foreign carmakers took the initiative by mastering core technologies such as engines and transmissions,” Zhu said in his speech. “In the EV era, we have to master core technologies including batteries, electric drive, electric control, cockpit, autonomous driving, thermal management and electric transmissions.”

Unlike many of Leapmotor’s Chinese rivals which have mostly targeted more affluent consumers with increasingly high-tech offerings — including Nio, Xpeng, Li Auto and Xiaomi — Leapmotor has chosen to go the mass market route with high volume simpler models.

This has proven to be savvy at a time of economic downturn in China. According to HSBC data in the first 10 months of 2025, the market share of EVs priced below Rmb150,000 ($21,500) increased to 58 per cent, up from 52 per cent in 2024.

The group’s “affordable, well designed, entry-level cars” are hitting a “sweet spot”, appealing to budget conscious buyers in Chinese lower-tier cities, said Yuqian Ding, lead China auto analyst for HSBC.

“The philosophy of this company is very pragmatic,” she said, adding that rather than trying to drive the industry forward with cutting-edge technology like BYD and Tesla, Leapmotor’s view was, ‘You paint me the future, I will only focus on the execution’.

Leapmotor also has additional revenues licensing EV platform technology to state-owned carmakers, but Tu Le, founder of consultancy Sino Auto Insights, said some questioned whether the no-frills group would be able to keep up with rivals pushing into sophisticated driver-assistance systems, a forerunner to driverless car technology.

However, according to Feng Xiao, a China auto analyst at brokerage CLSA, the team Zhu brought from Dahua to Leapmotor is experienced in developing electronics systems.

“They are highly efficient in R&D. They spend every single penny on the places it needs to go,” he said. He added that Leapmotor had a vertical integration rate of about 60 to 70 per cent, meaning it is self-reliant across a lot of its key hardware and software, a level which trailed only BYD’s 90 per cent.

In Europe, Leapmotor has launched three models in the past 12 months that led to over 35,000 registered vehicles in European markets. The carmaker will soon expand its offerings to cover all sizes from small to large vehicles.

While Leapmotor International’s Xin had previously said the company would not rush to localise production in Europe due to high energy and labour costs compared to China, he expressed more confidence that the growing scale of its business would allow the company to produce vehicles at affordable prices.

For now, Leapmotor’s additional sales will help to fill the extra capacity at Stellantis’ plant in Spain at a time when overall vehicle demand in Europe remains below pre-pandemic levels.

Some analysts and rival executives have warned that the Fiat and Peugeot maker’s tie-up with Leapmotor could eventually lead to cannibalisation with customers potentially switching their cars to the Chinese brand.

But so far, Xin said up to 80 per cent of Leapmotor’s customers were newly acquired. “It’s complementary to what Stellantis is offering,” he said. “Leapmotor brand is really providing a strong bullet and weapon for the Stellantis group to compete with other Chinese offensives.”

Emanuele Cappellano, the new European boss of Stellantis, added that its partnership with Leapmotor also gave it access to advanced Chinese technology that was not yet available in Europe. “So it’s also a way to learn,” he added.