Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

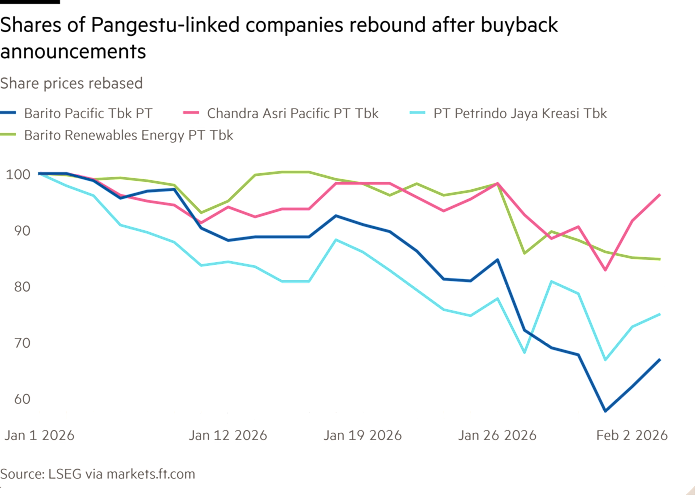

Companies linked to Indonesia’s richest man have announced share buybacks after a market rout triggered by a downgrade warning from index provider MSCI helped wipe out more than a quarter of his net worth.

Listed groups tied to billionaire Prajogo Pangestu — including Barito Pacific, Barito Renewables, Chandra Asri Pacific and Petrindo Jaya Kreasi — said they would begin buybacks worth up to Rp5.75tn ($343mn). Shares in the companies rose sharply early on Wednesday before paring gains.

Pangestu has lost $11.7bn of his wealth since the start of the year amid Indonesia’s worst stock sell-off since the Asian financial crisis of 1998, according to Bloomberg data. His net worth stands at $34.4bn as of Tuesday.

The main index tumbled as much as 16 per cent in two days last week after MSCI released a report pointing to “fundamental investability issues” in the market and raised questions over concentrated shareholdings.

Barito Pacific, the main holding company, said on Wednesday that supporting market stability was its “immediate priority” and that it would strengthen its “footprint in supporting Indonesia’s economic growth”.

“The share buyback reflects management’s confidence in the company’s fundamentals and long-term growth prospects, and underscores our belief that the current short-term market volatility does not reflect the intrinsic value of the business,” it said.

However, the buybacks would reduce the companies’ free floats, the number of shares available for trading. High shareholder concentration is particularly an issue for companies controlled by Indonesia’s powerful tycoons.

In its announcement, MSCI cited issues with opacity in data on publicly traded shares and warned that Indonesia could be reclassified from an emerging to a frontier market if the problems were not resolved by May.

The turmoil sent officials rushing to respond. Regulators vowed to double the free-float requirement for listed companies to 15 per cent and raise the limit on stock investment by pension funds and insurers to 20 per cent of their assets from 8 per cent. The heads of the financial regulator and stock exchange resigned on Friday.

“Given the carnage in the markets, it makes sense to buy back,” said Chris Leahy, executive director of Barbican Advisory. “This seems market driven, not political.”

Alicia García-Herrero, chief Asia-Pacific economist at Natixis, said the buybacks would only “worsen the problem” of low free floats, one of the central concerns for investors in the Indonesian market. Shares in companies with low free floats can fluctuate wildly because of thin trading.

Two of the companies that announced buybacks, Barito Renewables and Chandra Asri Pacific, already have free floats below 15 per cent. But Leahy said the buyback amounts were “very small” and Pangestu would “have time to adjust free float when he has to”.

Indonesian regulators have said they would introduce the new free-float requirement in stages for already listed companies.

Barito Pacific said it was awaiting further regulatory guidance on free-float adjustments.